Begin typing your search above and press return to search.

Income Tax Rule Amendment: CBDT inserts new Form 15CD for IFSC Unit Quarterly Statements w.r.t. Sec. 80LA(1A) [Read Order]

![Income Tax Rule Amendment: CBDT inserts new Form 15CD for IFSC Unit Quarterly Statements w.r.t. Sec. 80LA(1A) [Read Order] Income Tax Rule Amendment: CBDT inserts new Form 15CD for IFSC Unit Quarterly Statements w.r.t. Sec. 80LA(1A) [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/10/Income-Tax-Rule-Amendment-CBDT-Form-15CD-IFSC-Unit-Quarterly-Statements-TAXSCAN.jpg)

The Central Board of Direct Taxes, under the powers granted by the Income-tax Act, 1961, vide notification G.S.R. 740(E) has introduced the Income-tax Amendment (Twenty-fifth Amendment) Rules, 2023. These rules will come into effect from January 1, 2024.

Key amendments In rule 37BB of the Income-tax Rules, 1962 includes:

- Addition of a clause to cover remittances made by a Unit of an International Financial Services Centre as per section 80LA(1A).

- Inclusion of Director General of Income-tax (Systems) alongside Principal Director General of Income-tax (Systems) for various provisions.

- Introduction of a quarterly statement requirement for specific remittances, to be furnished by authorized dealers and Units of International Financial Services Centres.

- Specification of procedures, formats, and standards by the Principal Director General of Income-tax (Systems) or Director General of Income-tax (Systems) for Form No. 15CA, Form No. 15CB, Form No. 15CC, and Form No. 15CD.

- Definitions for "authorized dealer," "International Financial Services Centre," and "Unit" for clarity.

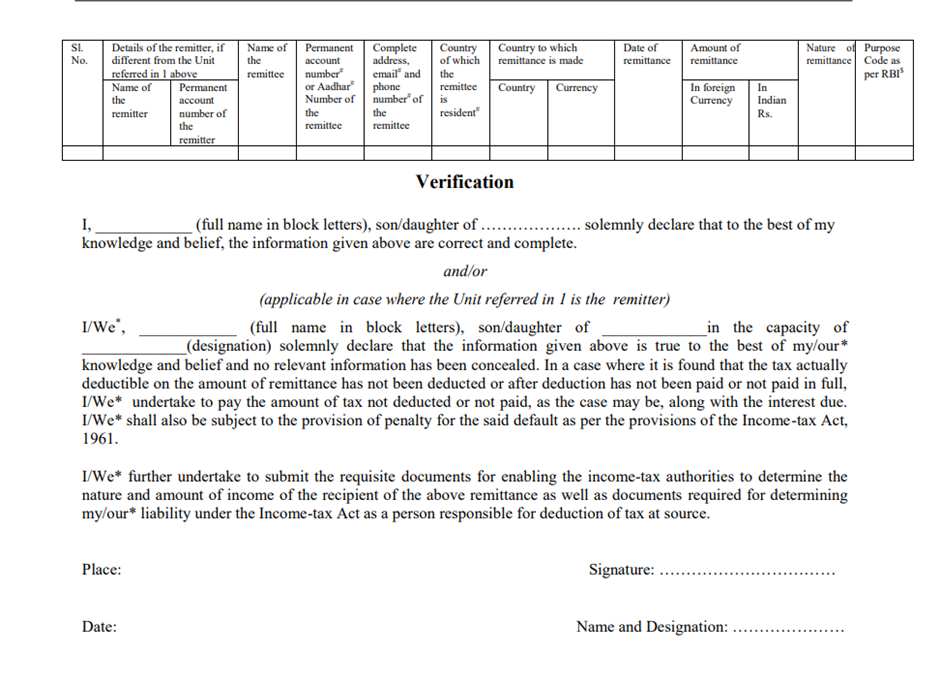

In the principal rules, in Appendix-II, after Form No. 15CC, the following Form shall be inserted, namely:-

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: 89 /2023 , 16th October, 2023Notification No: 89 /2023

Date of Judgement : 16th October, 2023Next Story