GSTN issues Advisory on E-invoices Services Offered by 4 New IRPs

The Goods and Services Tax Network (GSTN) has released guidance regarding E-invoices. The advisory highlights the various services related to E-invoices available through the recently launched Invoice Registration Portal (IRP). The recent update of e-invoicing is, it will be applicable for businesses with a turnover exceeding 5 crores from 1st August 2023.

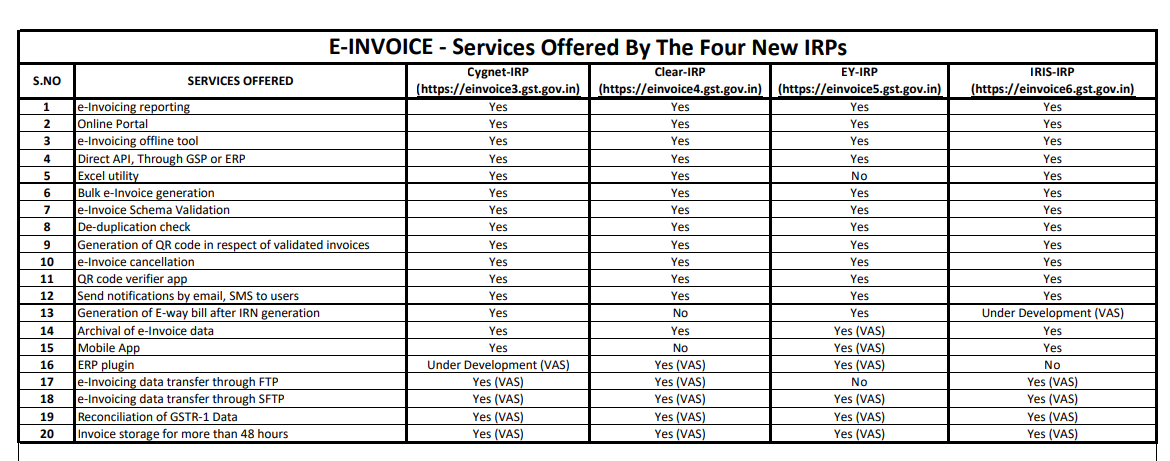

The 4 new IRPs are

- Cygnet-IRP - (https://einvoice3.gst.gov.in)

- Clear-IRP - (https://einvoice4.gst.gov.in)

- EY-IRP - (https://einvoice5.gst.gov.in)

- IRIS-IRP -(https://einvoice6.gst.gov.in)

All IRPs provides services on e-invoice reporting, online portal, e-invoicing offline tool, Direct API, Through GSP or ERP, Bulk e-Invoice generation, e-Invoice Schema Validation, De-duplication check, Generation of QR code in respect of validated invoices, e-Invoice cancellation, QR code verifier app and Send notifications by email, SMS to users.

The Excel utility services are available to all except EY-IRP. Also, Generation of E-way bill after IRN generation is now available in Cygnet-IRP and EY-IRP.

A Set of disclaimers was provided by the GSTN on e-Invoice Reporting and IRN Generation:

- Please be informed that e-Invoice reporting and IRN (Invoice Reference Number) generation services on all IRPs, including the 4 new IRPs, are provided free of charge. There are no fees associated with using these essential services for generating and reporting e-Invoices. The IRPs are mandated to offer e-Invoice reporting and IRN generation as part of their compliance process, ensuring that taxpayers can avail these services without incurring any additional cost.

- 2. However, we would like to highlight that any additional Value-Added Services (VAS) offered by IRPs are independent of the standard e-Invoice reporting and IRN generation and may have associated charges. GSTN has no role in the provision or pricing of such Value-Added Services.

- Before availing any additional VAS, we advise taxpayers to review the details of the services, data security and their associated costs as offered by the respective IRPs.

- Additionally, in addition to the four new IRPs, e-Invoice reporting and IRN generation services are also provided by NIC-IRP. Users can access these services at https://einvoice1.gst.gov.in and https://einvoice2.gst.gov.in.

- For any support related to the standard e-Invoice reporting and IRN generation services, taxpayers can reach out to GSTN or their respective IRPs

For Advisory Click here.

To access services offered click here.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates