GSTN enables generating system computed Liability for GSTR-3B, on the basis of GSTR-1 filed by the Taxpayers

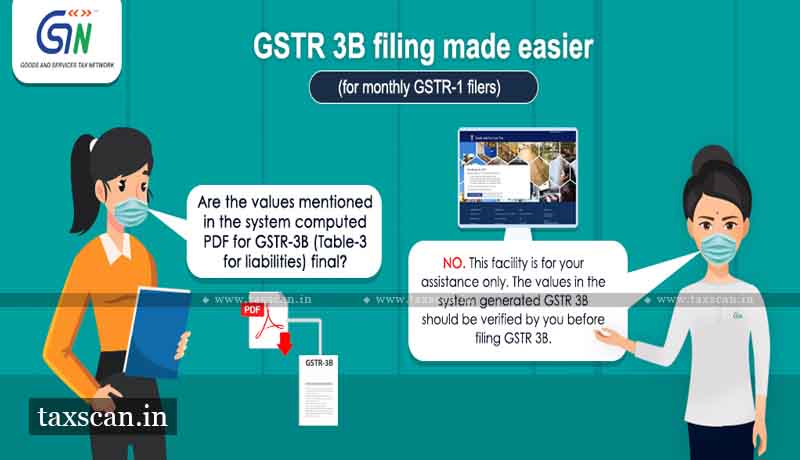

The Goods and Services Tax Network ( GSTN ) has enabled the System computed GSTR-3B (Table-3 for liabilities) on the basis of GSTR-1 filed by taxpayers now available on the GST portal for monthly GSTR-1 filers.

Comparing GSTR-3B with GSTR-1 is a much-needed process to be undertaken by every taxpayer in order to ensure that there are no variations or gaps, which could, in turn, lead to a demand notice from the tax authorities or unwanted issues that may arise and hinder the accurate filing of the annual returns.

GSTR – 3B is a monthly summary return filed by a taxpayer by the 20th of the next month. GSTR-3B discloses supplies made during the month along with GST to be paid, input tax credit claimed, purchases on which reverse charge is applicable, etc., and also makes a provision for the payment of taxes, if any, for the relevant month.

GSTR – 1 is a monthly or quarterly return filed by taxpayers to disclose details of their outward supplies for the month – along with their tax liability. Here, invoice-wise details are to be uploaded so that the Government can keep a check on every transaction.; this forms the basis for the recipient of supplies to accept the same and take the eligible input tax credit.