Income Tax Department launches E-Calculator; Aims to Assist Tax payers in choosing Old or New Tax Slabs

The Income-Tax Department has launched an e-calculator for individuals to estimate their tax liability.

It can be utilized by taxpayers who opt for the new tax slabs, as announced in the recent Budget, without claiming deductions and exemptions, for Income Tax Returns filing.

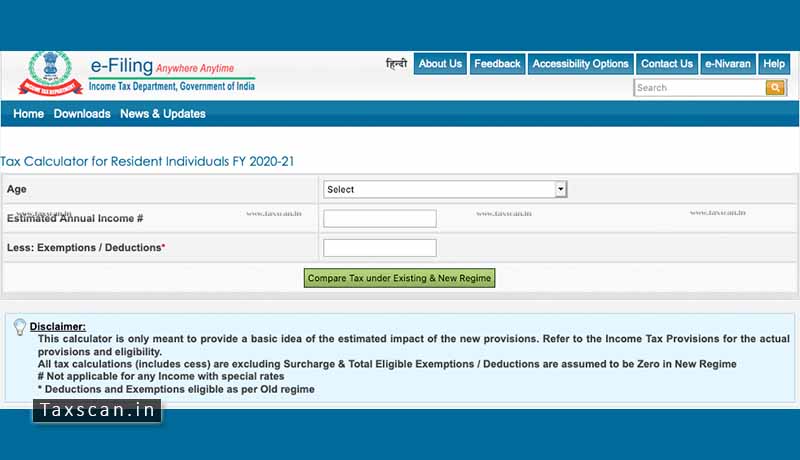

The e-calculator comes with a comparative table to help resident individuals (the financial year 2020-21) compare taxes in the old and the new tax regime. Taxpayers in three age categories, namely normal citizen (below 60 years), senior citizen (60-79 years) and super senior citizen (above 79 years) can fill in their estimated annual income from all sources, total eligible deductions and exemptions to analyze what will there total taxable income be if they continue in the old regime or opt for the new one.

The calculator takes into account eligible exemptions and deductions, as proposed under the new regime, after being extracted from the Budget memorandum 2020.

It has been hosted on the official e-filing website of the department.