ICSI proposes MCA to introduce CS Compliance Certificate for Small Companies Turnover not Exceeding Rs. 40 crores [Read Notification]

ICSI – MCA – CS -Compliance -Certificate – Companies -Turnover – Exceeding -TAXSCAN

ICSI – MCA – CS -Compliance -Certificate – Companies -Turnover – Exceeding -TAXSCAN

The Institute of Company Secretaries of India (ICSI) has recommended to the Ministry of Corporate Affairs (MCA) the introduction of a Compliance Certificate for Company Secretaries (CS) specifically for small companies with a paid capital "not exceeding 4 crore" and turnover "not exceeding Rs. 40 crores." In the communication sent to the MCA, the institute also included a draft of this Compliance Certificate.

The letter stated that small companies and its officers in default are also subject to penalty for non-compliance of the provisions of applicable laws akin to their larger counterparts. Even further it has been noticed that a large number of Multinational Corporations are formed and structured as small companies.

In such a scenario, an appropriate governance and compliance mechanism is required for such companies, not only to strengthen the Indian corporate governance scenario but show to the world as to how it must be done.

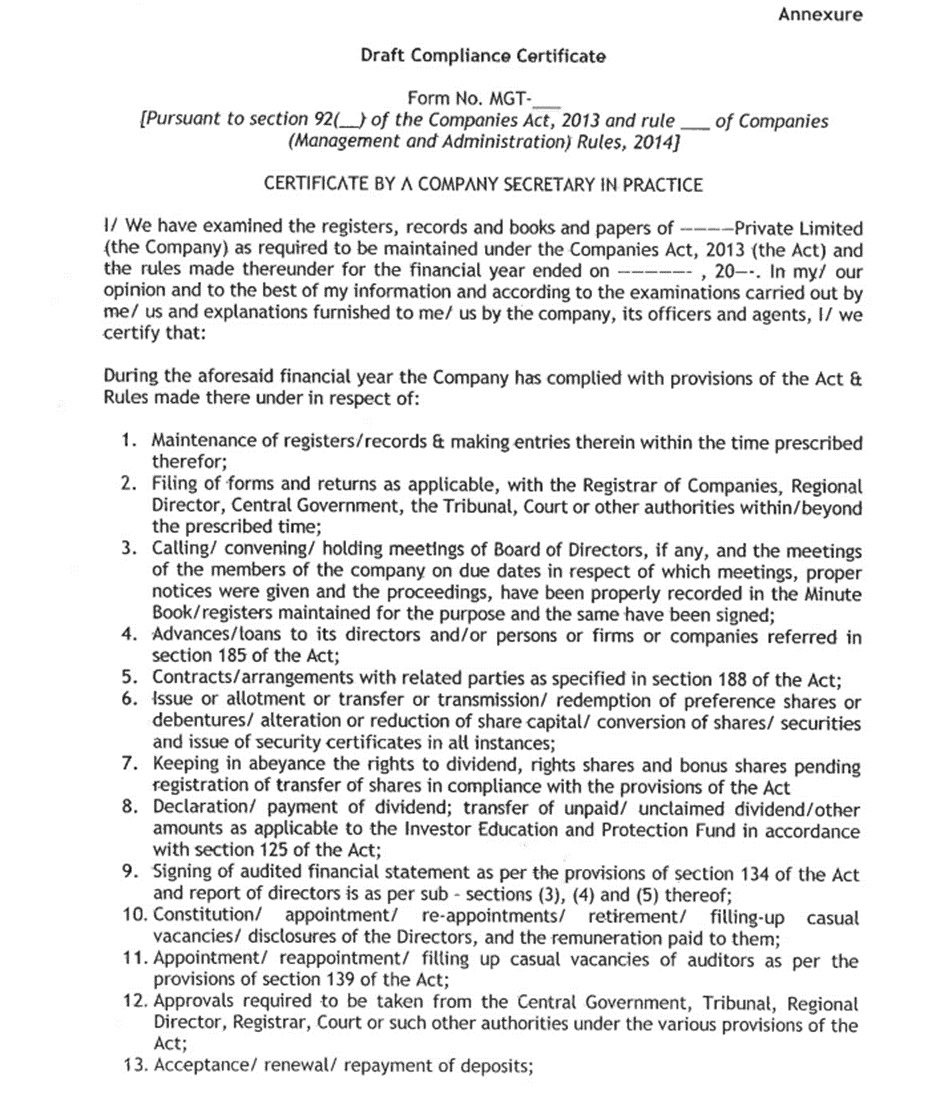

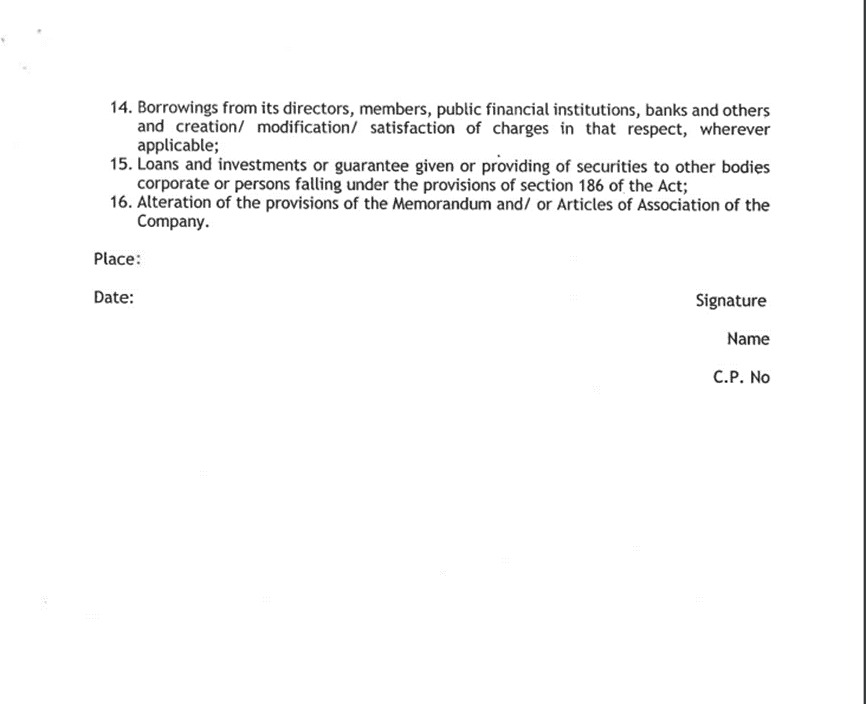

The ICSI requested the MCA to revisit the Companies Act, 2013 and make appropriate arrangements to inculcate provisions requiring every small company which has not employed a whole time company secretary under sub-section (1) of section 203 of the Act to file with the Registrar a certificate from a company secretary in whole-time practice in Form no. MGT- within thirty days of annual general meeting, as to whether the company has complied with all provisions of the Act and a copy of such certificate be attached with Board's report referred to in section 134.

Further stated that such a requirement would also help in considerably easing the workload of the concerned authorities, on one hand, and proper and timely compliance by the companies on the other.

The draft of compliance certificate is as follows:

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates