Income Tax Update: Dept releases Excel Based Utility for ITR-2 for filing AY 2023-24 ITR in Self-Service Portal

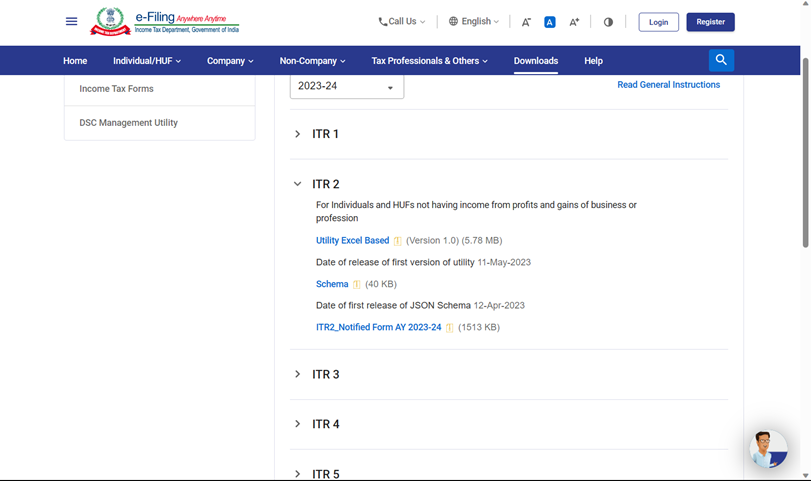

The Income Tax Excel-Based Utility for filing Income Tax Returns ITR-2 of Assessment Year AY 2023-2024 is available for download in the Self Service Portal.

Taxpayers can visit the official website of the Income Tax Department and download the same using the link: Downloads | Income Tax Department

ITR-2 is to be filed by Individuals and HUFs not having income from profits and gains of business or profession.

Here are the benefits of filing your Income Tax Return (ITR) on time:

Compliance: Filing your ITR is mandatory if your total income exceeds the basic exemption limit, and failure to comply can result in legal consequences.

Financial Record: Your ITR acts as a financial record of your income, deductions, and tax paid, which can serve as proof of income for various purposes such as loan or visa applications.

Visa Applications: Many foreign countries require ITR as proof of income to grant a visa.

Penalty Avoidance: By filing your ITR before the deadline, you can avoid paying any penalty for late filing of returns.

Loan Approval: ITR is also necessary for the loan application process, and having a record of ITR filings can increase your chances of getting loan approvals.

Carry Forward Losses: Filing your ITR is necessary to carry forward any losses incurred in a financial year to subsequent years for set off against future profits.

Refund Claims: In case you have paid more tax than your actual tax liability, you can claim a refund by filing your ITR.

Considering these benefits, it's evident that filing your ITR is essential for your financial well-being and to fulfill your legal obligations.

General Instructions for Returns from A.Y. 2021-22 onwards

Select the Assessment Year (2023-2024).

Download and extract the zip file containing the utilities to the folder and open the utility.

System Requirements

Operating System: Windows OS

Architecture: ia32, x36, Windows 7 or later are supported (ia64, x64 systems binaries will run on ia32). Please note, the ARM version of windows is not supported.

Note: libstdc++ 6 ABI 1.3.8 or above in lower environments to function In linux the app should be run in a sandbox mode only.

Hardware: Intel pentium processor or later that's SSE2 capable or AMD K10 or above core architecture 2 GB of RAM or more.

HDD: 700 MB or more of free space

Excel Utilities:

Macro enabled MS-Office Excel version 2007/2010/2013 on Microsoft Windows 7/8/10 with .NET Framework (3.5 & above).

The instructions, utilities, schemas and validation rules will be updated as and when there is a change after due approval from ITD.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates