Income Tax Update: CBDT enables New Functionality for Correcting Tax Challan Online

A new functionality has been introduced by the Central Board of Direct Taxes (CBDT) on the Income Tax portal on 18th August 2023, allowing taxpayers to rectify their income tax challan online. This proactive step by the board is commendable, as it empowers taxpayers to correct challan details without approaching the Assessing Officer (AO). Earlier, one has to approach the AO for correcting the errors.

The taxpayers can correct the following in the challan:

- Assessment Year

- Change in Tax applicable (Major Head) i.e. Income tax other than company, income tax for companies

- Change in Type of Payment (Minor Head) i.e. Advance Tax, Self Assessment Tax, Tax on Regular assessment etc.

Apart from the above-mentioned corrections, it is advised to approach the assessing officer for the corrections. Currently, the option to rectify the challan for the Assessment year 2020-21 and beyond is exclusively accessible on the portal.

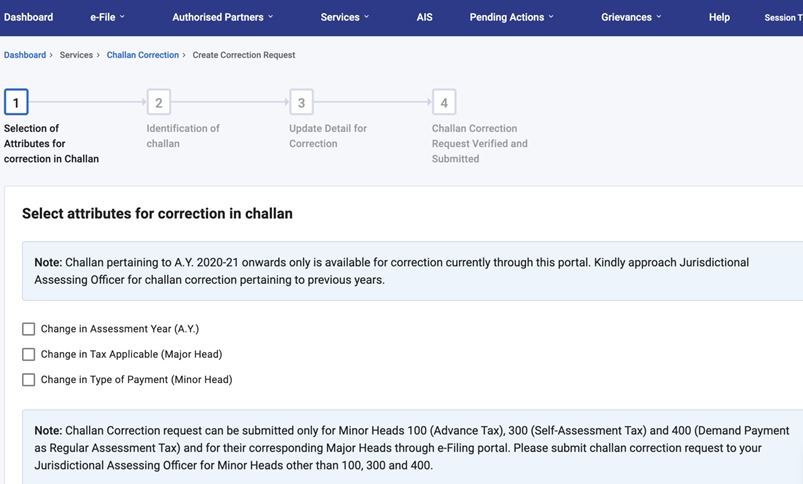

Steps to Correct the Challan Online

- Go to Income Tax Portal - https://www.incometax.gov.in/iec/foportal/ and Login to your profile

- Navigate to ‘Services’

- Select ‘Challan Correction’

- Then click on ‘Create Correction request’.

- Select the attributes for the correction in challan - You can select from the 3 in which you need the correction.

- Update the ‘Identification of Challan’ Eg: Challan Identification Number (CIN)

- Update the details for the correction

- Final verify and submit the corrections

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates