Important Update: Your PAN Status is now shown on Form 26AS

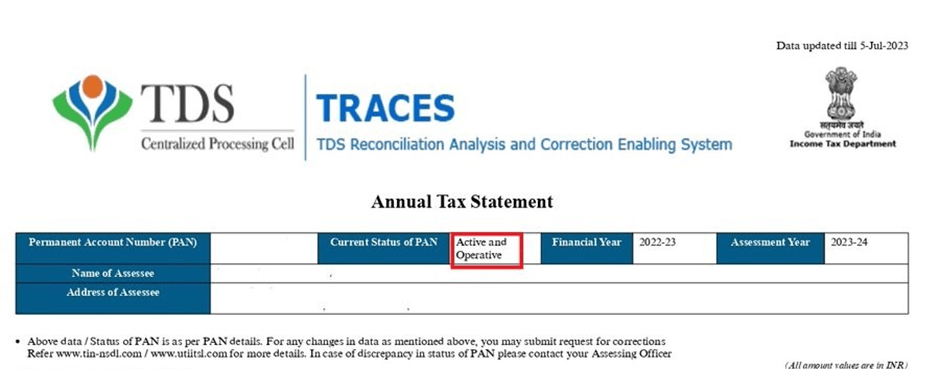

The Income Tax Department has come up with a new update that your Permanent Account Number status will be shown on Form 26AS. Now you can see whether your PAN is active and operative or inactive and non-operative through the form.

The Form 26AS is a document that presents a comprehensive summary of the amount deducted as TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) from different income sources of a taxpayer.

The due date to link PAN and Aadhaar was already finished. The department stated that if anyone failed to link PAN with Aadhaar has to face several consequences. Recently, the department has announced that with a penalty of Rs. 1000, the taxpayers can link the PAN-Aadhar, however now it’s stating that no penalty is charged for the PAN cards allotted on or after July 1st 2017.

In the above image, it is clearly shown where the current status of the PAN is shown and also the status.

Consequences of Not Linking PAN-Aadhaar

- no refund shall be made against such PAN;

- interest shall not be payable on such refund for the period during which PAN remains inoperative; and

- TDS and TCS shall be deducted /collected at a higher rate as provided in the Act

According to the press release issued by the Central Board of Direct Taxes (CBDT) on 28th March 2023, “Under the provisions of the Income-tax Act, 1961 (the ‘Act’) every person who has been allotted a PAN as on 1 st July, 2017 and is eligible to obtain Aadhaar Number, is required to intimate his Aadhaar to the prescribed authority on or before 31st March, 2023, on payment Of a prescribed fee. Failure to do so shall attract certain repercussions under the Act w.e.f 1st April, 2023.”

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates