ITR Filing 2024: Know Banks available for Income Tax Payments at E-pay Tax Service

The income tax department has released a list of 28 banks

ITR Filing 2024 – Know Banks – Income Tax Payments – E-pay Tax Service – taxscan

ITR Filing 2024 – Know Banks – Income Tax Payments – E-pay Tax Service – taxscan

The Income Tax department has updated the list of banks available for payments at E-pay tax service. The due date of ITR filing is July 31st. The income tax payers are urged to file their returns within the due date.

The income tax department has released a list of 28 banks for making your income tax payments at E-pay Tax. The lists are as follows:

- Axis Bank

- Bandhan Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- DCB Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Jammu & Kashmir Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Karnataka Bank

- Punjab National Bank

- Punjab & Sind Bank

- RBL Bank

- State Bank of India

- South Indian bank

- UCO Bank

- Union Bank

- Dhanlaxmi Bank

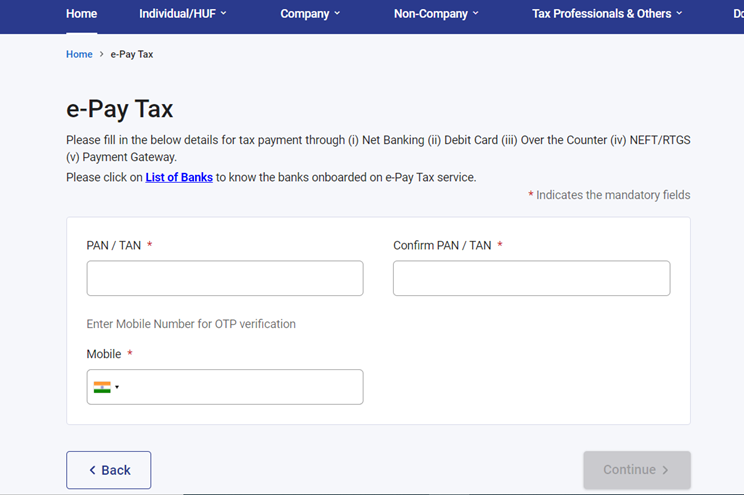

The above image shows the e-Pay Tax page on the income tax portal where you can make your payment using PAN/TAN, mobile number and bank details.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates