Income Tax Portal Update: Rectification Application u/s 154 directly with AO Online Live on Portal

Section 154 of the Income Tax Act allows taxpayers to request rectification of errors apparent on the face of the record in their income tax orders.

The Income Tax Department has updated its portal, enabling taxpayers to file rectification applications of Assessment Order issued by AO under Section 154 of the Income Tax Act, 1961, directly with their Assessing Officer (AO) online.

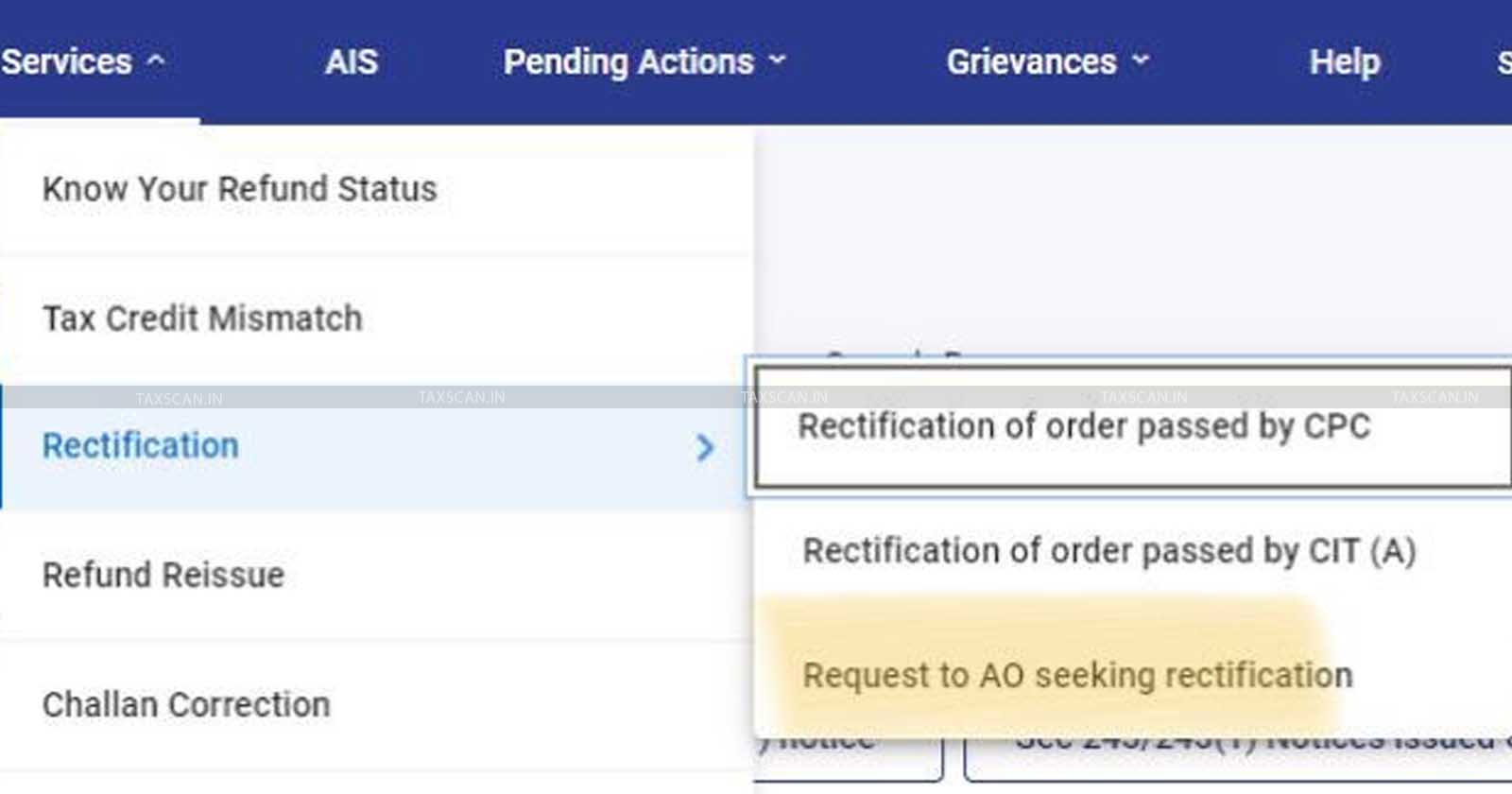

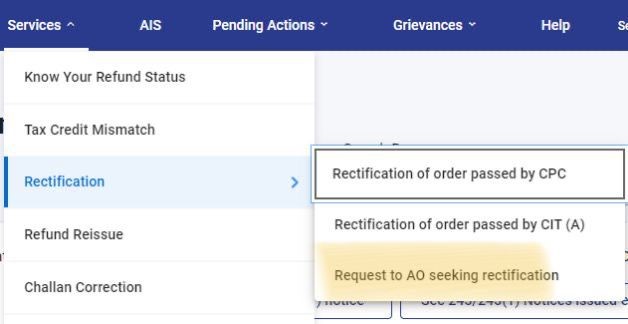

Currently, the income tax portal has the provision to seek rectification of order passed by CPC and CIT(A). By implementing the rectification online to the assessment order issued by the Assessing Officer will help the taxpayers and will avoid submitting the correction requests manually or raising a grievance. However, this will reduce all those unwarranted steps.

Section 154 of the Income Tax Act allows taxpayers to request rectification of errors apparent on the face of the record in their income tax orders. These errors may include clerical mistakes, calculation errors, or other discrepancies that require correction. Previously, the process for rectification often involved multiple steps and manual interactions, leading to delays and inefficiencies.

Transform GST Learning: Master Sections Faster with Memory Power- Click here to know more

The taxpayers can now submit rectification requests directly to their AO through the Income Tax Portal. By introducing the key update, the taxpayers can seek the AO to rectify the mistakes or errors in the assessment order at the initial stage itself online.

Chartered Accountant Himank Singala described the new functionality as a "much-needed update" in a post on his 'X' account.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates