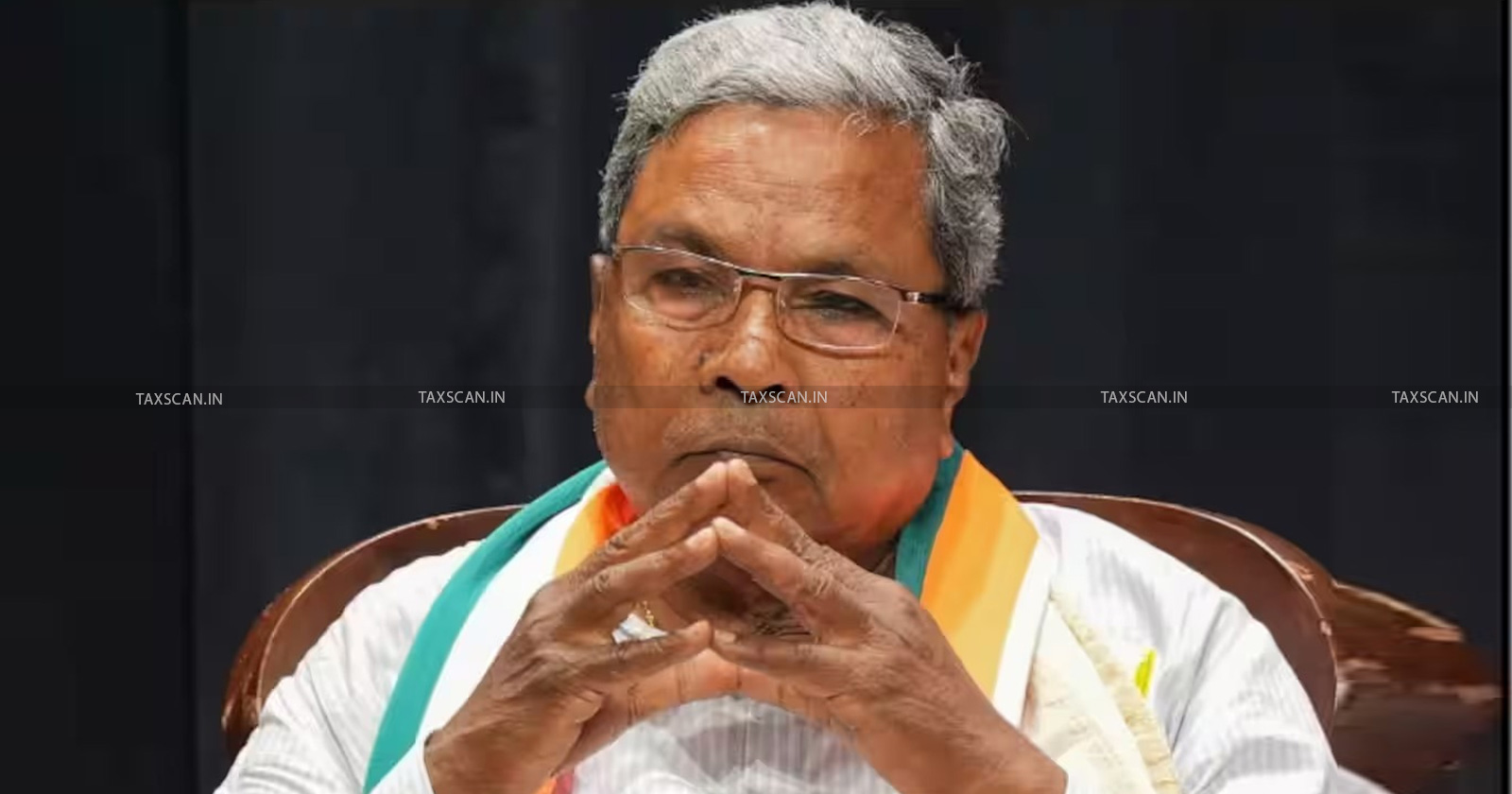

Karnataka CM Siddaramaiah Warns Tax Officials: Meet Collection Targets or Face Consequences

Karnataka CM Siddaramaiah issued a strict directive to tax officials, mandating they meet revenue targets or face accountability

Karnataka CM Siddaramaiah Warns Tax Officials – Meet Collection Target – Consequences – taxscan

Karnataka CM Siddaramaiah Warns Tax Officials – Meet Collection Target – Consequences – taxscan

Chief Minister Siddaramaiah has issued a strict warning to tax officials, stating that they must meet the state’s ambitious tax collection targets for the financial year 2024-25. Those who fail to meet these targets will be held accountable. In recent review meetings, Siddaramaiah stressed that achieving these targets is crucial to support Karnataka’s development goals.

The Karnataka government has set high revenue goals this year, aiming to collect Rs. 1,10,000 crore in commercial taxes and Rs. 38,525 crore from excise (liquor taxes). By the end of October 2024, the state had collected Rs. 58,773 crore in commercial taxes, reaching 53.5% of the target.

How to Compute Income from Salary with Tax Planning, Click Here

This amount includes Rs. 44,783 crore from the Goods and Services Tax (GST), Rs. 13,193 crore from Karnataka Sales Tax (KST), and Rs. 797 crore from Professional Tax. Collections have grown by Rs. 5,957 crore compared to last year, but there’s still a long way to go to meet the final target.

To meet the full goal by March 2025, Karnataka now must collect about Rs. 10,200 crore each month for the next five months. The excise department has also made progress, reaching 52.53% of its target with Rs. 20,237 crore collected, an increase of Rs. 1,301.15 crore over last year.

To help reach the revenue target, the Chief Minister introduced the Karasamadhana scheme, which will help resolve old, pending tax issues. This scheme is expected to bring in an additional Rs 2,000 crore. The Karnataka CM stressed that it’s important for all departments to work together and do their part to make sure the revenue goals are met.

How to Compute Income from Salary with Tax Planning, Click Here

To keep a close watch on progress, CM Siddaramaiah will hold monthly review meetings to monitor the tax collections. He emphasized that meeting the targets is important for the state’s development because the revenue will fund important projects and services for Karnataka’s citizens. CM Siddaramaiah’s message is clear: any official who does not meet the targets will be held responsible.

Chief Minister Siddaramaiah also directed the excise department to take firm measures against illegal liquor smuggling, particularly from Goa. To prevent tax losses, the government will be tough on any activities that reduce state revenue. CM Siddaramaiah warned that if there are any cases of corruption in the department, they will be dealt with firmly.

The review meetings included key officials such as Additional Chief Secretary L.K. Atheeq, Commercial Tax Commissioner C.A. Shikha, and Excise Minister R.B. Thimmapur. Their presence highlights the importance of reaching these goals and shows that all levels of government are committed to meeting the targets.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates