Income Tax Portal Update: CBDT enables Online and Offline Filing of ITR-1, ITR-2, ITR-4 and ITR-6 in e-Filing Portal

In an attempt to ease compliance, the Income Tax Department has enabled the e-filing of ITR 1-6 in the Income Tax e-filing Portal.

In a move aimed at streamlining tax filing for citizens, the Income Tax Department has announced the availability of online and offline filing for ITR forms 1, 2, 4, and 6 on the e-filing portal.

"This is a welcome step by the Income Tax Department," said a spokesperson. "Offering both online and offline filing options caters to a wider range of taxpayers and makes the process more accessible", he added.

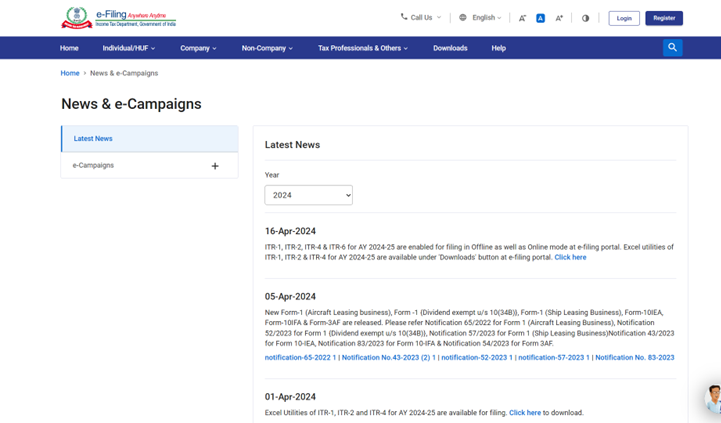

Taxpayers can now file their Income Tax Returns (ITRs) for the Assessment Year (AY) 2024-25 (relevant to Financial Year 2023-24) electronically through the e-filing portal.

The ITR forms enabled for online and offline filing include ITR-1, ITR-2, ITR-4, and ITR-6. The deadline for filing ITRs for FY 2023-24 (AY 2024-25) remains as July 31, 2024.

Taxpayers can access the e-filing portal and related resources at Income Tax.

This update is expected to streamline the tax filing process for many individuals and businesses, promoting timely compliance and reducing potential complexities.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates