ICAI CA New Education and Training At a Glance

The Institute of Chartered Accountants of India (ICAI) has decided to launch the new scheme for Chartered Accountancy (CA) syllabus on 1st July 2023. The gazette notification and the press release of the same is out.

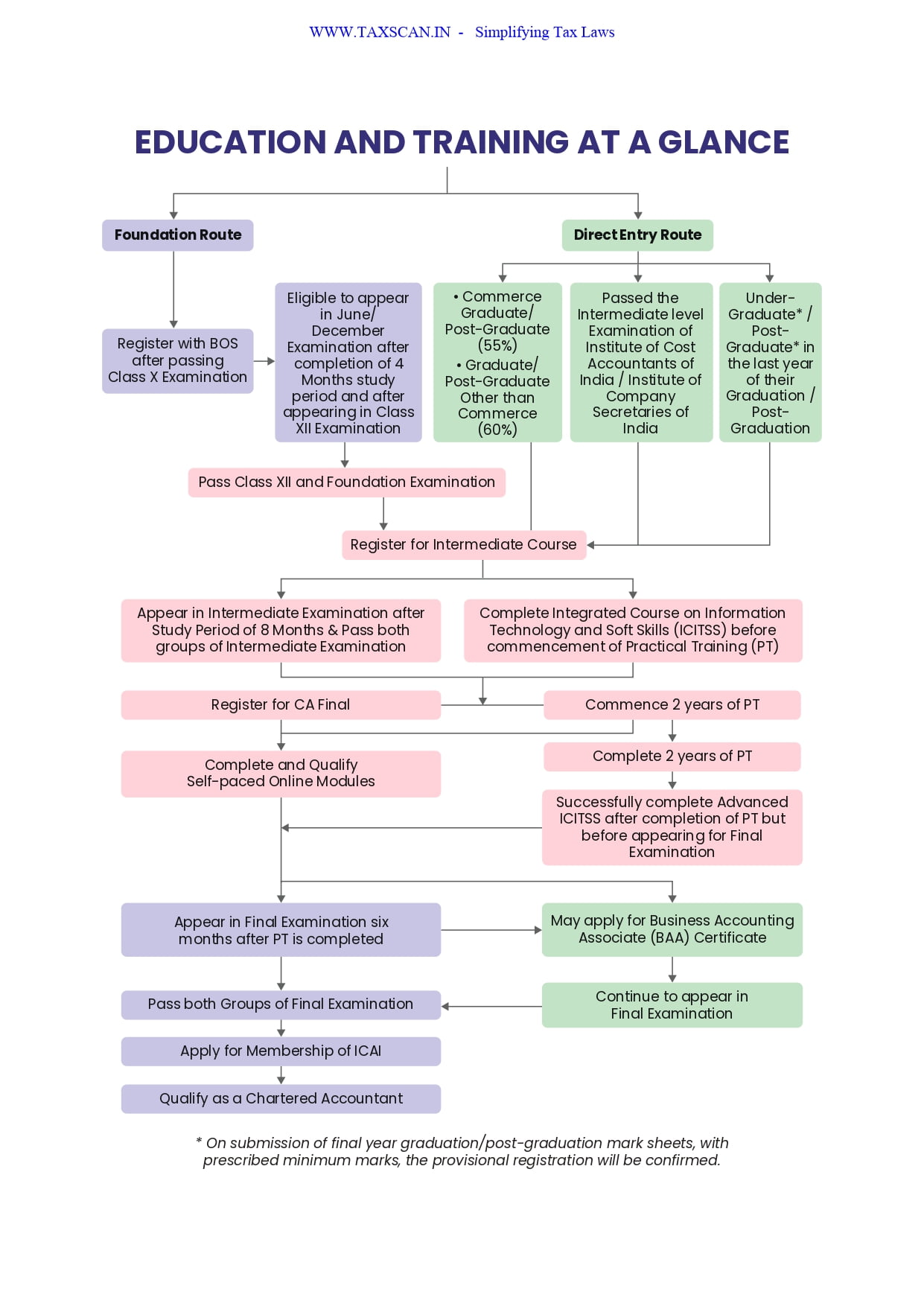

The CA Education and Training as per the ICAI new scheme at a glance:

- Foundation Route

- Register with BOS after passing Class X Examination

- Eligible to appear in June/ December Examination after completion of 4 Months study period and after appearing in Class XII Examination

- Pass Class XII and Foundation Examination

- Register for Intermediate Course

I. Appear in Intermediate Examination after Study Period of 8 Months & Pass both groups of Intermediate Examination

II. Complete Integrated Course on Information Technology and Soft Skills (ICITSS) before commencement of Practical Training (PT)

- Register for CA Final ; Commence 2 years of PT

- Complete and Qualify Self-paced Online Modules ; Complete 2 years of PT

- Successfully complete Advanced ICITSS after completion of PT but before appearing for Final Examination

- Appear in Final Examination six months after PT is completed

- May apply for Business Accounting Associate (BAA) Certificate

- Continue to appear in Final Examination

- Pass both Groups of Final Examination

- Apply for Membership of ICAI

- Qualify as a Chartered Accountant

2. Direct Route Entry

- I. • Commerce Graduate/ Post-Graduate (55%)

• Graduate/ Post-Graduate Other than Commerce (60%)

II. Passed the Intermediate level Examination of Institute of Cost Accountants of India / Institute of Company Secretaries of India

III. UnderGraduate/ PostGraduate in the last year of their Graduation/ PostGraduation

Note: On submission of final year graduation/post-graduation mark sheets, with prescribed minimum marks, the provisional registration will be confirmed.

After this, the next step is to register for the Intermediate course. Then follow the same pattern stated in the foundation route. Through the direct route entry, a commerce graduate/ post graduate scoring 55% can enter directly to the intermediate course.

Also a non-commerce Graduate or Post graduate who scored 60% can also enter directly to the intermediate course of the CA.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates