Kerala GST Dept issues Instruction on Maintenance of Call Book for Adjudication including Cases to be Kept in Call Book [Read Circular]

![Kerala GST Dept issues Instruction on Maintenance of Call Book for Adjudication including Cases to be Kept in Call Book [Read Circular] Kerala GST Dept issues Instruction on Maintenance of Call Book for Adjudication including Cases to be Kept in Call Book [Read Circular]](https://www.taxscan.in/wp-content/uploads/2023/09/Kerala-GST-Dept-Instruction-Maintenance-Call-Book-for-Adjudication-Adjudication-Cases-to-be-Kept-in-Call-Book-GST-Taxscan.jpeg)

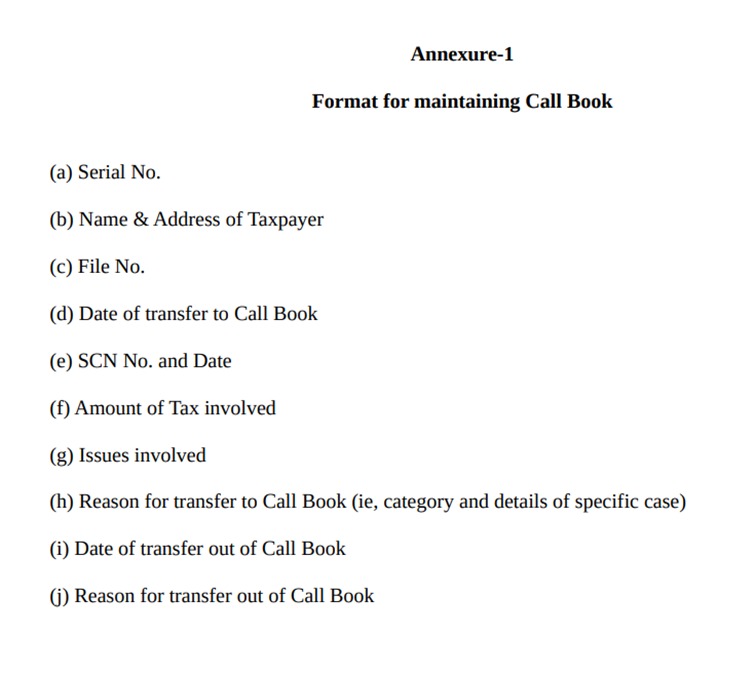

The Kerala Goods and Services Tax (KGST) Department vide circular number 13/2023 issued on 22-06-2023 has released the Instruction on Maintenance of Call Book for adjudication. The instruction is also enclosed with an Annexure 1, the format of the call book.

For easy and better maintenance of Show Cause Notices (SCN) issued as per Sections 73(1) and 74(1), the department found it would be better to maintain a call book. According to the instruction “the Show Cause Notices (SCN) issued as per Sections 73(1) and 74(1) shall be transferred to the call book with the approval of the immediate supervisory authority, until a finality on the issue is either arrived at or the matter admitted by the department.”

The department has instructed all the adjudicating authorities to maintain the call book mandatorily in their respective offices, which shall be kept updated and made available for verification by the superior officers.

Cases that are required to be kept in the call book

- Cases in which the Department has gone on appeal before the appropriate authority: This category refers to cases where, on an identical issue, the Department has filed an appeal before a higher appellate authority against the order passed by the lower authority, which was against the Government.( prejudicial to the interest of revenue).

- Cases where an injunction has been issued by Supreme Court, High Court, GSTAT, etc.: These are the cases where the courts or tribunals have specifically directed that such cases not to be decided. This may happen in cases of subsequent demands, where noticee's appeals against earlier adjudicated cases are lying with the Supreme Court, High Court, GSTAT, etc., and the appellate court or tribunal directs the adjudicating authorities not to adjudicate upon such cases. This category also works as a tool to save from a multiplicity of litigation in the cases of other notices since the Department may transfer such cases to the Call Book under this category.

Transfer of case to Call Book

If any of the mentioned grounds are present, a Show Cause Notice (SCN) can be moved to the call book. If there is any pending SCN related to the same issue, whether involving the same or different parties, as outlined earlier, it should also be moved to the call book until the matter is resolved by the Hon'ble Supreme Court, High Court, or GSTAT.

Nonetheless, an SCN can only be moved to a call book for reasons explicitly stated above if there is prior approval from the supervisory officer. This approval process involves the Additional Commissioner when the Joint Commissioner is the adjudicating authority, the Joint Commissioner when the Deputy Commissioner is the adjudicating authority, and the Deputy Commissioner when the adjudicating authority is the Assistant Commissioner or State Tax Officer. Similarly, for cases where the adjudicating authority is the Deputy or Assistant State Tax Officer, the approval is required from the Assistant Commissioner/State Tax Officer.

When the SCN is moved to the call book, it is essential to promptly inform the affected taxpayer. Neglecting this notification could have adverse consequences for the SCN. Authorities responsible for transferring cases to the call book are instructed to adhere to this directive diligently.

Transfer of cases out of the Call Book

If the reasons for transferring a case to the call book cease to exist, or if the matter has been conclusively decided by the Hon'ble Supreme Court, Hon'ble High Court, or Tribunal, the case should be removed from the call book and subjected to adjudication. The adjudicating authority can proceed with this action without the need for specific instructions or approval from the supervisory authority.

Periodical Review of Call Book

Supervisory authorities, including those from Additional Commissioner to State Tax Officer in their respective jurisdictions, must regularly assess every case in the Call Book on a monthly basis.

They should guarantee that the Call Book is maintained correctly, kept up-to-date, and that actions are taken within the specified time limits for cases where a final decision has been either reached or acknowledged by the department. These reviews should not rely on statistical summaries but should involve a thorough examination of each case file to ensure that no case is wrongly placed in or retained in the call book.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Circular No: 13/2023 , 22nd June, 2023