Kerala Finance Act, 2025: Kerala GST Payers Can Now Settle Kerala Flood Cess Arrears of 2019-2021 in Full [Read Bill]

If the flood cess dues are included in a show cause notice or order under the CGST/SGST Acts along with other tax demands, the payment of the flood cess portion alone under the scheme will be considered as full settlement of that component.

![Kerala Finance Act, 2025: Kerala GST Payers Can Now Settle Kerala Flood Cess Arrears of 2019-2021 in Full [Read Bill] Kerala Finance Act, 2025: Kerala GST Payers Can Now Settle Kerala Flood Cess Arrears of 2019-2021 in Full [Read Bill]](https://www.taxscan.in/wp-content/uploads/2025/05/Kerala-Finance-Act-Kerala-GST-Kerala-Flood-Cess-Arrears-Taxscan.jpg)

The Government of Kerala has launched the Flood Cess Amnesty Scheme, 2025. This scheme provides a one-time opportunity for Kerala Goods and Services Tax ( GST ) payers who are in arrears of Kerala Flood Cess to settle their outstanding dues in full for the period from 1st August 2019 to 31st July 2021.

Under the scheme, any taxpayer with arrears under Section 14 of the Kerala Finance Act, 2019 can opt for settlement by making complete payment of the flood cess due. This payment must be made electronically through the e-treasury portal on or before 30th June 2025, and will be based on the arrears as on 1st April 2025.

Want a deeper insight into the Income Tax Bill, 2025? Click here

If the flood cess dues are included in a show cause notice or order under the CGST/SGST Acts along with other tax demands, the payment of the flood cess portion alone under the scheme will be considered as full settlement of that component.

The explanation in the finance bill, 2025 states that “If a show cause notice issued under the Central Goods and Services Tax Act, 2017/Kerala State Goods and Services Tax Act, 2017 includes the demand of flood cess along with the other demands under the said Acts and payment as per sub-section (1) is made to settle the flood cess payable as per the notice/order, then the demand to the extent of flood cess alone shall stand settled.”

Further, if the government has filed an appeal under Section 14 of the Kerala Finance Act and the taxpayer chooses to settle the original demand through this scheme, the taxpayer must inform both the concerned appellate/revisional authority and the jurisdictional proper officer. Once verified, the proper officer will intimate the same to the authority or court for appropriate action.

The section 14 of the Kerala Finance Act states as follows:

“14. Kerala Flood Cess.- (1) There shall be levied a cess called the Kerala Flood Cess on such intra-State supplies of goods or services or both made in furtherance of business by a taxable person as provided for in section 9 of the Kerala State Goods and Services Tax Act, 2017 (20 of 2017) and collected in such manner, as may be prescribed, by rules made by the Government in this behalf, for the purposes of providing reconstruction, rehabilitation and compensation needs which had arisen due to the massive flood which occurred in the State of Kerala in the month of August, 2018, for a period of two years, with effect from the date notified by the Government in the Official Gazette:

Provided that no such cess shall be leviable on,-

(i) supplies made by a taxable person who is paying tax under section 10 of the Kerala State Goods and Services Tax Act, 2017 (20 of 2017) or opted to pay tax as per G.O.(P) No.66/2019/TAXES dated 30th March, 2019 and published as S.R.O. No.256/2019 in the Kerala Gazette Extraordinary No.882 dated 30th March, 2019.;

(ii) supplies of goods or services or both wholly exempted from tax by virtue of notifications issued under section 11 of the Kerala State Goods and Services Tax Act, 2017 (20 of 2017); and;

(iii) supplies of goods or services or both made in furtherance of business by a taxable person in the State to another taxable person having goods and services tax registration in the State.

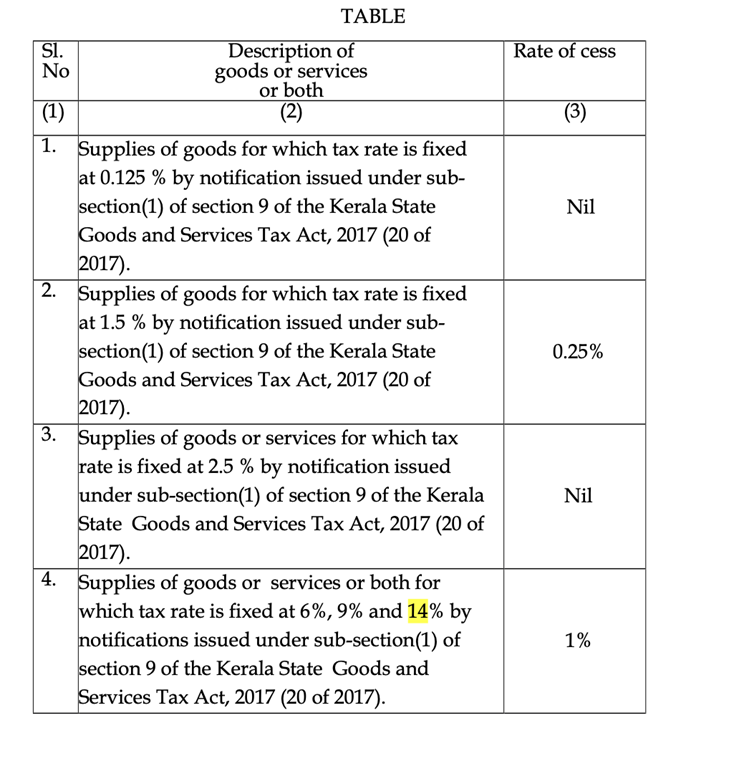

(2) The cess shall be levied on such supplies of goods and services as are specified in column (2) of the table below, on the basis of value determined under section 15 but excluding the cess levied under this section of the Kerala State Goods and Services Tax Act, 2017 (20 of 2017) at such rate set forth in the corresponding entry in column (3) of the Table.

(3) Every taxable person, making a taxable supply of goods or services or both, shall,—

(a) pay the amount of cess as payable under this section in such manner; and

(b) furnish such returns in such forms, along with the returns to be filed under the Kerala State Goods and Services Tax Act, 2017 (20 of 2017) and in such manner, as may be prescribed.

(4) The provisions of the Kerala State Goods and Services Tax Act, 2017 (20 of 2017) and Central Goods And Services Tax Act, 2017 (Central Act 12 of 2017) and the rules made thereunder, including those relating to definitions, authorities, assessment, audits, non-levy, short-levy, interest, appeals, recovery of tax, offences and penalties, shall, as far as may be, mutatis mutandis, apply, in relation to the levy and collection of the cess leviable under section 9 on the intra-State supply of goods and services, as they apply in relation to the levy and collection of tax on such intra-State supplies under the said Act or the rules made thereunder.”

The revenue recovery proceedings that were initiated under the Kerala Revenue Recovery Act, 1968 will be deemed withdrawn from 1st April 2025 for cases where dues are settled under this scheme. Such withdrawal will be binding on revenue authorities, and no additional collection charges will be levied.

The scheme also makes it clear that no refund or adjustment shall be permissible for any amount paid under the amnesty, regardless of any legal orders, decrees, or judgments to the contrary.

Complete Referencer of GSTR-1, GSTR-1A, GSTR-3B, GSTR-9 & GSTR-9C Click Here

The Commissioner of State Tax is empowered to issue instructions for the better implementation of this scheme, and also to remove any difficulties that may arise, provided such measures are taken within one year from the scheme's commencement. All such orders will be placed before the Legislative Assembly for transparency and accountability.

To Read the full text of the Bill CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates