ICAI introduces Exemption(s) from appearing in paper(s) or Group of CA Exams under New Scheme of Education and Training w.e.f. May 2024 Examination

On July 1, 2023, the Institute of Chartered Accountants of India implemented the revised Education and Training Scheme. Beginning with the May 2024 Examination Session, the exams for the Intermediate and Final levels under this new framework will be administered.

The ICAI’s Council has chosen to provide waivers based on the newly approved syllabus for the Intermediate Examination and for the Final Examination to current students who have successfully cleared papers under the previous/existing scheme. The details are as follows:-

I. Final Examination:

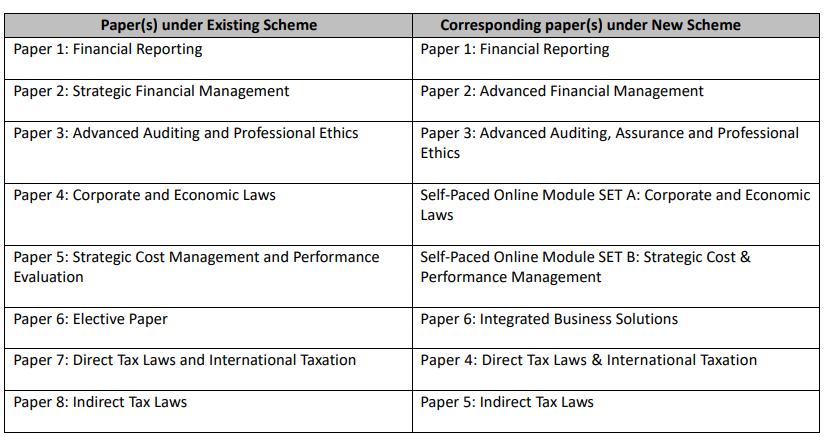

(i) Paper-wise exemption on the basis of securing sixty per cent or more marks:

The Council has resolved to persist in granting exemptions to a candidate for a particular paper or papers. This exemption had been previously granted under the Old/Existing Scheme due to achieving at least sixty percent marks in one or more papers within a Group/s according to the existing criteria for exemption. This exemption will remain valid for the remaining opportunities in the corresponding paper(s) as approved by the Council under the New Scheme, as outlined below:

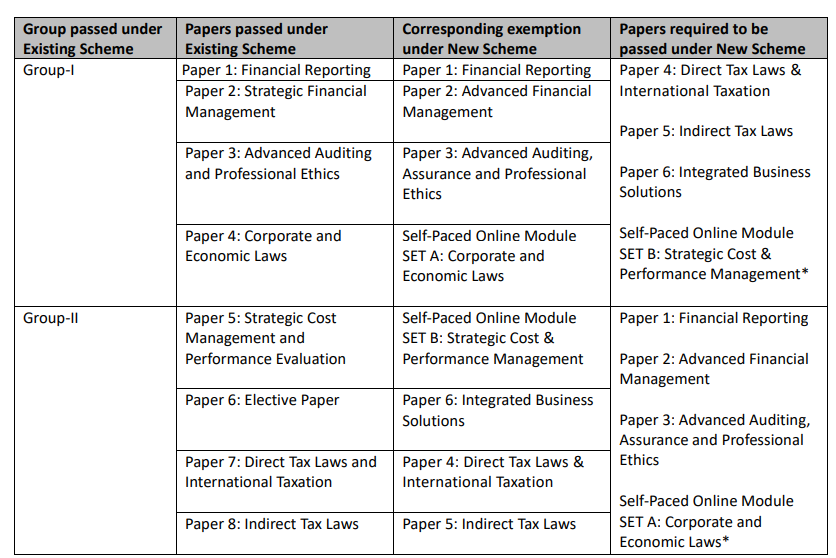

(ii) Details of papers/ group in which candidates are required to appear and pass in Final Examination under New Scheme:

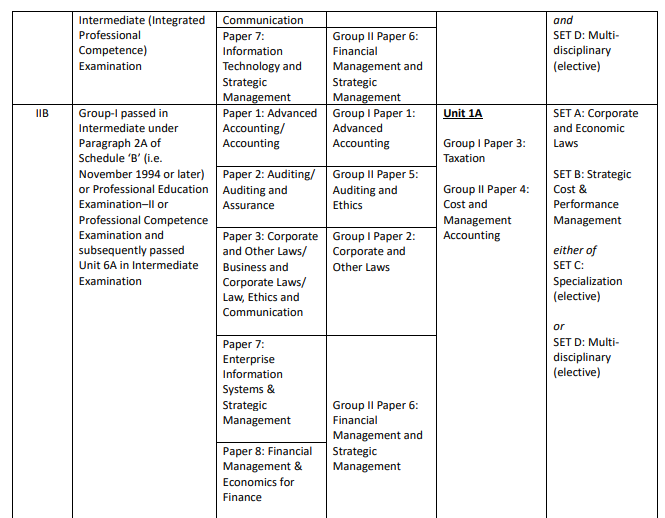

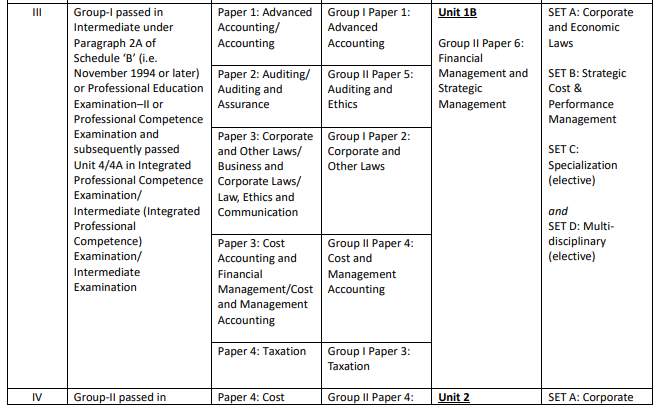

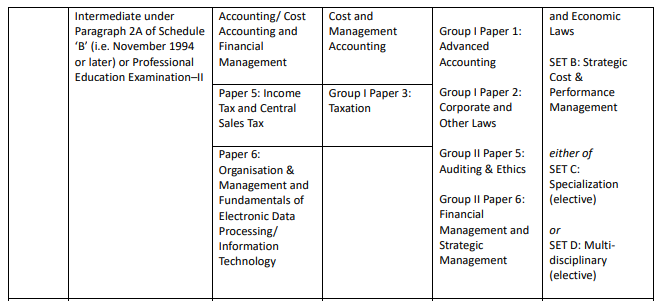

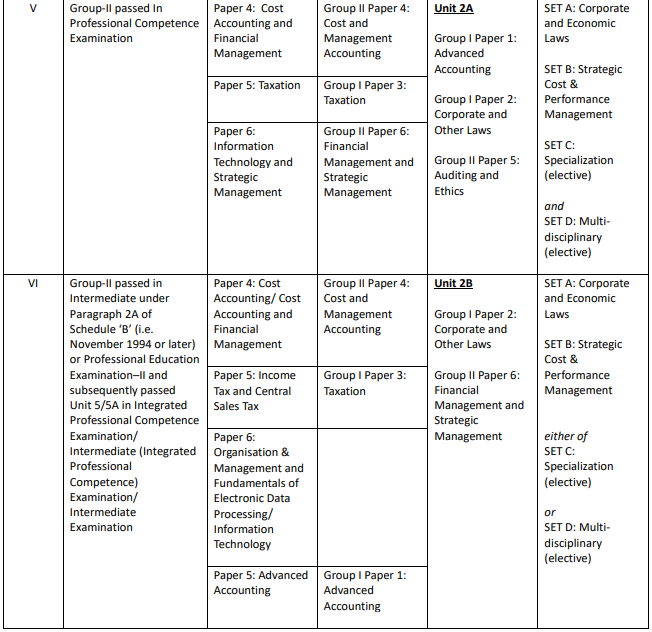

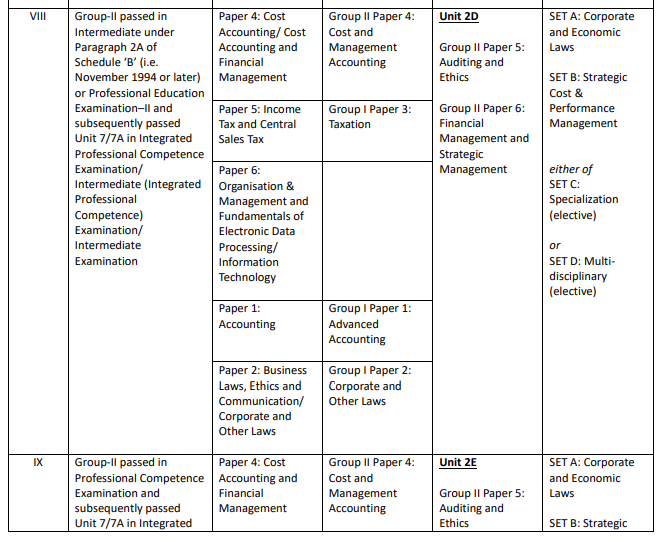

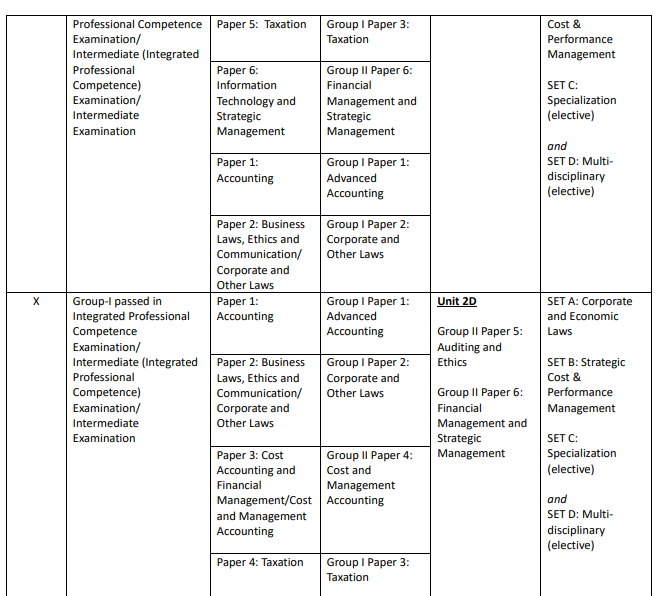

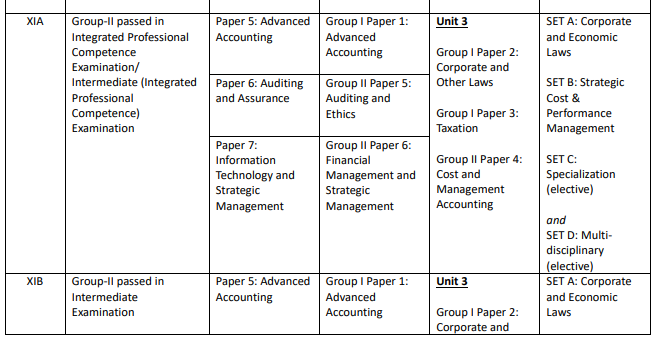

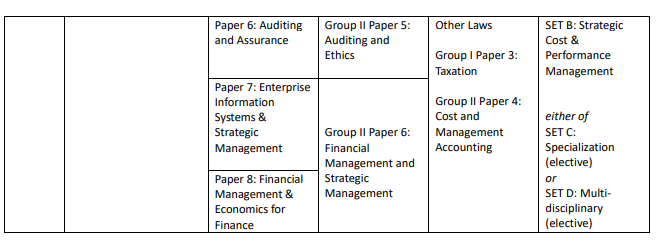

The Council decided that a candidate who has passed in any one but not in both the groups of the Final Examination under Existing Scheme shall be eligible for exemption in that particular group and shall be required to appear and pass in the remaining group / paper(s) in order to pass the Final Examination under New Scheme as given below:

*Final Course Students appearing in the May 2024 Examination under New Scheme may qualify Self-Paced Online Modules, as applicable, after passing the May 2024 Examination but before applying for membership.

Thereafter, the candidate would be eligible for subsequent examination only after qualifying Self-Paced Online Modules, as applicable. Students who have appeared in Final Old/ Existing Scheme and converted to Final New Scheme are exempted from appearance in Self-Paced Online Module SET C and SET D.

II. INTERMEDIATE EXAMINATION

(i) Paper-wise exemption on the basis of securing sixty per cent or more marks:

The Council has resolved to uphold the practice of granting exemptions in a paper or multiple papers to a candidate. These exemptions were previously granted under the Old/Existing Scheme, based on the achievement of a minimum of sixty percent marks in one or more papers within a Group/s, according to the existing criteria for exemption. This exemption will remain applicable for the remaining opportunities in the corresponding paper(s) as approved by the Council under the New Scheme, as outlined in the following manner:

| Paper(s) under Existing Scheme | Corresponding paper(s) under New Scheme |

| Paper 1: Accounting | Paper 1: Advanced Accounting |

| Paper 2: Corporate and Other Laws | Paper 2: Corporate and Other Laws |

| Paper 3: Cost and Management Accounting | Paper 3: Cost and Management Accounting |

| Paper 4: Taxation | Paper 3: Taxation |

| Paper 5: Advanced Accounting | Paper 1: Advanced Accounting |

| Paper 6: Auditing and Assurance | Paper 5: Auditing and Ethics |

| Paper 7: Enterprise Information Systems & Strategic Management | Paper 6: Financial Management and Strategic Management |

| Paper 8: Financial Management & Economics for Finance | Paper 6: Financial Management and Strategic Management |

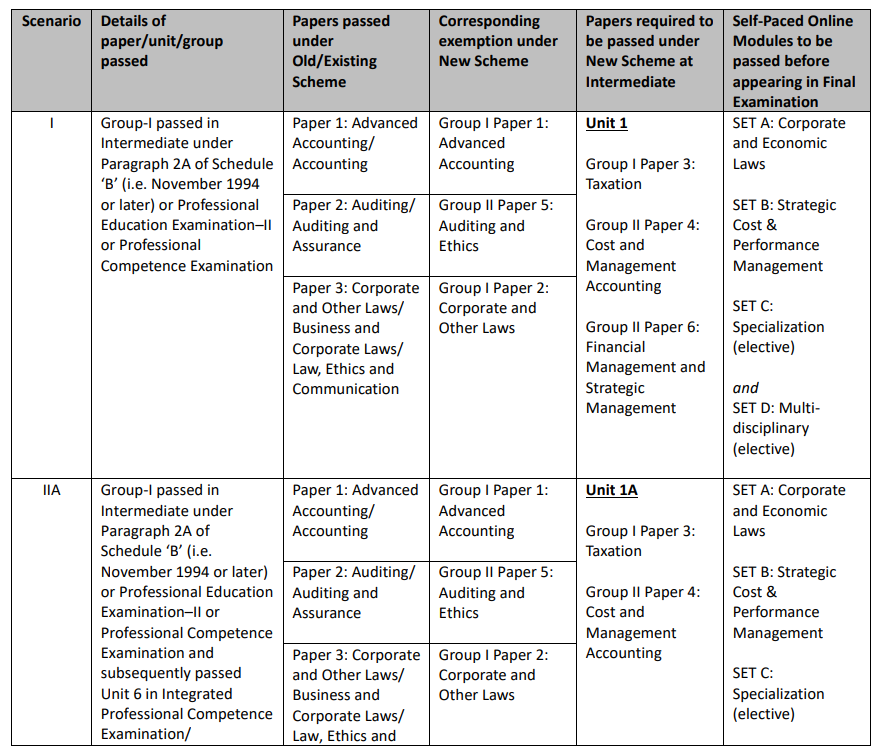

(ii) Details of paper/unit/group in which candidates are required to appear and pass in Intermediate Examination under New Scheme:

The Council also endorsed the "Unit" Scheme for individuals who have successfully finished one of the Groups within the previous Intermediate Examination syllabus, as mentioned in paragraph 2A of Schedule B to the Chartered Accountants Regulations, 1988, or the Professional Education (Examination II), Professional Competence Examination (PCE), Intermediate (Professional Competence) Examination, Integrated Professional Competence Examination, Intermediate (IPC) Examination, or Intermediate Examination. These individuals intend to finalize the Intermediate Course under the New Syllabus, as presented below:

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates