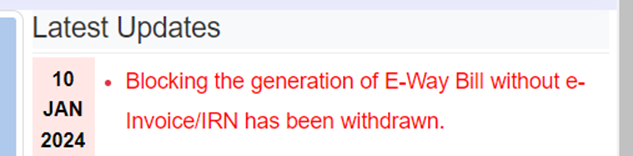

Important E-Way Bill Update: Blocking Generation of E-Way Bill without e-Invoice/IRN Withdrawn

E-way BIll system has updated that blocking Generation of E-Way Bill without e-Invoice/IRN has been Withdrawn

E-Way Bill Update – E-Way Bill – Generation of E-Way Bill – e-Invoice – irn – invoice reference number – eway bill – taxscan

E-Way Bill Update – E-Way Bill – Generation of E-Way Bill – e-Invoice – irn – invoice reference number – eway bill – taxscan

The E-way Bill system has updated that the introduction of blocking generation of E-Way Bill without e-Invoice/IRN has been ‘WITHDRAWN’. The same has been officially announced through the official website of the E-way Bill system.

On 5th January 2024, the National Informatics Centre (NIC) announced that, starting from March 2024, the generation of E-way bills will require inclusion of e-invoice details and will not be permitted otherwise.

This is applicable for e invoice enabled tax payers and for the transactions related to Supplies under B2B and Exports. However, EWBs for other transactions such as B2C and non-supplies will function as usual without any change. However, the same has been withdrawn now. Read More: E-way Bill Generation not allowable without E-invoice details w.e.f. 1st March 2024: NIC

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates