Income Tax Dept clarifies Issuance of Notice for Schedule 80P Deduction to Partnership Firms and LLPs not Claimed is Inadvertent Error

The Income Tax Department has provided clarification on the issuance of notices for the 80P Deduction to Partnership firms and Limited Liability Partnerships (LLPs) who have not yet made a claim for it.

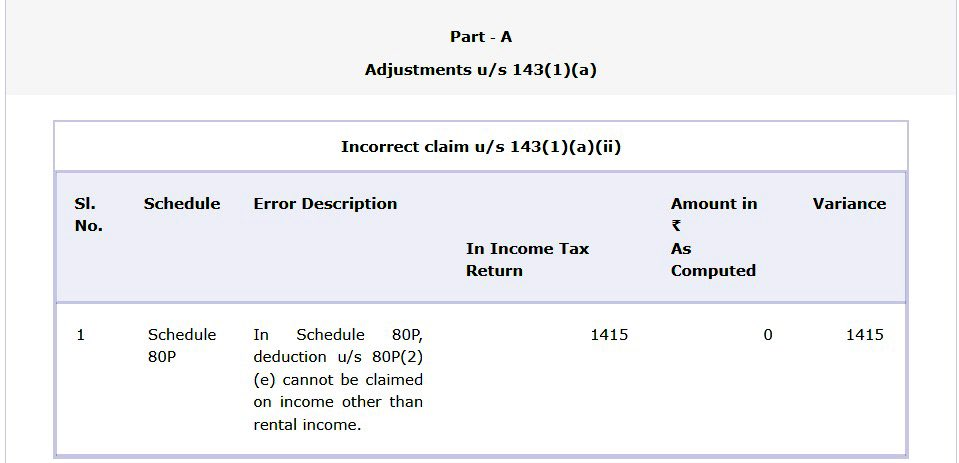

The twitter was flooded with tweets in which numerous individuals asserted that they had received an adjustment notice under Section 143(1)(a)(ii) of Income Tax Act, 1961 regarding deduction of Section 80P(2)(e) where they haven’t claimed the same. The department clarified that the notice was an inadvertent error and deeply regretted the same.

Furthermore, it should be observed that Section 80P deduction pertains to cooperative societies, not firms or LLPs.

One of the tweet is as follows:

The notice mentioned the error that ‘in schedule 80, deduction u/s 80P(2)(e) cannot be claimed on the income other than rental income’. The notice was even sent to the firms/LLPs where they haven’t claimed the deduction.

In reply, the income tax department has replied that ‘Intimation u/s 143(1) of Income-tax Act, 1961 with the error description: “In Schedule 80P, deduction u/s 80P(2)(e) cannot be claimed on income other than rental income” has been inadvertently sent. An email communication regarding this will be sent to you shortly. The inconvenience caused is regretted.’

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates