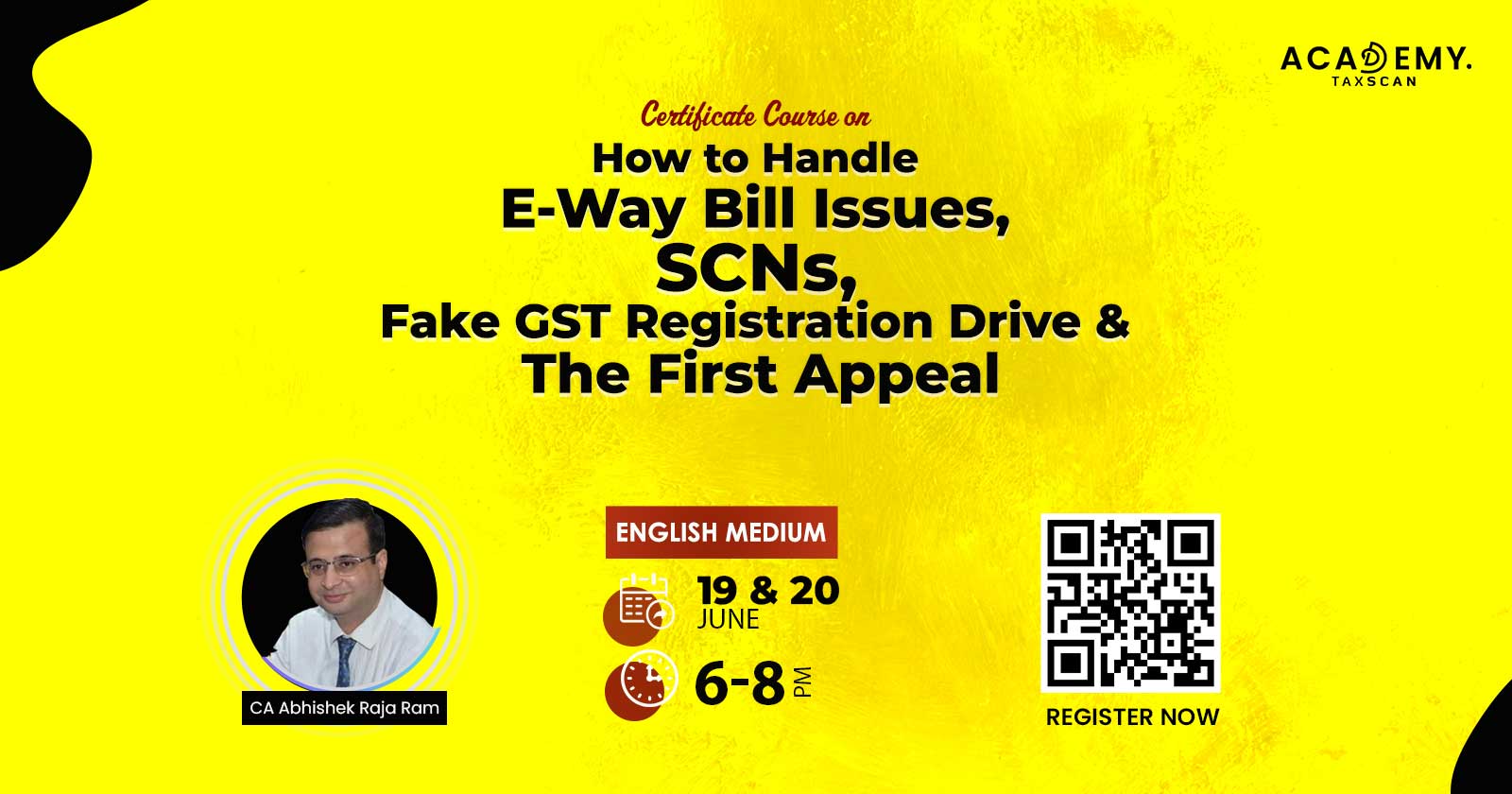

How to Handle E Way Bill Issues, SCNs, Fake GST Registration Drive & The First Appeal

How to Handle E Way Bill Issues, SCNs, Fake GST Registration Drive & The First Appeal – TAXSCAN aCADEMY

How to Handle E Way Bill Issues, SCNs, Fake GST Registration Drive & The First Appeal – TAXSCAN aCADEMY

Faculty - CA Abhishek Raja Ram

📆 19 & 20 June

⏰ 6.00PM - 8.00PM

Course Fees999(Including GST)

599(Including GST)

Click Here To Pay

✅e-Certificate

✅Duration 4 Hours

✅E Notes Available

✅The Recorded Session will be Provided

What will be covered in the course?

☑Understanding of E-Way Bill Issues

Professionals will gain a thorough understanding of common E-Way bill issues and their solutions, enhancing their ability to provide effective advice and assistance to their clients.

☑Ability to Handle Show Cause Notices

Knowledge of the process and requirements for responding to show cause notices will enable professionals to better manage these situations, potentially saving their clients from penalties and legal complications.

☑Awareness of Fake GST Registrations

By understanding the indications of fake GST registrations and how to protect against them, professionals can safeguard their clients' interests and enhance their reputation as trusted advisors.

☑Familiarity with the First Appeal Process

An understanding of the first appeal process under GST law will enable professionals to guide their clients through this process, providing valuable support during potentially challenging times.

Remember, the topics covered should be current and reflect the most recent changes in GST laws and regulations. Similarly, the instructor must be up-to-date and well-prepared to address the complexities of these topics.

For Queries - 8891 128 677, 8943 416 272, info@taxscan.in