Income Tax Portal Update: Revised ITR-2 and ITR-3 Utilities with S.87A Rebate Expected Soon

This update is particularly significant for taxpayers looking to claim rebates under Section 87A on income taxed at special rates

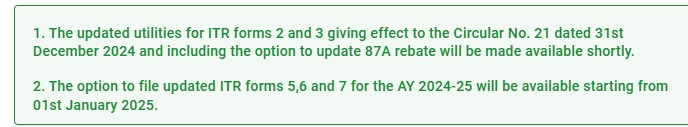

The Income Tax Department has announced that the updated utilities for Income Tax Return (ITR) forms 2 and 3, incorporating the provisions of Circular No. 21 dated December 31, 2024, will be made available shortly. This update is particularly significant for taxpayers looking to claim rebates under Section 87A for income taxed at special rates, such as Short-Term Capital Gains (STCG) under Section 111A and Long-Term Capital Gains (LTCG) under Section 112.

The Bombay High Court had earlier directed the Income Tax Department to enable these utilities, ensuring fair opportunities for taxpayers to claim rightful benefits. The updated forms aim to simplify the process for filing revised or belated returns, aligning with the extension provided by Circular No. 21, which allows such filings up to January 15, 2025.

The update will enable eligible taxpayers to avail themselves of the rebate for income that includes specific categories like STCG and LTCG. This is a welcome move for individuals earning under Rs. 5,00,000 taxable income in the old regime and Rs. 7,00,000 in the new regime, ensuring they can claim their full tax benefits.

Know Practical Aspects of Tax Planning, Click Here

Circular No. 21 grants an extension for filing revised or belated returns till mid-January 2025, providing relief to those who faced delays in finalizing their returns due to the ongoing 87A rebate claim issue.

This move has been lauded as a significant victory for taxpayers, particularly in light of recent legal directives. Tax professionals and individual filers are advised to stay updated on these developments and leverage the revised utilities once they go live on the Income Tax portal.

It is also peculiar that the department will not be automatically processing ITRs processed with a demand due and the taxpayers will have to file a revised return.

Know Practical Aspects of Tax Planning, Click Here

Further, the rebate under Section 87A is available to individual taxpayers whose income doesn't exceed the specified threshold. The limit is Rs. 7 lakh under the new tax regime & Rs. 5 lacs under the old regime. If your income falls within these thresholds, ur tax liability will be reduced to zero as per the latest developments.

The Update is expected soon.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates