Income Tax Growth of 16.1%: Record ITR Filing of over 6.77 Crores and 3.44 ITRs Processed within Due Date

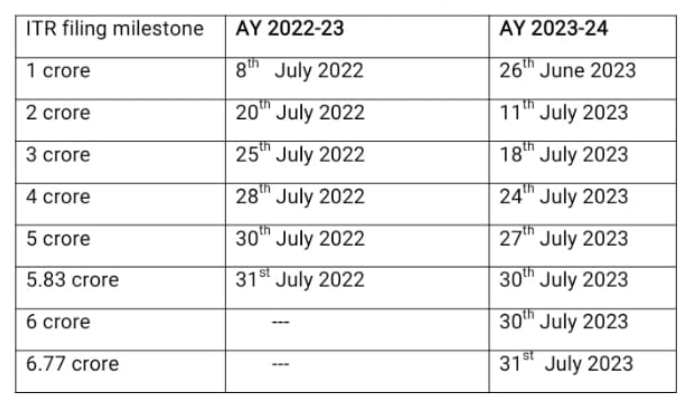

The Central Board of Direct Taxes (CBDT) has informed that the Income Tax Returns (ITR) filing has witnessed a record growth of 16.1% year on year. Also 6.77 crores ITRs were filed within 31st July and 3.44 ITRs were processed. Last year, the total filings till 31st July 2022 was 5.83 crores.

The department reports that they conducted campaigns on social media, as well as targeted email and SMS campaigns, to motivate taxpayers to file their Income Tax Returns (ITRs) early. These efforts were successful as taxpayers responded positively, leading to a higher number of ITR filings for Assessment Year (AY) 2023-24 compared to the same period in the previous year.

The department also released a table of milestones in the ITR filings.

Throughout the peak filing period, the e-filing portal effectively managed a substantial amount of traffic, ensuring a smooth experience for taxpayers while filing their Income Tax Returns (ITRs). From 1st July 2023 to 31st July 2023, the e-filing portal recorded over 32 crore successful logins, with a particularly high number of 2.74 crore successful logins on 31st July 2023 alone.

According to the department, a significant number of taxpayers performed their necessary checks by cross-referencing data from their financial transactions through the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS).

To make the process more convenient for taxpayers, a considerable portion of data for ITR-1, ITR-2, ITR-3, and ITR-4 was already prefilled. This included information related to salary, interest, dividends, personal details, tax payments, TDS-related information, carried forward losses, MAT credit, etc. As a result, taxpayers extensively utilized this feature, leading to a smoother and quicker filing of their Income Tax Returns (ITRs).

The board commented that the e-verification process, which included methods like Aadhaar OTP and others, plays a vital role in enabling the Department to initiate the processing of Income Tax Returns (ITRs) and issue refunds, if applicable.

Further, out of 5.63 crore returns, more than 5.27 crore have been e-verified, with 94% of them using Aadhaar-based OTP. As a result, by 31st July 2023, over 3.44 crore e-verified ITRs for Assessment Year (AY) 2023-24 have already been processed, accounting for 61% of the total.

The department has appreciated the taxpayers and tax professionals for making compliances in time, leading to a surge in filing of Income-tax Returns (ITRs).

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates