Kerala Budget 2021: Dr. Thomas Issac proposes relaxation in Vehicle Tax for Electric and Hybrid Vehicles, 50% Building Tax waiver on Eco-friendly Constructions [Read Document]

Kerala Budget 2021 – Dr. Thomas Issac – Vehicle Tax – Building Tax waiver – Eco-friendly Constructions – Taxscan

Kerala Budget 2021 – Dr. Thomas Issac – Vehicle Tax – Building Tax waiver – Eco-friendly Constructions – Taxscan

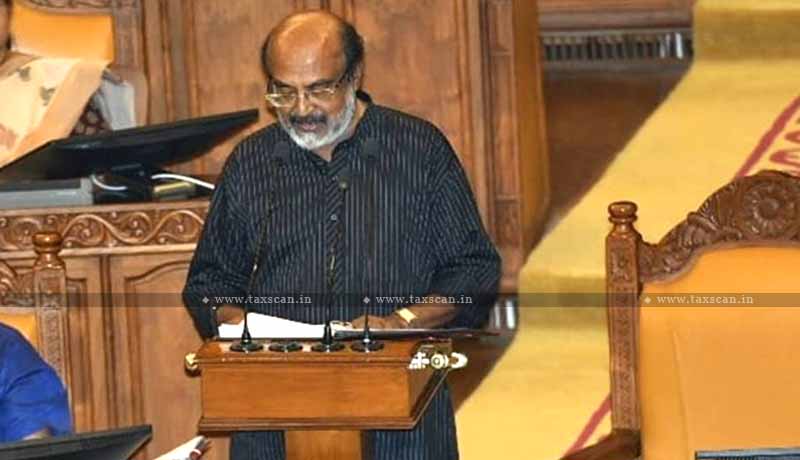

The Kerala Finance Minister T.M. Thomas Isaac has presented the Kerala Budget 2021 claiming Kerala had scripted a success story in the management of COVID-19.

He has also proposed the relaxation inmotor vehicle tax for electric and hybrid vehicles. Also, he also proposed the 50% waiver was announced on one-time building tax for eco-friendly constructions.

He said that, Kerala is the first State in the country to formulate an e-vehicle policy. Kerala is the State which brought solar and electric ferries into use for the first time in the country. Currently, 2000 e-vehicle have been registered in Kerala. In order to encourage the use of e-vehicles, full hybrid battery electric vehicles, fuel cell electric vehicles etc these will be given 50 percent reduction in Motor Vehicle tax for the first five years.

In this Budget, he also proposes, A policy for encouraging eco-friendly construction of buildings will be formulated. Sir, exact standards will be devised for avoiding power wastage, water conservation and for adopting eco-friendlyconstruction methods.

He also said that the incentives will be provided to buildings adhering to these standards. The incentives like 50 percent reduction in one-time building tax, 1 percent reduction on Stamp duty during transaction, 10 percent reduction in electricity tariff for 5 years if 20 percent power savings is achieved, 20 percent reduction in local building tax.

The motor vehicle tax on vehicles registered in the name of institutions engaged in palliative care and used exclusively for palliative activities will be exempted based on the recommendations of the District Collector.

Motor cabs and tourist motor cabs registered from 01st April 2014 and had remitted the five year tax in lieu of 15 year one time tax based on orders of High Court has to remit the balance tax and interest. This arrears will be permitted to be remitted in ten bi-monthly instalments before 31st March 2021.

To Read the full text of the Document CLICK HERE

Support our journalism by subscribing to Taxscan AdFree. We welcome your comments at info@taxscan.in