GSTN unveils Upcoming GSTR-1/IFF enhancements on GST Portal

The Goods and Services Tax Network ( GSTN ) has unveiled the Upcoming GSTR-1/IFF enhancements on GST Portal.

In a Statement issued by GSTN said that, The statement of outward supplies in FORM GSTR-1 is to be furnished by all normal taxpayers on a monthly or quarterly basis, as applicable. Quarterly GSTR-1 filers have also been provided with an optional Invoice Furnishing Facility (IFF) for reporting their outward supplies to registered persons (B2B supplies) in the first two months of the quarter. Continuous enhancements & technology improvements in GSTR-1/IFF have been made from time to time to enhance the performance & user-experience of GSTR-1/IFF, which has led to improvements in Summary Generation process, quicker response time, and enhanced user-experience for the taxpayers.

The previous phase of GSTR-1/IFF enhancement was deployed on the GST Portal in November 2021. In that phase, new features like the revamped dashboard, enhanced B2B tables, and information regarding table/tile documents count were provided. In continuation to the same, the next Phase of the GSTR-1/IFF improvements would be implemented shortly on the Portal.

- GSTR-1/IFF can be viewed as usual by navigating in the following manner :

Return Dashboard > Selection of Period > Details of outward supplies of goods or services GSTR-1 > Prepare Online

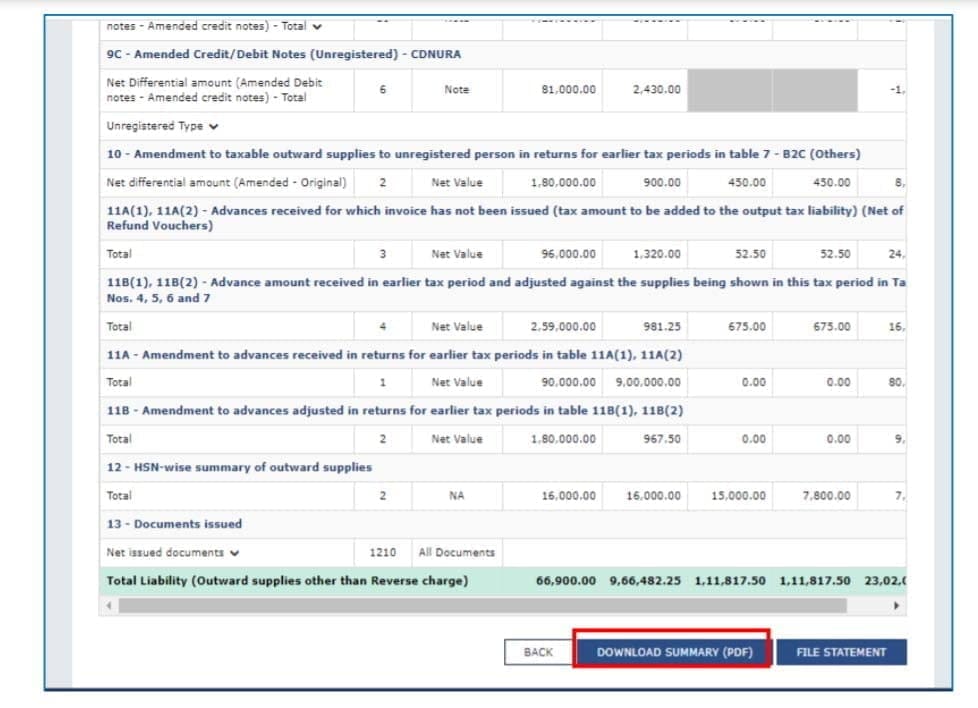

The following changes are being done in this phase of the GSTR-1/IFF enhancements :- Removal of ‘Submit’ button before filing : The present two-step filing of GSTR-1/IFF involving ‘Submit’ and ‘File’ buttons will be replaced with a simpler single-step filing process . The upcoming ‘File Statement’ button will replace the present two-step filing process and will provide taxpayers with the flexibility to add or modify records till the filing is completed by pressing the ‘File Statement’ button.

- Consolidated Summary : Taxpayers will now be shown a table-wise consolidated summary before actual filing of GSTR-1/IFF. This consolidated summary will have a detailed & table-wise summary of the records added by the taxpayers. This will provide a complete overview of the records added in GSTR-1/IFF before actual filing.

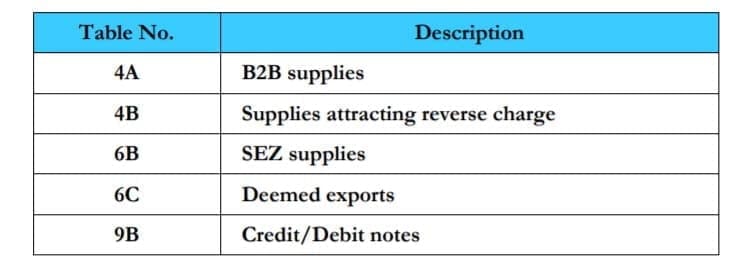

- Recipient wise summary : The consolidated summary page will also provide recipient-wise summary, containing the total value of the supplies & the total tax involved in such supplies for each recipient. The recipient-wise summary will be made available with respect to the following tables of GSTR-1/IFF, which have counter-party recipients :

Taxpayers can now view and download detailed summary of the GSTR-1/IFF in a new PDF format. The earlier format of the GSTR-1 summary was slightly different from the notified format, in which few tables of the notified format were clubbed together and made available to the users. The new summary format has been aligned with the notified format of GSTR-1. It will also contain the total outward supplies liability of the taxpayer (other than reverse charge), to be auto-populated in GSTR-3B.

The CBIC also said that, The functionality will be made available on the GST Portal shortly, and the same will be intimated to taxpayers.

For Detailed Advisory Click here.

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.