Income Tax Portal Update: New Excel-Based Utility for ITR-1, ITR-2, ITR-3 and ITR-4 Available Now

New Income Tax Excel-Based Utility for ITR-1, ITR-2, ITR-3 and ITR-4 Available Now

The Income Tax Department of India has introduced the latest versions of Excel-based utilities for filing Income Tax Returns ( ITR ) for the financial year 2024-25. These updated tools are expected to solve the issues related to Section 87A Income Tax rebate claim in the filing process for taxpayers with short term capital gains, which was earlier disallowed by the utility issues.

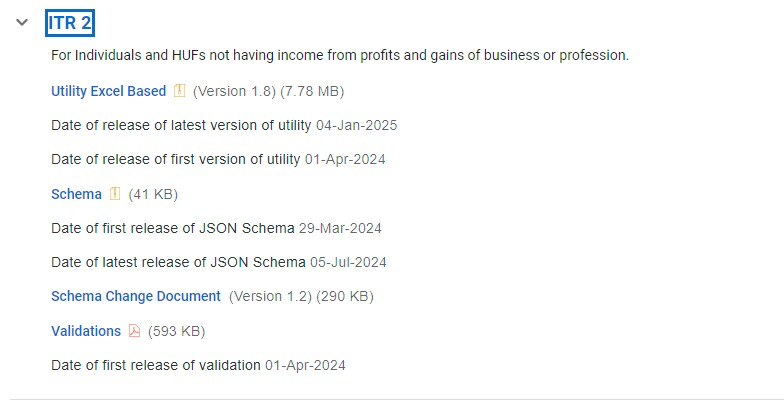

ITR 2: For Individuals and HUFs Without Business Income

The updated Utility Excel-Based (Version 1.8) for ITR 2 is now available for download. It caters to individuals and Hindu Undivided Families (HUFs) who do not have income from profits and gains of business or profession.

Step by Step Guidance for Tax Audit & E-filing, Click Here

Key highlights:

● Utility Size: 7.78 MB

● Release Date: 4th January 2025

● Initial Launch Date: 1st April 2024

Accompanying resources for ITR 2 include:

● JSON Schema: Initially released on 29th March 2024, with the latest version dated 5th July 2024.

● Schema Change Document (Version 1.2): Provides detailed changes and is sized at 290 KB.

● Validation Document: First released on 1st April 2024, this 593 KB file helps ensure accurate filing.

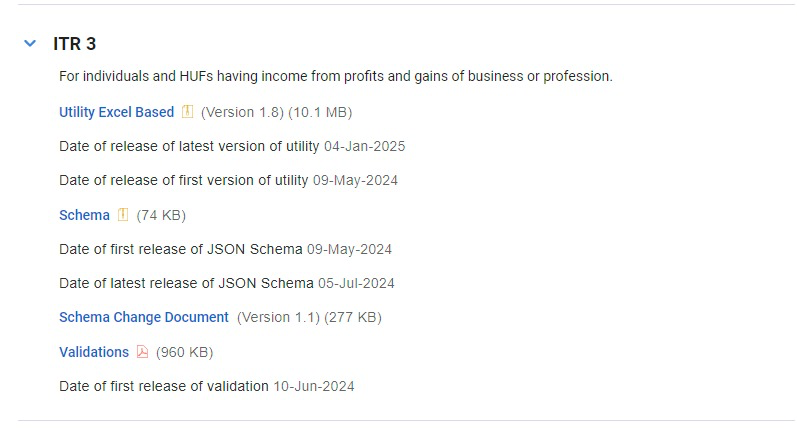

ITR 3: For Individuals and HUFs With Business Income

The new Utility Excel-Based (Version 1.8) for ITR 3 targets individuals and HUFs having income from business or profession. This tool is an updated solution for taxpayers with diversified income sources.

Step by Step Guidance for Tax Audit & E-filing, Click Here

Key highlights:

● Utility Size: 10.1 MB

● Release Date: 4th January 2025

● Initial Launch Date: 9th May 2024

Supporting documents for ITR 3 include:

● JSON Schema: Released initially on 9th May 2024, updated on 5th July 2024.

● Schema Change Document (Version 1.1): Sized at 277 KB, it details the schema revisions.

● Validation Document: Released on 10th June 2024, the 960 KB file ensures accurate reporting.

Step by Step Guidance for Tax Audit & E-filing, Click Here

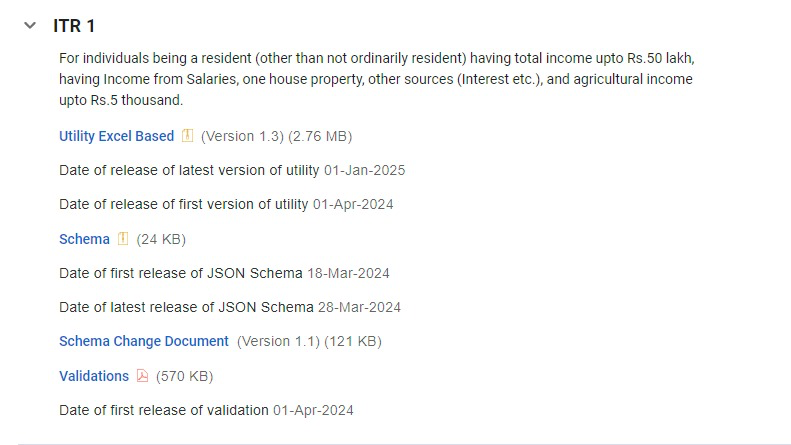

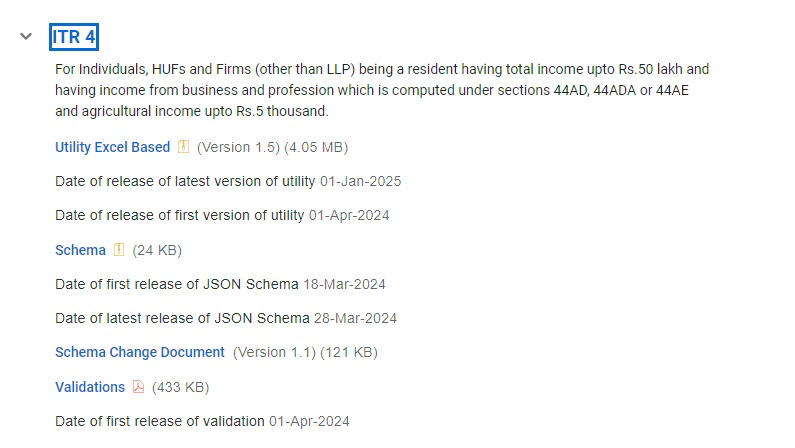

ITR-1 is applicable for individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand and ITR-2 is relevant to Individuals and HUFs not having income from profits and gains of business or profession. ITR-3 pertains to individuals and HUFs having income from profits and gains of business or profession whereas ITR-4 individuals, HUFs and Firms (other than LLP) being a resident having total income upto Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE and agricultural income upto Rs.5 thousand.

How to Access the Utilities?

Taxpayers can download these tools from the official Income Tax portal at Downloads | Income Tax Department.

Why the Update Matters

The update follows a deadline extension after the Bombay High Court issued directions to rectify the error in the utility, allowing users to claim the rebate under Section 87A of the Income Tax Act which was earlier disallowed on Short Term Capital Gains (STCG).

The Excel Utilities for preparation and filing of Income Tax forms ITR-1, ITR-2, ITR-3 and ITR-4 have been updated accordingly.

Read Full Coverage Here:

1. Know the Income Tax Regime Changes Effective from April 1, 2024

2. S. 87A Rebate Denial under Challenge before Gujarat HC in PIL [Read Petition]

3. How to Respond to Income Tax Notice with FAQs: Know Here

4. ITRs filed under New Tax Regime get demand notice for taking Section 87A Rebate

6. Received Income Tax Notice for claiming Section 87A Rebate on STCG? Here's what you need to know

7. Bombay HC directs CBDT to Extend ITR Deadline amid Section 87A Rebate Issue

8. CIT(A) Ruling Brings Relief on Income Tax Rebate under Section 87A to STCG Earners

9. Income Tax Portal to Release Revised ITR-2, ITR-3 with S.87A Rebate

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates