Important update: GSTN releases Offline Utility for GSTR-9 and GTR-9C for Financial Year 2022-23

The Goods and Services Tax Network (GSTN) has released the offline utility for form GSTR-9 and form GSTR-9C for the Financial Year 2022-23.

Form GSTR-9

Form GSTR-9 is an annual return that must be filed once during each financial year by registered taxpayers who were previously regular taxpayers, which includes SEZ units and SEZ developers. In this return, taxpayers need to provide information about their purchases, sales, input tax credit, as well as any claims for refunds or demands created.

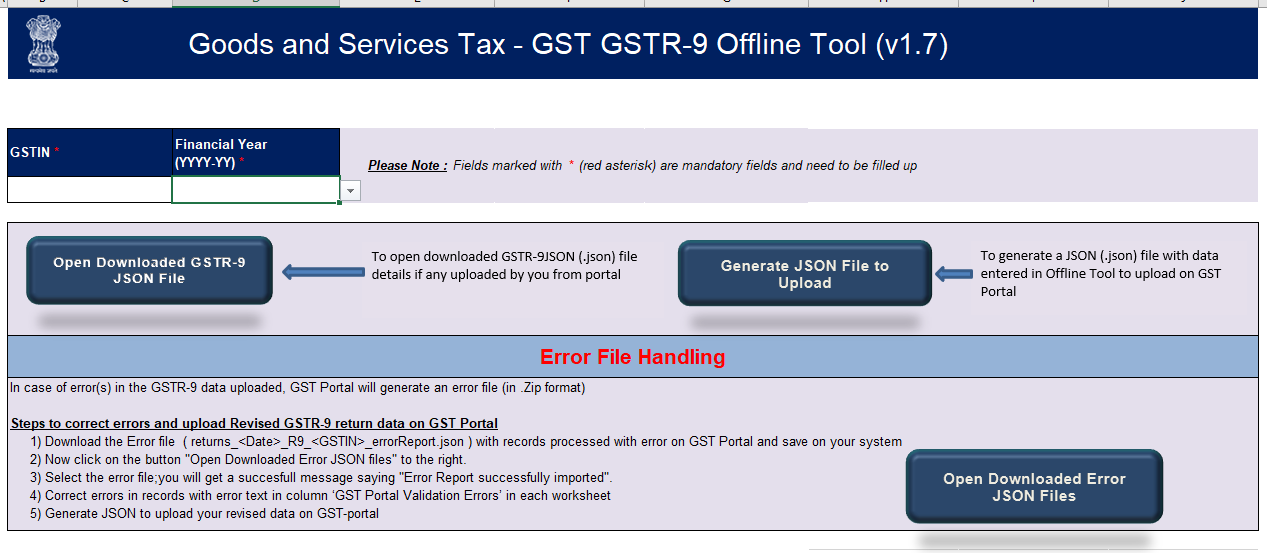

The Details for following Tables of GSTR-9 return can be added by the taxpayer using the offline Tool. It is not Mandatory to fill data in all worksheets. The taxpayer has to declare outward, ITC availed, ITC Rev, Tax paid, HSN outward…etc.

Form GSTR-9C

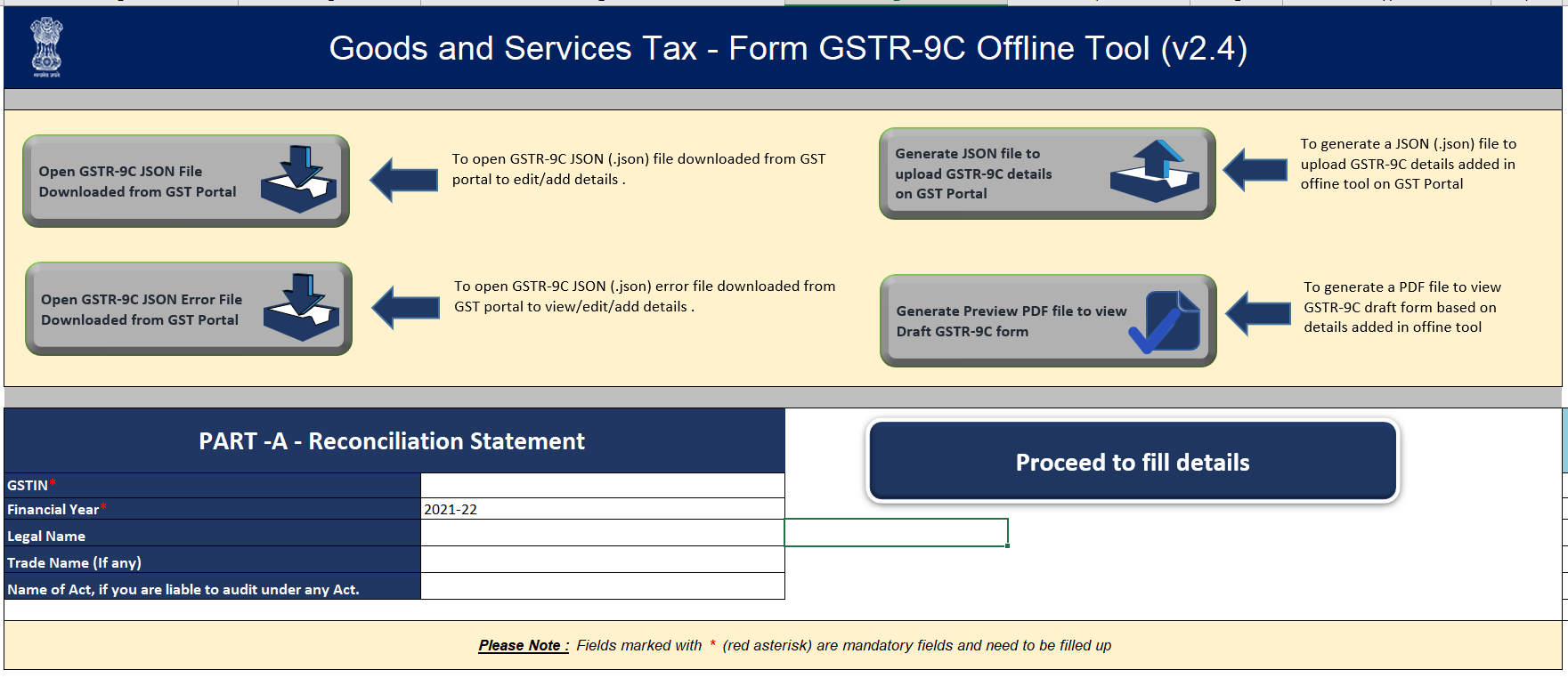

GSTR 9C serves as a reconciliation statement that compares the data from the annual returns filed in GSTR 9 for the relevant financial year with the figures presented in the taxpayer's audited annual financial statements. It includes details of the gross and taxable turnover as recorded in the taxpayer's books of accounts, along with the corresponding figures derived from the consolidation of all GST returns for the financial year.

The details in the Form GSTR-9C statement can be added by the auditor using the offline Tool. It includes Reconciliation of turnover declared in audited Annual Financial Statement with turnover declared in Annual Return (GSTR9), Reconciliation of Gross Turnover, Reasons for Un - Reconciled difference in Annual Gross Turnover, Reconciliation of Taxable Turnover, Reasons for Un - Reconciled difference in taxable turnover, Reconciliation of tax paid, Reconciliation of rate wise liability and amount payable thereon, Reconciliation of Input Tax Credit (ITC), Auditor's recommendation on additional Liability due to non-reconciliation..etc.

How to Download GSTR-9 and GSTR-9C Offline Tool

- Go to GST Portal : https://www.gst.gov.in/

- Navigate to ‘Downloads’ and ‘Offline Tools’

- Click ‘GSTR-9 offline tool’

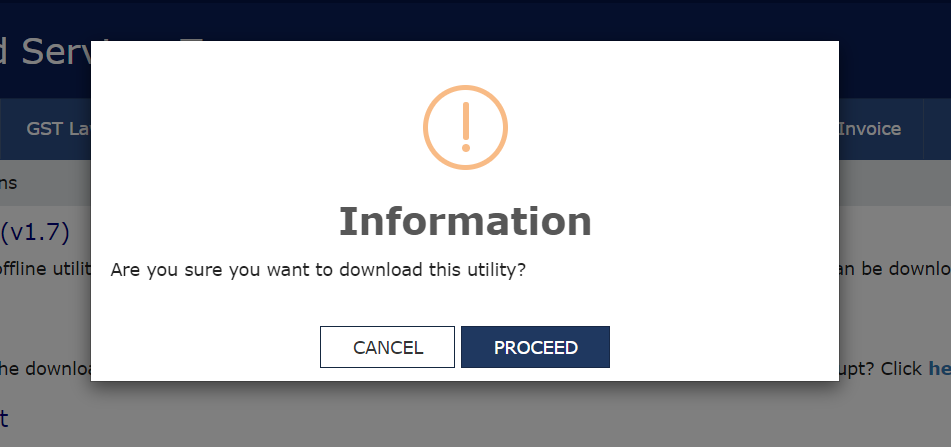

- Click ‘Download’ and you can see a page given below.

- Click on ‘Proceed’ and the zip file of excel utility will be downloaded.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates