Income Tax TRACES Portal new functionality: Dept enables lower/nil TDS Application Facility against Excessive TDS Deductions

The new TRACES Portal update enables Individuals to avoid higher TDS Rates beyond their tax liability

In a recent TRACES Portal update, individuals encountering high TDS deductions beyond their tax liability under the Income Tax Act now have the opportunity to seek relief.

By applying for a Lower/Nil deduction of TDS with the tax authorities, individuals can enhance their cash flow. It's crucial to note that the functionality for filing applications for Lower/Nil deduction certificates will be available for specific timeframes.

If you are facing excessive TDS deductions, consider applying for a Lower/Nil deduction of TDS to mitigate the financial burden. The option to file such applications is available during the following periods:

For the Financial Year ( FY ) 2023-24: Applications accepted until March 15, 2024.

For the Financial Year ( FY ) 2024-25: Applications open from February 28, 2024.

This initiative aims to provide relief to individuals experiencing undue financial strain due to TDS deductions beyond their actual tax liability.

For additional insights into TDS regulations and rates, refer to the TDS Rate Chart for FY 2023-24 & AY 2024-2025. Stay informed about changes in procedures related to obtaining nil TDS certificates, as recently altered by the Central Board of Direct Taxes ( CBDT ). The Income Tax Department has also introduced an e-procedure for obtaining NIL or lower TDS certificates.

The TRACES Portal update offers a timely solution for individuals grappling with excessive TDS deductions, allowing them to optimize their cash flow. Stay informed about the latest developments in TDS regulations and take advantage of the available relief mechanisms to manage your financial obligations effectively.

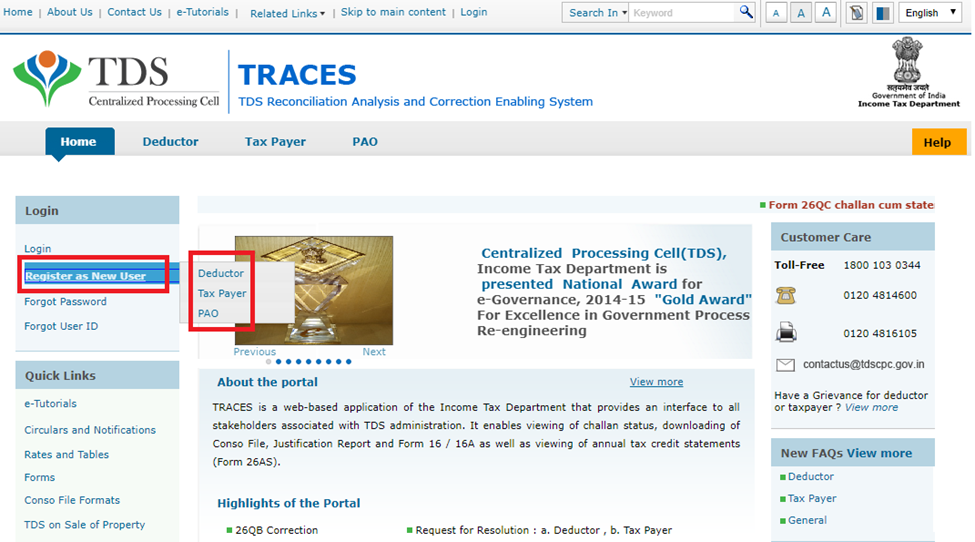

For further details, visit the official TRACES Portal.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates