Imported Aluminium Composite Plate is not 'prepared for use in structures', not classifiable under Aluminium Structures and its Parts under Customs Tariff Act: CESTAT

A Two-Member Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT), Ahmedabad ruled that the imported aluminium composite plate is not 'prepared for use in structures' and is not classifiable under the head of Aluminium structures and its parts under the Customs Tariff Act.

The revenue is in appeal against the order where under the Commissioner (Appeals) have accepted the assessee’s contention of classification of the imported goods under heading 76061190 by rejecting the revenue’s stand of classification under Heading 76109090 under the Customs Tariff Act.

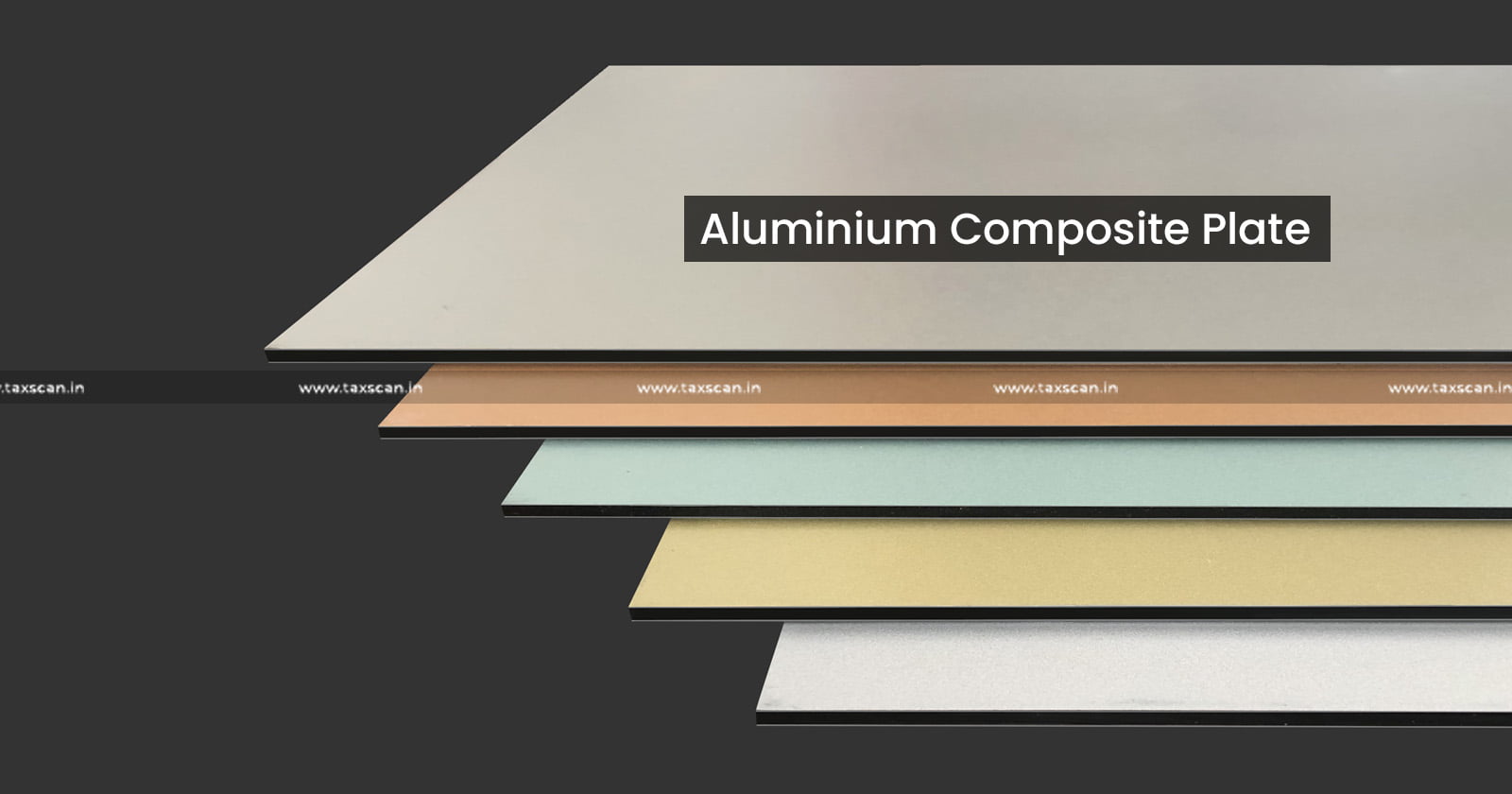

The respondent, Chandan Exports had filed the bill of entry for clearance of aluminium plate of various thickness classifying the goods under CTH 76061190. A show cause notice was issued to the respondent proposing to classify the product, aluminium plates (Composite and both sides coated) of different thickness under CTH 3920 99 99 or under CTH 7610 90 90 for the purpose of assessment and further to load the value as per Customs Valuation (Determination of Value of Imported Goods), Rules, 2007.

The Counsel for the Department submitted that the appellate authority has further erred in classifying the imported goods aluminium composite plate under CHT 7606 11 90 and adopting invoice price for the purpose of assessment. The chapter heading 76061190 covers Aluminium plates, sheet and strips of thickness exceeding 0.2 mm. Thus, the said heading covers plates, sheets or strips which are bare in nature and not containing any other material inside or outer side.

The Counsel further argued that as per test report, the imported goods are aluminium sheets in both sides and containing layer ie. Fillers of inorganic substance. The produce is composite material having both side aluminium and polyethylene between two sheets and known as aluminium composite panels/ plates” in trade parlance. Therefore, they are plates/ sheet or strips and hence cannot be classifiable under CTH 76.06.

The Coram comprising Ramesh Nair, Judicial Member and Raju, Technical Member observed that “In the present matter neither the show cause notice nor impugned order-in-original indicate that the imported Aluminium Composite Plates was prepared in any manner for use in structures. Therefore, the Commissioner (Appeals) in the present matter correctly held that the imported goods cannot be considered as prepared for use in structures and therefore falls out of the scope of heading 7610.”

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

C.C vs Chandan Exports , 2023 TAXSCAN (CESTAT) 428 , Shri. R.K. Agarwal , Shri. Prashant Patankar