Income Tax Department releases JSON Schema for ITR-1 and ITR-4 for AY 2024-25

JSON schema for ITR 1 & ITR 4 for A.Y. 20240-25 updated in Income Tax Portal on 18th March 2024

The Income Tax Department released the JSON Schema for Income Tax Return ( ITR ) forms 1 and 4 for the Assessment Year (AY) 2024-25 on 18th March 2024. This release occurred 23 days early of schedule compared to A.Y. 2023-24.

JSON is a file format utilized for downloading or importing pre-filled ITR data into the offline utility. It is also employed in generating prepared ITRs within the offline utility.

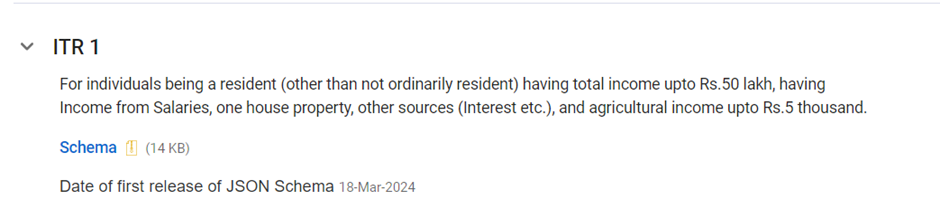

ITR - 1

ITR-1, commonly referred to as Sahaj, stands as an income tax return form in India designed to provide a user-friendly filing option for salaried individuals. Nevertheless, not all salaried individuals are eligible to utilize ITR-1, as eligibility hinges on specific criteria. As per the criteria for FY 2022-23, an individual must qualify as a resident with a total income not exceeding Rs 50 lakh to be eligible.

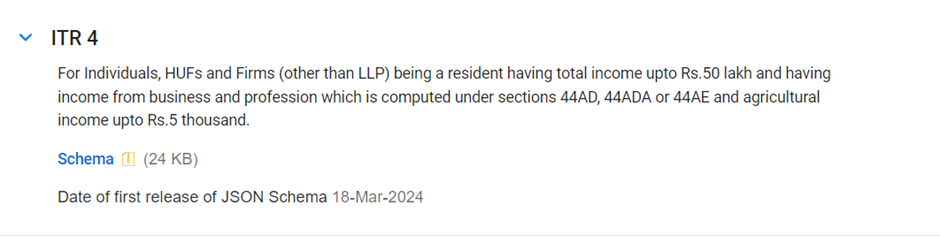

ITR - 4

ITR-4, also known as Sugam, applicable to individuals, Hindu Undivided Families ( HUFs ), and Partnership Firms deriving income from business or profession activities, which is computed under Section 44AE, 44ADA, or 44AD of the Income Tax Act, 1961, you are required to file the ITR-4 form.

The Income tax department has mentioned a note that “While using the utility to file the returns u/s 142(1)/148/153A/153C/119(2)(b), in the place meant for DIN in the ITR/utility, please input the last 23 characters of the DIN ( 23 characters from the right ), after omitting special characters if any.”

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates