GSTN enables online filing of Annexure-V for Newly Registered GTAs under FCM

GSTN enables online filing of Annexure-V for Newly Registered GTAs under FCM

In a significant development, the Goods and Services Tax Network (GSTN) has rolled out a highly anticipated feature enabling the online filing of Annexure-V on the GST Portal. Specifically tailored for newly registered Goods Transport Agencies (GTAs) opting for Forward Charge, this new functionality streamlines the process for users.

This innovative facility allows users to seamlessly upload manual Annexure-V submissions made to the jurisdictional office before the introduction of the online filing option. For GTAs providing services and intending to pay tax under Forward Charge for the current financial year and beyond, it is imperative to file the Annexure V Form by January 28, 2024.

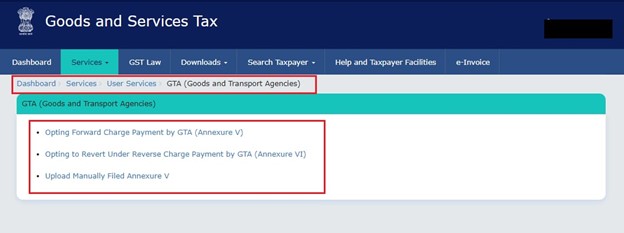

Upon selecting the affirmative option of "YES," users will be guided to the Annexure V Form. Alternatively, those not engaged in providing GTA services or those preferring to pay tax under Reverse Charge can choose the "NO" option. It is noteworthy that the Annexure V Form is also accessible through the Dashboard, under Services > User Services > GTA > Opting Forward Charge payment by GTA (Annexure V)."

Recent Changes to GST Portal

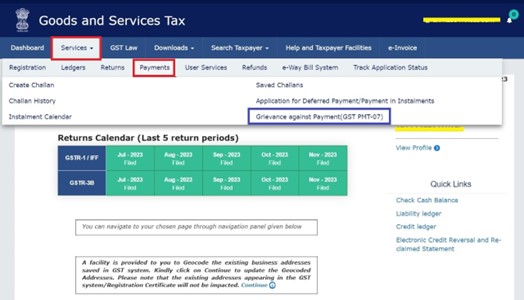

The GST portal was recently updated with the new features. The portal Introduces the new feature for addressing Grievances against Payment (GST PMT-07) system, giving users the power to swiftly address payment-related concerns.

To access this feature:

1️⃣ Log in to the GST Portal

2️⃣ Navigate to “Services”

3️⃣ Click on “Payments”

4️⃣ Find “Grievance against Payment (GST PMT-07)

Read Also: Key changes related to GST for MSMEs in 2023

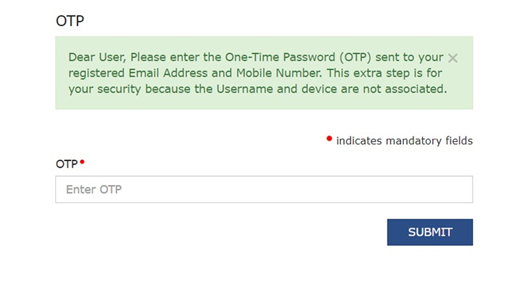

The Goods and Services Tax Network (GSTN) issued an advisory on implementation of Two-factor authentication to safeguard the GST portal to the whole nation from the date of December 1st 2023.

The advisory states as follows: GSTN is introducing two-factor authentication (2FA) for taxpayers to strengthen the login security in the GST portal. The pilot rollout has been done for the state of Haryana and working seamlessly.

Currently, 2FA will be rolled out for Punjab, Chandigarh, Uttarakhand, Rajasthan and Delhi in the 1st phase. In the 2nd phase, it is planned to be rolled out to all states across India.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates