Haryana Govt’s Tax Amnesty: Waives Rs 8,000 Crore in Interest and Penalties on Property Tax Dues

Haryana Govt’s – Tax Amnesty-Waives – Crore – Interest – Penalties – Property Tax Dues-TAXSCAN

Haryana Govt’s – Tax Amnesty-Waives – Crore – Interest – Penalties – Property Tax Dues-TAXSCAN

The Haryana government has taken a significant decision to alleviate the financial burden on its citizens by waiving interest and penalties amounting to approximately Rs 8,000 crore on outstanding property taxes throughout the state.

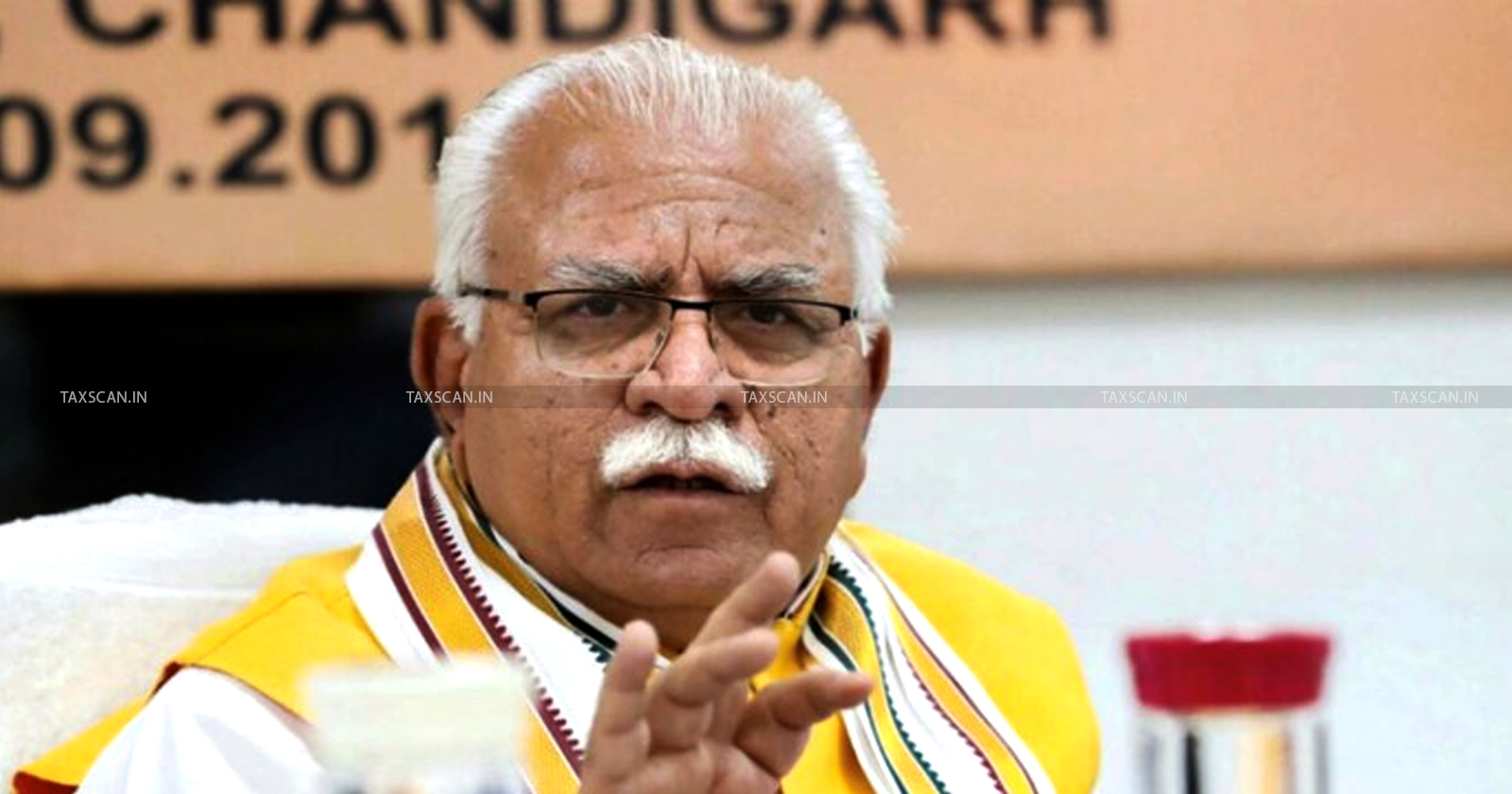

This momentous announcement was made during a press conference held in Chandigarh on October 6th by Haryana Chief Minister Manohar Lal Khattar. Additionally, the chief minister disclosed that a 15 percent rebate would be granted on the payment of property tax arrears.

In light of this development and in the interest of the state's residents, I am pleased to announce the waiver of both interest and penalties amounting to approximately Rs 8,000 crore on outstanding property tax dues. Furthermore, individuals depositing their arrears will receive a 15 percent discount, Chief Minister Khattar declared during the press conference.

The Chief Minister emphasized that the introduction of the 'Property IDs' system, an online property management platform, had led to the identification of a substantial number of properties with outstanding property tax arrears.

He acknowledged that there might be instances of discrepancies or disputes in which individuals have made tax payments but those payments are not accurately reflected in the system. To address such cases and ensure that as many people as possible can benefit from this initiative, the government intends to establish special camps throughout the state. These camps will be staffed by officials from the property tax department who will provide necessary data and information to assist citizens in resolving any issues related to their property taxes.

This decision reflects the government's commitment to providing financial relief to its citizens, particularly in light of the challenges posed by outstanding property tax arrears. It also underscores the government's determination to enhance transparency and facilitate tax compliance by introducing digital solutions such as the 'Property IDs' system. The move to establish special camps further demonstrates the government's dedication to addressing individual concerns and ensuring the effective implementation of this significant relief measure.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates