Income Tax Portal Technical Glitches Frustrate CAs and Tax Filers as Deadline Nears: Here's 15 Glitches Found

The tax filers have mentioned their concerns in their ‘X’ account tagging the income tax department

The income tax portal technical glitches frustrated the Chartered Accountants ( CAs ) and income tax return ( ITR ) filers as the deadline nears. The last date to file the return is July 31st 2024.

We have found 15 glitches, which are raised frequently by the CAs and tax filers.

When we come to the solution for the income tax portal issues, the income tax department’s one solution to multiple portal issues is really not working for many of the CAs ( Chartered Accountants ) or the income tax filers. The ‘X’ account of the income tax department is flooded with concerns of income tax portal glitches.

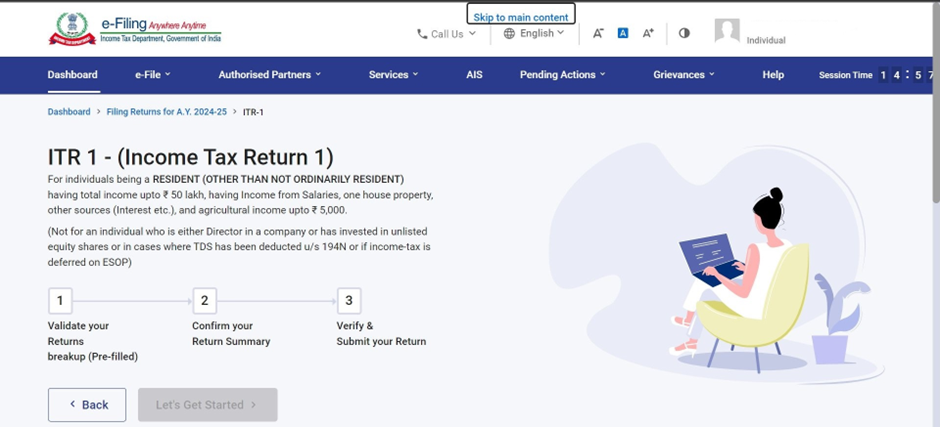

For all issues, the department has suggested one solution: “Please retry after clearing the browser cache.” And the reply for the solution was not helping the income tax portal users. The most seen portal issue is “Not enable ‘Let’s get started option’” in the ITRs. The issue is not resolved even after clearing the caches. The tax filers have mentioned their concerns in their ‘X’ account tagging the income tax department.

The major 15 issues with the Income Tax portal are:

- Inability to download Form 26AS

- Loading problems

- Server down or not available

- 'Portal not found' errors

- Payment difficulties

- Errors in prefilled data

- Not able to access 26AS page and AIS

- website unresponsive every 5 seconds

- Error number ITD-EXEC2002 while Paying Income Tax Challan

- Non-receipt of OTP for authentication

- Difficulty in downloading filed ITR receipts

- Income tax utility not working neither site in utility showing wrong password and no problem logging in from web

- Form 15CB Processed (Image 1), on clicking it is showing pending (Image 2). Form 15CB is filed with payment date as 11.07.2024.

- "Error: Cannot claim both 10(13A) and 80GG, but only 80GG is being claimed and not HRA."

- Error ITR Utility

The aforementioned issues with the ITR portal have impacted user grievances on the Income Tax ‘X’ platform. Users report extended session times, with some Chartered Accountants noting continuous website loading for up to an hour.

The two different replies of the most of these issues by the Income Tax Department on these portal issues:

- There seem to be some intermittent issues. We have flagged them to the team concerned. The technical team is working to resolve the issues. However, please share your details (with PAN & mobile no.) at orm@cpc.incometax.gov.in for our team to assist.

- Please retry after clearing the browser cache. If you still face any issues, please share your details (with PAN & mobile no.) at orm@cpc.incometax.gov.in Our team will get in touch with you.

These responses are unlikely to provide real help. Effective resolution will only occur if the concerned officers address the issues promptly and efficiently. The technical team, currently Infosys, had ample time to resolve these problems.

The inability to enable the 'Let’s Get Started' option and the website loading issues is a major issue faced by tax filers. The Income Tax Department and technical team need to investigate and resolve this common problem.

As deadlines approach, it is foreseeable that technical glitches will arise, and proactive measures should be taken by both the team and the department to prevent and address these issues.

Enjoy Tax Comedies with Our Combo - Sit, Relax & Read.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates