Income Tax Portal updates with 'Authenticate Insight DIN' Feature for Taxpayers

The latest addition to the income tax portal enables taxpayers to examine and confirm the legitimacy of communications issued by the income tax department

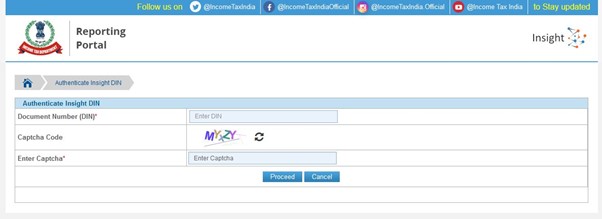

The Income Tax portal has been updated with a new feature of 'Authenticate Insight DIN' for the taxpayers. The feature will help the taxpayers to verify the communications of the income tax department. The functionality is available on AIS Home Page.

This functionality is designed to assist taxpayers in authenticating communications received from the income tax department. By utilising this feature, taxpayers can ensure the legitimacy and validity of the messages or notifications they receive from the income tax authorities. It adds an additional layer of verification, enhancing the overall security and reliability of the communication process between taxpayers and the income tax department.

The services provided by the Compliance Portal and Reporting Portal are accessible to all registered users on the e-Filing portal after logging in. With a Single Sign-On (SSO), this feature seamlessly transitions users from their e-Filing accounts to the Compliance Portal and Reporting Portal. This convenient service empowers users to:

- Navigate directly to the Compliance Portal for access to services like the Annual Information Statement, e-Campaigns, e-Verifications, e-Proceedings, and DIN Authentication.

- View an up-to-date tally of e-Campaigns and e-Verifications relevant to their profile before proceeding to the corresponding sections on the Compliance Portal.

- Easily transition to the Reporting Portal directly from their e-Filing account.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates