Income Tax Department Releases Utility to Compare Old vs New Income Tax Act Sections

The tool is expected to be particularly beneficial during the transition period as the new provisions come into effect.

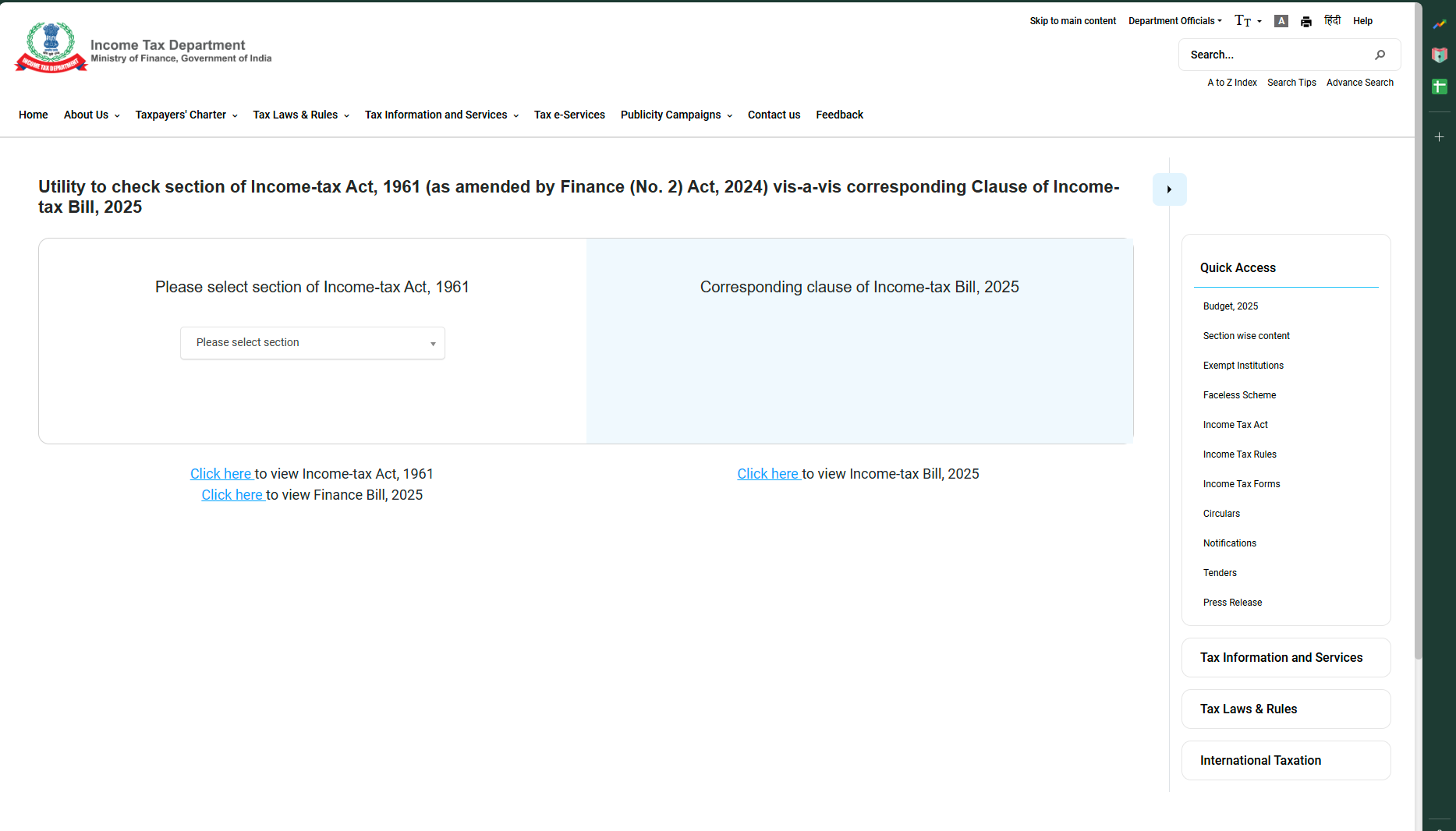

The Income Tax Department has introduced a new utility that allows taxpayers and professionals to compare sections of the Income Tax Act, 1961, with the corresponding clauses of the Income Tax Bill, 2025. This tool, currently available in the Income Tax Portal is designed to help users understand the changes also brought about by the Finance (No. 2) Act, 2024, along with the proposed amendments in the Income-tax Bill, 2025.

The utility, accessible on the department's official website, enables users to select a specific section of the Income-tax Act, 1961, and view its corresponding clause in the Income-tax Bill, 2025. This feature is particularly useful for taxpayers, tax consultants, and legal professionals who need to navigate the complexities of the evolving tax landscape.

Key features of the utility include:

1. Section-wise Comparison: Users can select any section of the Income-tax Act, 1961, and instantly view the corresponding clause in the Income-tax Bill, 2025. This helps in understanding the modifications, additions, or deletions made to the existing provisions.

2. Access to Relevant Documents: The utility provides direct links to the Income-tax Act, 1961, the Finance Bill, 2025, and the Income-tax Bill, 2025, allowing users to refer to the complete texts for detailed analysis.

3. User-friendly Interface: The tool is designed to be intuitive and easy to use, with a search function that allows users to quickly locate specific sections or clauses.

4. Quick Access to Resources: The utility is part of a broader suite of resources available on the Income Tax Department's website, including tax laws, rules, forms, circulars, and notifications.

This initiative is part of the government's ongoing efforts to digitize and streamline tax administration, making it easier for taxpayers to comply with the law and stay informed about changes. By providing a clear and accessible comparison tool, the Income Tax Department aims to reduce confusion and ensure that taxpayers are well-informed about the latest developments in tax legislation.

Ensure trust with the Forensic Accounting

Taxpayers and professionals are encouraged to utilize this new utility to stay updated on the changes and ensure accurate compliance with the Income-tax Act.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates