GSTN Issues Procedures Filing Application for Rectification of Orders

The Central Government established a unique process for correcting orders pertaining to improperly claiming Input Tax Credit (ITC) under the CGST Act

By issuing Notification No. 22/2024–Central Tax on October 8, 2024, the Central Government established a unique process for correcting orders pertaining to improperly claiming Input Tax Credit ( ITC ) under the Central Goods and Services Tax ( CGST ) Act, 2017. The Goods and Service Tax Network through the website issued the complete procedure to apply for the rectification order.

Registered individuals who have received orders under Sections 73, 74, 107, or 108 of the CGST Act verifying demands resulting from the improper use of ITC in violation of Section 16(4) would be covered by this. The following are the steps to be followed when filing an application for a rectification order.

Step-by-Step Process for Filing Application for Rectification of Orders

1) Access the www.gst.gov.in URL and login to the portal with valid credentials.

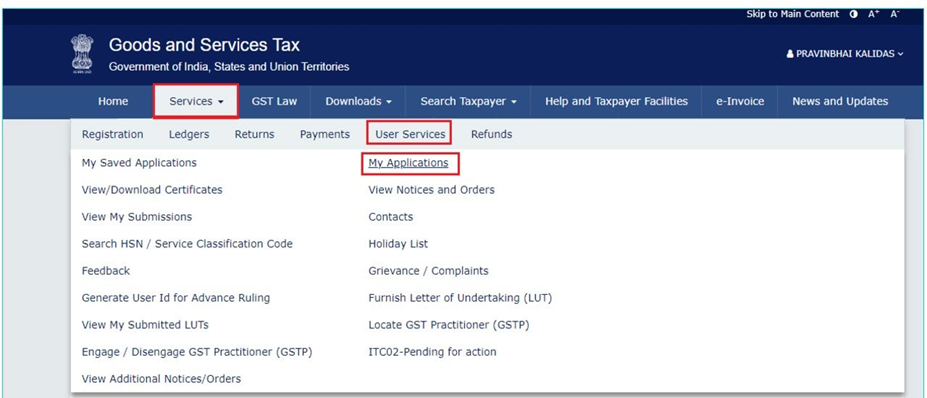

2) Click Dashboard > Services > User Services > My Applications

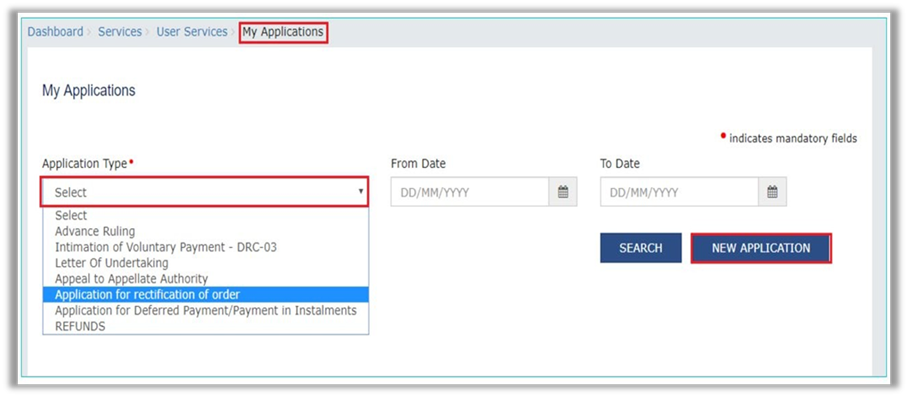

3) Select "Application for rectification of order" in the Application Type field and click the NEW APPLICATION button.

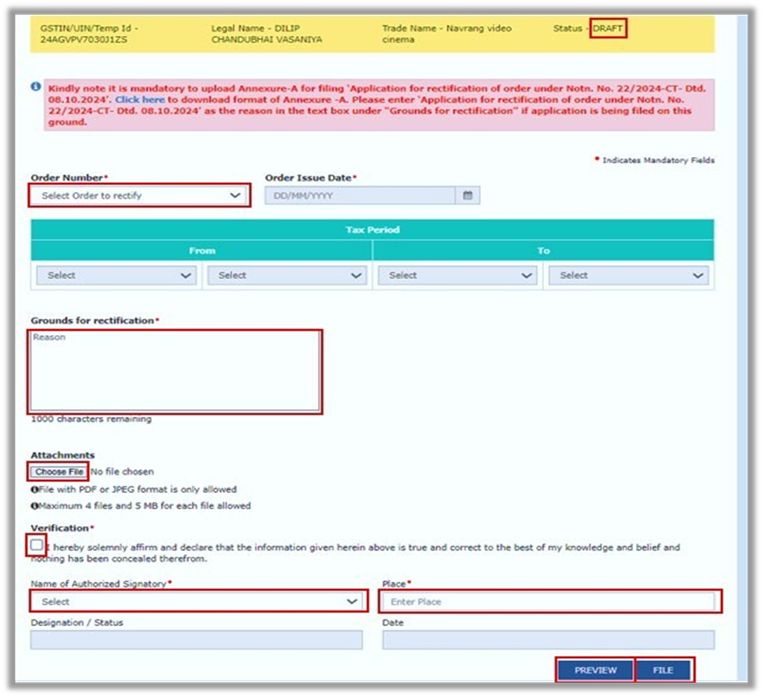

4) Enter details in the displayed fields as mentioned in the following steps:

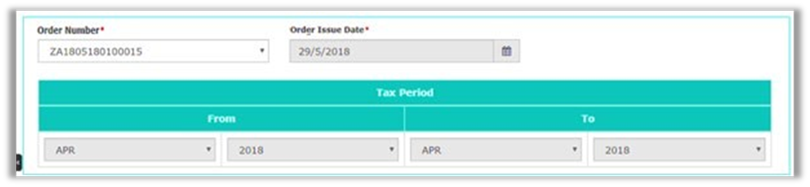

- In Order Number field, select the order number of the order that you wish to rectify.

- Based on your selection, latest Order Issue Date and Tax Period fields will get autopopulated.

c) In Grounds for rectification field, enter the reason, "Application of rectification of order under Notification No. 22/2024-Central tax dated 08.10.2024".

d ) Click Choose File to upload details in Annexure A as notified vide Notification No. 22/2024, dated 8th October 2024, in support of your application. This would be a mandatory step.

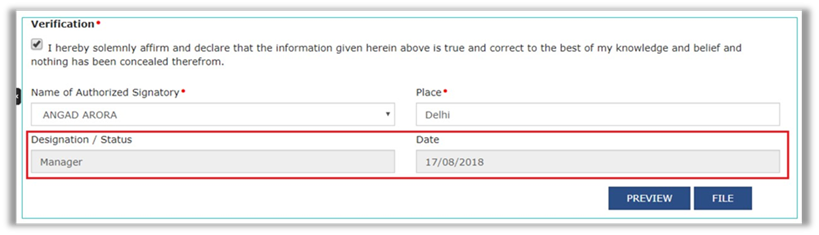

e) Enter Verification details. Select the declaration check-box and select the name of the authorized signatory.

f) Based on your selection, the fields Designation/Status and Date (current date) displayed below will get auto-populated. Enter the name of the place where you are filing this application.

g) Complete the filing process by clicking on PREVIEW and FILE.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates