ITR Refund Update: CBDT advises to check Bank Account Validation Status

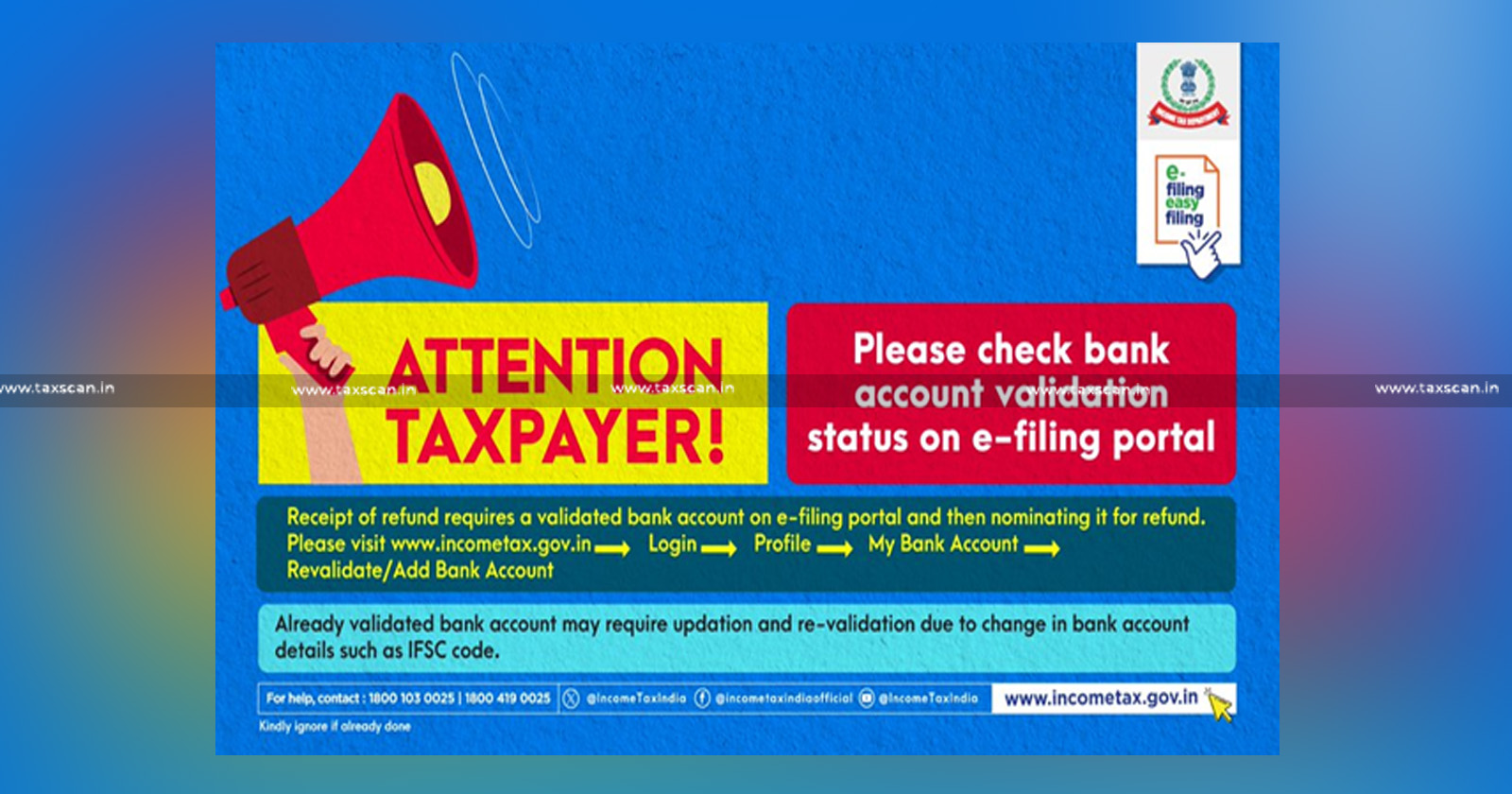

The Income tax department has advised the taxpayer to check bank account validation status in the income tax portal with regards to income tax refund. The department informed that “Your refund can only be credited into a validated bank account. So, please check bank account validation status on the e-filing portal.”

Steps to Validate Bank Account:

- Visit http://incometax.gov.in > Login

- Go to ‘Profile’

- Navigate to ‘My Bank Account’ > Revalidate/Add Bank Account Previously validated bank account may require updation and re-validation due to change in bank account details.

The department also stated that previously confirmed bank accounts might need to be updated and re-verified because of modifications in bank account information, like the IFSC code.

Nevertheless, numerous taxpayers have expressed their concern on Twitter, reporting that despite successful validation, they are encountering restricted refund statuses. In some instances, tax returns submitted on June 10th have yet to undergo processing. These issues were brought to the department's attention, but there has been no response from them.

The deadline to file the income tax returns was 31st July 2023 and no extension was provided by the Finance Ministry. According to the data shown by the Income tax department in its portal, 6,97,75,724 returns were filed as on 3rd September 2023 and 6,83,00,382 were verified for the Assessment Year 2023-24. Out of the verified ITRs, only 5,89,27,315 were processed.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates