How Do the U.S. Presidential Elections Impact Gold Prices

U.S – Presidential Elections – Gold Prices – taxscan

U.S – Presidential Elections – Gold Prices – taxscan

The U.S. Mid-term elections are just around the corner. In November, congressional seats will be up for grabs, which will help determine if the democrats remain in power or if the republicans re-take either the House of Representatives or the Senate. A change in the power structure usually can have an impact on riskier assets, since most investors believe that a split government will accomplish nothing, and the lack of change might not affect investments in a negative way. The markets will likely become more volatile ahead of the elections as the outcome will not be solidified until all the votes are counted. Gold historically has been a safe-haven asset that can withstand some of the volatility associated with a new or consistent government.

What Occurs with a Divided Legislative Branch

In November, the U.S. electorate will go to the polls to vote on several candidates in the legislature. The U.S. government at the federal level is divided into three co-equal parts. There is the Executive Branch which is the president of the United States. There is the Judicial Branch, which includes judges at the federal level appointed by the Executive. Lastly, there is the Legislative Branch. The legislature votes on new laws that will be implemented once the president of the United States signs them. The legislature is divided into the House of Representatives and the Senate. Each state has two senators. A U.S. state will have several congresspeople based on the state's population.

For a law to be passed in the United States, it needs to be approved by both the House of Representatives and the Senate, and then signed by the president of the United States. The Judicial Branch interprets these laws. The importance of having a majority in the House or the Senate can drive policy. The head of the House or Senate does not have to bring up a vote for law and, therefore, can determine what will even have a chance of becoming law. When the branches are split (the House and the Senate) or the congress and the Executive, it's unlikely that many new laws will be passed.

Historically, the S&P 500 has performed well when a split congress exists. The S&P 500 benchmark index has outperformed in the years of a divided congress. Leading up to the last mid-term elections in 2020, the S&P 500 index has been higher the past 10 times when Congress was divided.

How Will Gold Be Impacted?

Investors will also be evaluating how other assets will handle the mid-term elections. Gold trading could be front and center as investor look for investments that might outperform ahead of a volatile situation.

Performing a Seasonal Study On Gold Prices

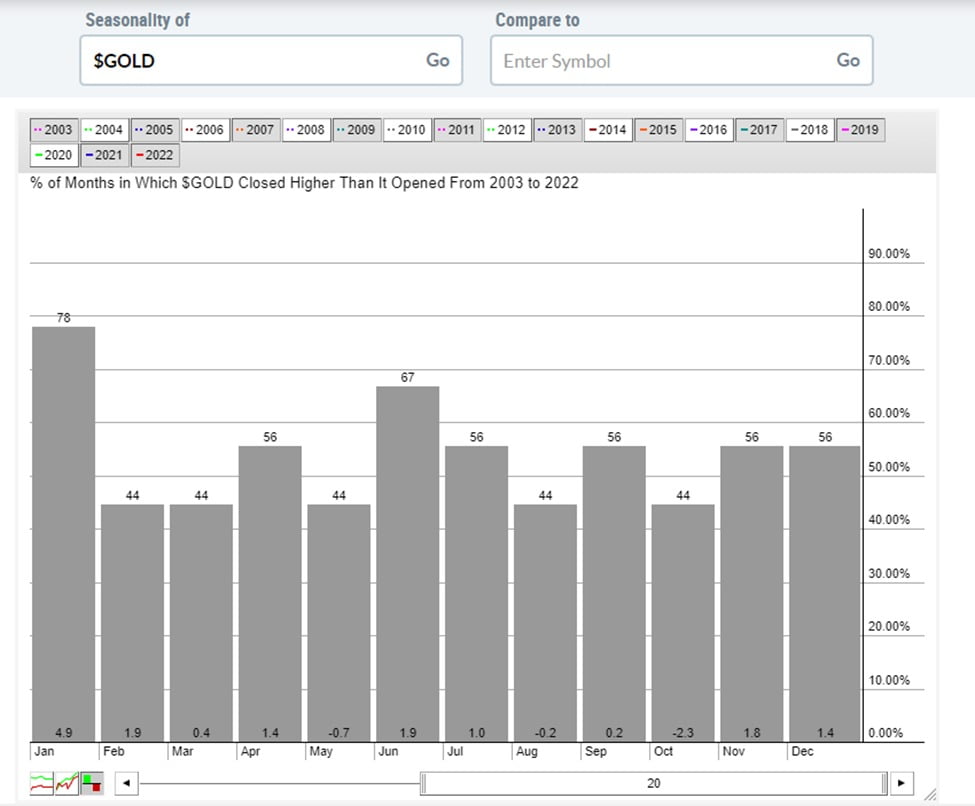

One way to determine how gold prices could react to U.S. elections is to look at a seasonal study. Seasonality is a study that looks at historical data and determines if any regular patterns occur. If any fluctuations in the data are predictable, then you can say there is some seasonality to the data. A seasonality study was performed on gold prices to determine if there is any seasonality to gold prices around or after the election.

*Source Stock Charts

During the past 20 years, gold prices have traded under pressure ahead of the election cycle. In the study of the past 20 years, presidential elections, which include congressional elections, are included. Ahead of the election, during the past 20 years, the price of gold has been lower 44% of the time for an average loss of 2.3%. In the month of the election (November), gold prices generally move higher, rising an average of 1.8% for an average gain of 1.8%.

The most exciting number appears when new congresspeople take office during the election year (every other year) in January. After an election, it takes about two months for the previously elected officials to wind up their business and hand their posts to newly elected officials. During this period, the Congress or Executive is called a lame duck. A lame duck is an official that presides over a position but does not take any new action.

When new officials take office in the Congress or White House, there seems to be a robust move historically in the price of gold. Gold trading over the past 20 years has seen an upward bias in January. Historically, gold prices have increased on average nearly 5% in January, rising almost 80% of the time. January seems to be the most pronounced month of the year in the years that there have been U.S. elections.

The Bottom Line

The upshot is that there is likely to be volatility in gold trading ahead of the mid-term elections in the United States. Stock prices usually outperform when there is a split congress, as investors believe that little will be accomplished, and that knowledge provides a stable backdrop to invest in riskier assets. Historically the S&P 500 has performed well during these periods. Gold prices seem to underperform ahead of the elections when the president or most of congress is expected to be elected. A seasonal study shows that the best performance for gold prices is in January, when the newly elected officials take office. Historically January has been the best month during these periods rising nearly 80% of the time for an average gain of 4.8% (see chart).

Of course, these statistics are never to be taken as a guarantee for future performance, and only used as a reference to make more informed trading decisions.

Support our journalism by subscribing to TaxscanAdFree. Follow us on Telegram for quick updates.