GSTN issues Advisory on Proper Entry of RR No./Parcel Way Bill (PWB) Numbers in EWB system Post EWB-PMS

Indian Railways Integrates Parcel Management System with E-Way Bill for Seamless Tracking

The Goods and Services Tax Network (GSTN) has issued an advisory on integration of the Parcel Management System (PMS) with the E-Way Bill (EWB) system.

This integration, achieved through Application Programming Interfaces (APIs), allows seamless transfer of Railway Receipt (RR) and Parcel Way Bill (PWB) data directly to the e-way bill portal, enhancing efficiency in goods transportation.

The integration is aimed at ensuring that taxpayers transporting goods via Indian Railways provide accurate details, thereby avoiding discrepancies. Taxpayers must now follow specific guidelines to enter Parcel Way Bill numbers into the EWB system correctly.

Applicability of RR No./PWB Entry in EWB System

Taxpayers utilizing the Indian Railways PMS for transporting goods must enter the correct RR or Parcel Way Bill number in Part-B of the EWB portal. A standardized format for entering these numbers has been introduced to ensure accuracy and consistency.

Complete Supreme Court Judgment on GST from 2017 to 2024 with Free E-Book Access, Click here

Updating E-Way Bill for Rail Transport

Suppliers transporting goods from their factory to the railway station must update Part-B of the EWB, particularly when using rail as a mode of transport under PMS. They must:

Use the "Multi-Transport Mode" option on the EWB portal.

Select Rail as the transport mode and enter the corresponding RR or Parcel Way Bill number as prompted.

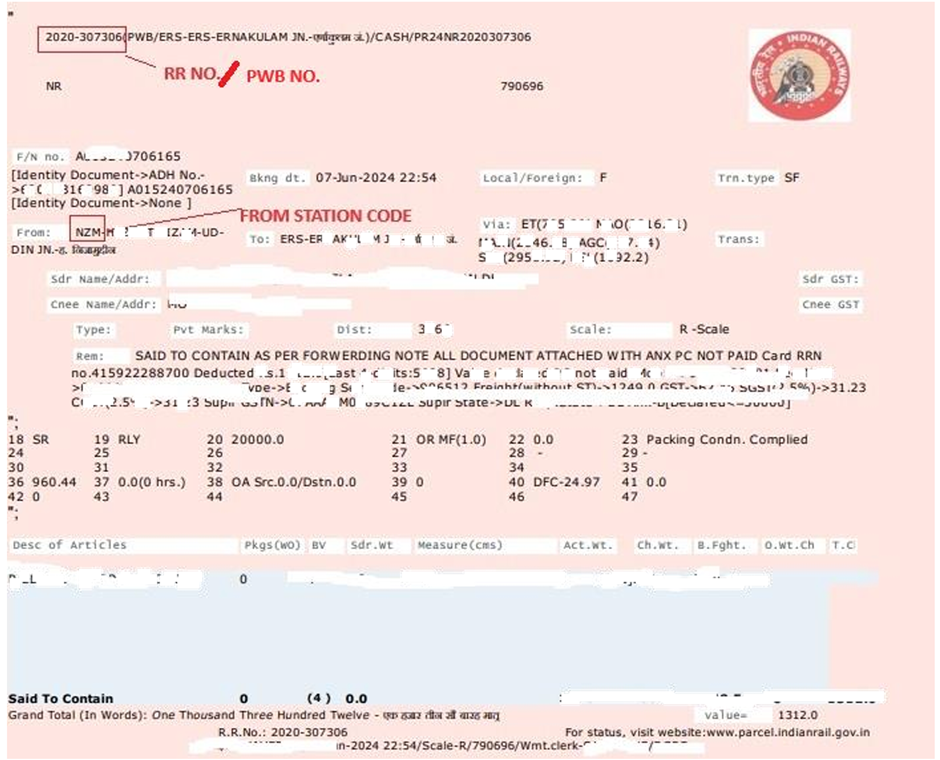

Standard Format for RR/PWB Number

The RR or Parcel Way Bill number must follow a specific format:

PXXXRRNo, where:

P stands for PMS.

XXX represents the originating station code.

RRNo is the actual Railway Receipt number.

For instance, if the RR number is 2020-307306 from station code NZM, it should be entered as PNZM2020-307306 in the EWB system.

Validation and Accuracy

The EWB system will cross-check entered RR/PWB numbers with the data from the PMS. In case of mismatches, alerts will be generated. Taxpayers are urged to enter these numbers accurately to prevent delays and complications.

Goods transported via Freight Operations Information System (FOIS) or Leased Wagons should follow the same entry process as before, ensuring the RR number is entered exactly as shown on the receipt.

Importance of Accurate Data Entry

Correct entry of RR and PWB numbers is essential for the smooth tracking and verification of goods transported via Indian Railways, facilitating hassle-free validation.

Taxpayers facing difficulties in entering RR/PWB numbers or finding discrepancies are encouraged to raise a support ticket, specifying the relevant RR or PWB number for assistance.

Complete Supreme Court Judgment on GST from 2017 to 2024 with Free E-Book Access, Click here

This integration marks a major step forward in boosting compliance and ensuring seamless coordination between the Indian Railways and the Goods and Services Tax Network (GSTN).

For more detailed guidance or to view a sample format of RR No./PWB entry, taxpayers can refer to the available resources within the system.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates