Important Update: E-way Bill System Issues Advisory on Verification of Transporter ID in E-way Bills [Read Order]

Important Update-E-way Bill – Advisory – Verification – Transporter ID – E-way Bills-TAXSCAN

Important Update-E-way Bill – Advisory – Verification – Transporter ID – E-way Bills-TAXSCAN

The E-way bill system has issued an advisory on verification of transporter ID in E-way bills based on the queries received by the transporters and taxpayers on 10th November 2023.

There are 3 categories of transporters in the e-Waybill System. They are:

- GST registered Transporters: In this category, the transporter gets registered in the GST Common portal and obtains a GSTIN number.

- Enrolled transporters: In this category, there are small transporters who want to do transport business but are not registered in GST Common portal and do not have the GST number. So, the transporter enrols himself in the e-waybill portal based on the PAN and obtains a TRANSIN that looks similar to a GSTIN number. They are called as Enrolled transporters.

- Common enrolled transporters: This is the third category of transporters. They are normal GST registered transporters having multiple GSTINs across different states. Such transporters move consignments with e-waybills which passes through multiple states. This involves transhipments and updating of transporter Id of the respective state for the e-waybills.

In order to simplify the process of updating transporter IDs, a unified enrollment facility has been incorporated into the e-waybill system, as outlined in Notification No. 28/2018 dated 19th June 2018 – Central Tax. Under this provision, GST-registered transporters have the option to consolidate all their GSTINs and enroll for a common enrollment. This results in the issuance of an enrollment number resembling the GSTIN but commencing with '88' followed by the same PAN. For instance, if a GST-registered transporter has GSTINs like 29ABCDE1234FX12, 27ABCDE1234FX13, etc., the common enrollment would provide a number such as 88ABCDE1234FX13.

This common enrollment number, starting with '88,' allows transporters to efficiently update their transporter IDs. This feature is designed to maintain consistency in the transporter ID as goods move across different states, eliminating the need for constant updates with the GSTINs of transporters in their respective states.

Upon examination, it has been noted that certain ERP, GSP, ASP, SAP, and other automated systems are neglecting to verify transporter IDs of various types. This oversight is impacting the operations of several transporters. Notably, specific ERP/GSP/ASP/SAP systems are exclusively validating 'GST registered Transporters' using the 'Get GSTIN details' API for authenticating transporter IDs. This particular API only provides status information for GST registered transporters, marking enrolled and common enrolled transporters as having an invalid status.

After analysis it is observed that some of the ERP, GSP, ASP, SAP and other automated systems are not verifying the transporter Id of all the given types. This is affecting the business of some of the transporters. Some of the ERP/GSP/ASP/SAP systems are verifying only the ‘GST registered Transporters’ using the ‘Get GSTIN details’ API to verify the authenticity of the transporter ID. This API will return the status only for the GST registered transporters. For the enrolled and common enrolled transporters, the API will return as Invalid status. There is another API ‘Get TRANSIN details’ to verify the transporter id under the categories of ‘enrolled and common enrolled transporters.

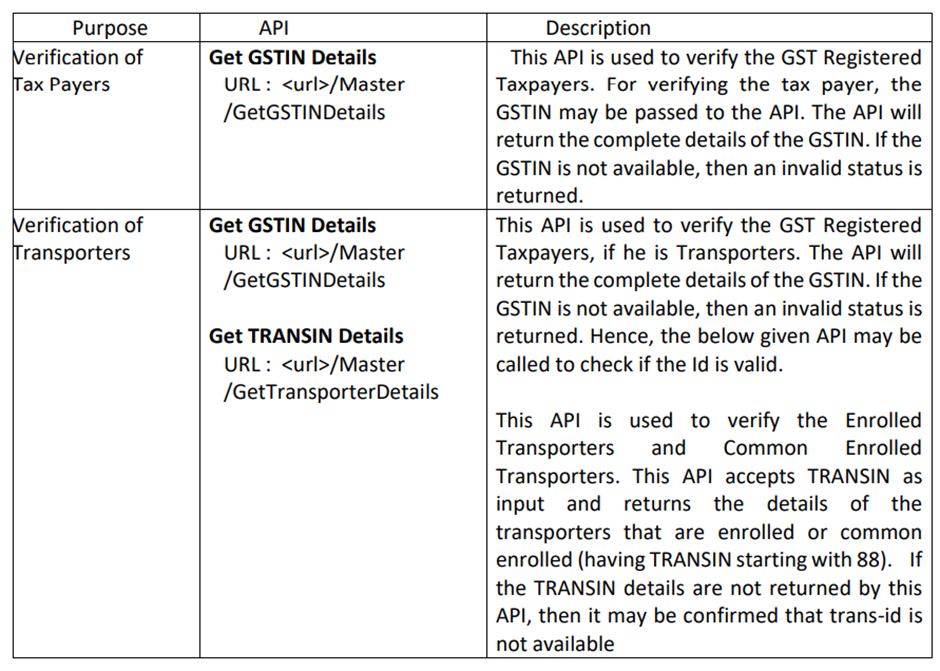

Hence, it is requested to use the API ‘Get TRANSIN Details’ also, in addition to ‘Get GSTIN details’ API. As ERP system cannot distinguish between registered and enrolled transporter IDs, hence the ERP may be modified to first call the ‘Get GSTIN Details’ to verify the transporter Id and in case the status is invalid then call ‘Get TRANSIN details’ API before finally concluding the status of the transporter Id. Details of APIs are given below:

Similarly, in e-Waybill Portal, two options to verify the GST taxpayers and transporters are provided under the Search option in the main menu.

1. Taxpayers: This option returns the details of the taxpayers registered under GST. The status of the enrolled and common enrolled transporters cannot be verified using this option.

2. Transporters: This options returns the details of the taxpayers registered under GST as well as the status of the enrolled and common enrolled transporters. So, for verifying the transporters, this option may be used instead of the previous one.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates