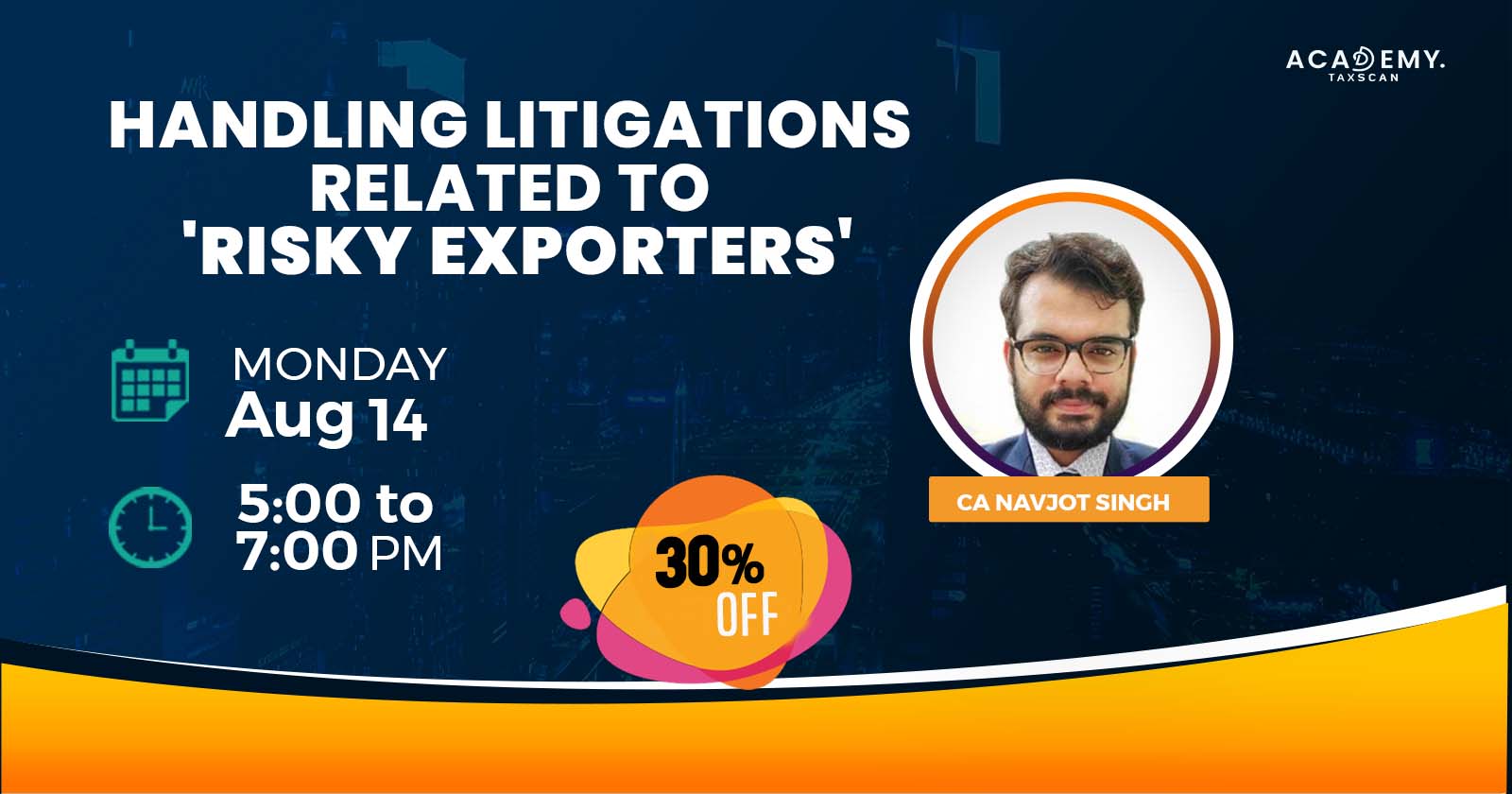

Handling Litigations related to 'Risky Exporters'

Handling Litigations – Litigations – Risky Exporters – Exporters – online certificate course – certificate course – Taxscan Academy – taxscan

Handling Litigations – Litigations – Risky Exporters – Exporters – online certificate course – certificate course – Taxscan Academy – taxscan

Faculty - CA Navjot Singh

📆Aug 14

⏰5.00PM - 7.00PM

Course Fees799(Including GST)

599(Including GST)

Click Here To Pay

Key Features

✅English Medium

✅Duration 2 Hours

✅E Notes available

✅The Recordings will be provided

What will be covered in the session?

The curious case of "Risky Exporters"

A detailed discussion on the issue and way forward.

When an alert of the risky exporter is invoked on the Import Export Code, all the refunds of IGST, Drawback, and other benefits get stopped and all the export consignments are subject to verification. This stoppage of refunds causes huge losses to the export businesses, which will impact the Indian Economy.

Agenda of Discussion:-

◾ Discussion about the concept of Risky Exporters.

◾ Chaos/Ground Reality

◾ Government's Intervention to resolve the issue?

◾ Way Forward

For Queries - 8891 128 677, 8943 416 272, info@taxscan.in