Interest cannot be levied for Late Payment of TDS due to System and Connectivity issues at the Bankers' End: ITAT Delhi

In ACIT v. M/s.Nokia Siemens Networks (P) Ltd, the Delhi ITAT held that assessee cannot be treated as Assessee-in-Default for Late payment of TDS due to system and connectivity issues at the bankers' end.

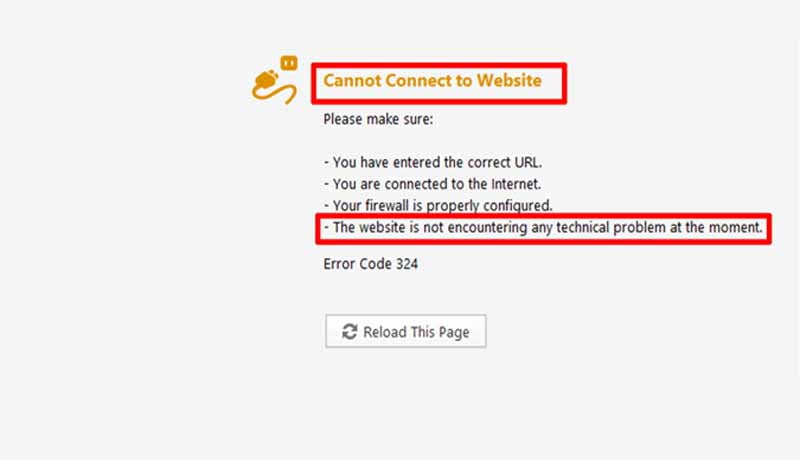

In the instant case, assessee was held as assessee-in-default for delay in deposit of TDS. Assessee maintained that the amount of TDS was debited from the bank account of the assessee on the due date i.e. 7.10.2009 and the delay in deposit of such tax by a day was on account of system and connectivity issues at the bankers' end, which were beyond the control of the assessee.

On appeal, the first appellate authority held in favour of assessee. However, it confirmed the levy of interest for late payment of TDS. Both the assessee and the Revenue preferred appeals against the order.

Before the Tribunal, the Revenue contended that the first appellate authority erred in holding in favour of the assessee in view of the decision of the Supreme Court in the case of CIT Vs. Ogale Glass Works.

Accepting the contentions of the assessee, the bench noted that the first appellate authority was not justified in holding the levy of interest on the alleged late deposit of tax deducted at source under section 201(1) read with section 201(lA) of the Act. Dismissing the departmental appeal, the bench held that the it had rightly decided the issue in favour of the assessee. “The facts of the present case as discussed' above nevertheless different as in the present case the amount of TDS was debited from the bank account of the assessee on the due date instead of payment by cheque. We hold accordingly.”

Read the full text of the Order below.