Import of Diffused Silicon Wafer which is Not ‘Product Under Consideration’ did not attracts Safeguard Duty: CESTAT quashes Demand of Safeguard Duty

The Chennai bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) quashed the demand for Safeguard duty on the ground of the import of diffused silicon wafers which was not a product under consideration did not attract safeguard duty.

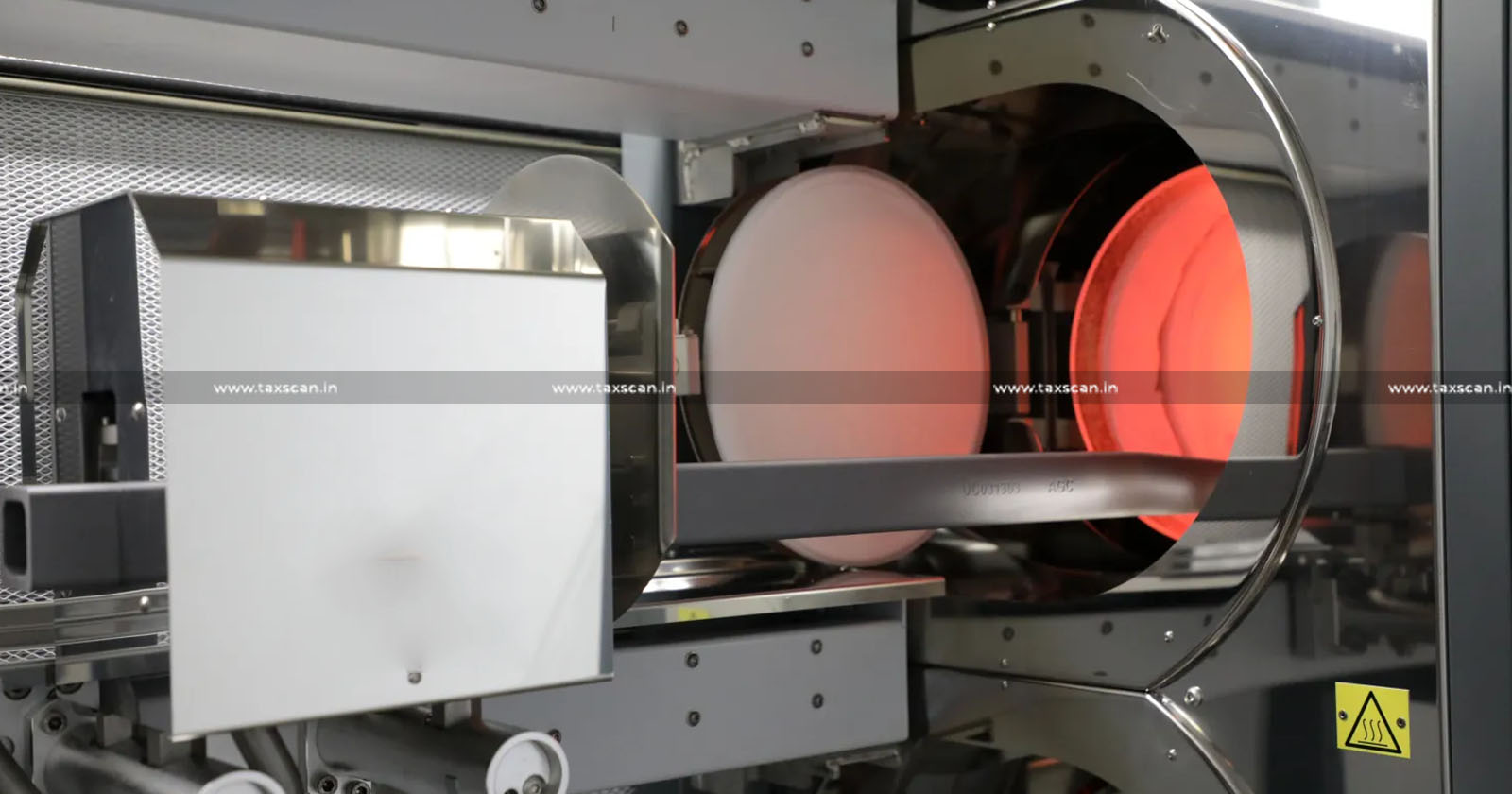

CETC Renewable Energy Technology (India) Private Limited, the appellant assessee was a private limited company importing various capital goods from overseas, to be used in the manufacture of Solar Cells, from Diffused / Undiffused Silicon Wafers / Blue Wafers and the Diffused / Undiffused Silicon Wafer / Blue Wafer was claimed to be the basic input / raw material required for the manufacture of Solar Cells.

The assessee appealed against the order passed by the Commissioner of Customs for confirming the classification of imported goods for demand safeguard duty and also for the imposition of a penalty for confiscation of imported goods by the assessee.

C. Manickam, the counsel for the assessee contended that the product imported was different and distinct from the Product Under Consideration and therefore, the same did not attract safeguard duty.

Further submitted that the demand of safeguard duty as confirmed in the impugned order was unsustainable and liable to be deleted.

R. Rajaraman, the counsel for the department relied on the decisions made by the lower authorities and contended that the imported goods by the assessee were products under consideration and the demand of safeguard duty was as per the law and liable to be sustained.

The two-member bench comprising P.Dinesha (Judicial) and Vasa Seshagiri Rao(Technical) quashed the demand for safeguard duty imposed on the assessee.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

M/s. CETC Renewable Energy Technology (India) Private Limited vs Commissioner of Customs , 2023 TAXSCAN (CESTAT) 921 , Dr. C. Manickam , Shri R. Rajaraman