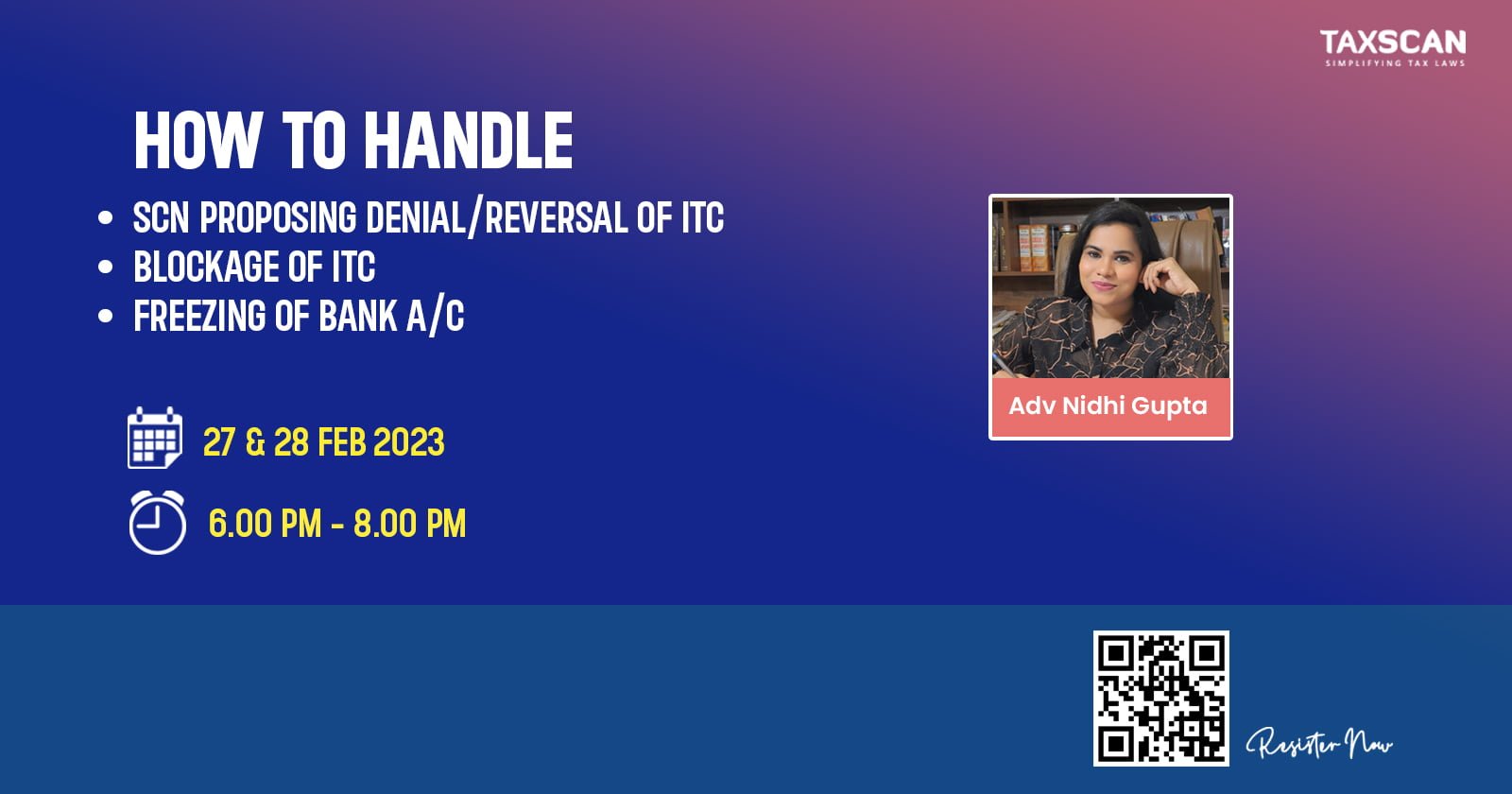

HOW TO HANDLE<br>● SCN PROPOSING DENIAL/REVERSAL OF ITC<br>● BLOCKAGE OF ITC<br>● FREEZING OF BANK A/C

HOW TO HANDLE – SCN PROPOSING DENIAL – SCN – REVERSAL OF ITC – ITC – BLOCKAGE OF ITC – freezing of bank account – Certificate Course – online certificate course – certificate course 2023 – taxscan – taxscan academy

HOW TO HANDLE – SCN PROPOSING DENIAL – SCN – REVERSAL OF ITC – ITC – BLOCKAGE OF ITC – freezing of bank account – Certificate Course – online certificate course – certificate course 2023 – taxscan – taxscan academy

Faculty - Adv Nidhi Gupta

📆27 & 28 Feb 2023

⏰6.00 PM - 8.00 PM

Course Fees999+GST)

599+GST

Click Here To Pay

Key Features

✅E - Certificate

✅E Notes available

✅The Recordings will be provided

✅Dedicated WhatsApp Group for updates

What will be covered in the session

Day 1

How to handle SCNs based on the following issues with reference to relevant statutory provisions, Circulars, and various judgements under GST as well as under erstwhile period:

☑SCNs based on difference between 2A and 3B

☑SCNs based on suo moto cancellation of supplier’s registration

☑SCNs based on non-filing of GSTR-3B return by the supplier

Day 2

How to deal with the following issues keeping in view the Constitutional Provisions, GST Law, Circulars, and relevant judgments:

☑Blockage of ITC under Rule 86A

☑Attachment of bank a/c under section 83

---‐--------------------------------------------

For Queries - 8891 128 677, 89434 16272, info@taxscan.in