Know How to E-File Income Tax Returns on the New Portal

The due date i.e. 31 December, 2021 for filing income tax returns for the assessment year 2021-22 is approaching and the income tax return-filing process this time is vastly different from earlier years due to a host of reasons.

As earlier, the filing of income tax returns is available under both online and offline modes. Taxpayers who have many data points to fill in would prefer the offline mode, since the timeout period for one session is 40 minutes.

It is noteworthy, you keep your key documents like last year’s returns, bank account statements, Form-16 and Form 26AS ready before you start the process.

Steps to File ITR

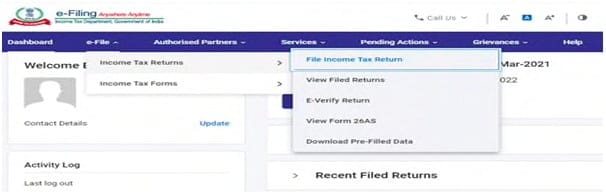

Step 1: Log in to the portal (https://www.incometax.gov.in/iec/foportal ) and go to e-File > Income Tax Returns > File Income Tax Return.

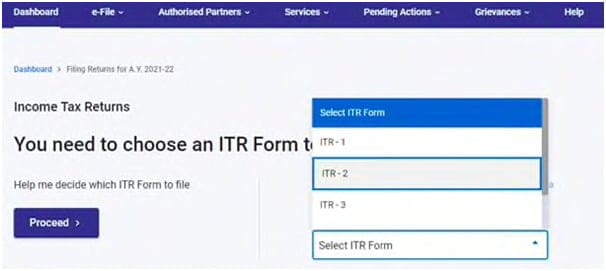

Step 2: Then Select “Assessment Year”, “Filing type”, “Status” as applicable. You will have to choose between online and offline modes, and also the assessment year. Like in the case of private e-filing portals, this one, too, enables you to complete the entire process online. Earlier, this was restricted largely to ITR-1 and ITR-4S.

Step 3: Select Continue if you are sure about the ITR type or you can click on “proceed” to help find your ITR

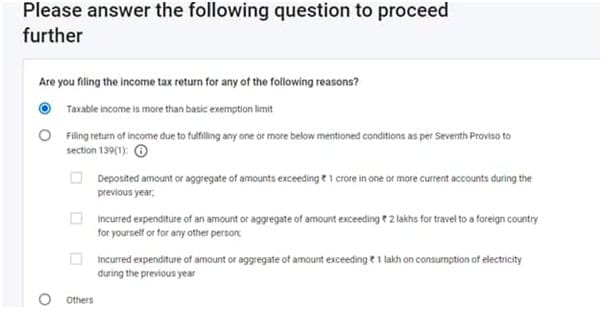

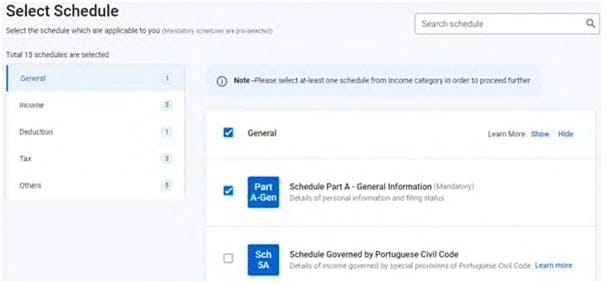

Step 4: Once you have selected the ITR, select reason for filing & fill the applicable fields of the ITR and make the payment if applicable

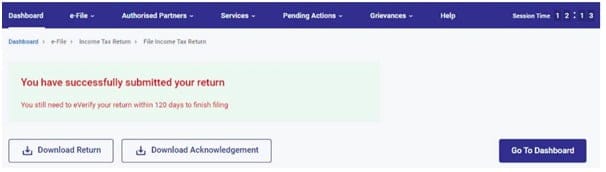

Step 5: Click on preview and submit return.

Step 6. Click proceed to verification.

Step 7. Select verification mode.

Step 8: Enter EVC/OTP for e verifying ITR OR Send the signed ITR V to CPC for verification.

For offline filing, the JSON utility has to be downloaded, since excel/java utility has been discontinued.

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.