Last Date to File Rectification Application to avail GST Amnesty Scheme on DRC 07 for 16(4) ITC Availment ends Today!

The amnesty window applies specifically to cases where DRC-07 has been issued in respect of ineligible ITC claims after the due date of September of the following financial year

Today marks the final opportunity for eligible taxpayers to file rectification applications under the GST Amnesty Scheme announced for certain Input Tax Credit (ITC) disputes pertaining to Section 16(4) of the CGST Act. The amnesty window applies specifically to cases where DRC-07 has been issued in respect of ineligible ITC claimed after the due date of September of the following financial year.

This relief measure, as outlined in Circular No. 237/07/2024-GST dated 15th October 2024 and Notification No. 22/2024-CT dated 8th October 2024 is due today for filing rectification applications.

Know How to Investigate Books of Accounts and Other Documents, Click Here

This is a significant opportunity for taxpayers to settle old disputes and regularize their GST compliance without prolonged litigation. The government has reiterated that this amnesty is a one-time measure and strict compliance is expected going forward.

Eligible Scenarios for GST Amnesty:

DRC-07 Issued, No Appeal Filed:

Taxpayers who received a DRC-07 demand order related to ITC claims disallowed under Section 16(4) but did not file an appeal are eligible to apply for rectification under the scheme.

DRC-07 Issued, Appeal Filed but Rejected:

Taxpayers who challenged the DRC-07 order but had their appeal rejected by the appellate authority can also benefit by submitting a rectification request.

Key Benefit of the Scheme:

Taxpayers opting in by the due date can avail relief from interest and penalty components, subject to the conditions laid down in the circular and notification. The intention is to offer a one-time opportunity for resolution of disputes related to delayed ITC claims without resorting to prolonged litigation.

The circular lays down the procedure as follows:

3.5 Where order under section 73 or section 74 of the CGST Act has been issued but no appeal against the said order has been filed with the Appellate Authority, or where the order under section 107 or section 108 of the CGST Act has been issued by the Appellate Authority or the Revisional Authority but no appeal against the said order has been filed with the Appellate Tribunal:

In such cases, where any order under section 73 or section 74 or section 107 or section 108 of the CGST Act has been issued confirming demand for wrong availment of input tax credit on account of contravention of provisions of sub-section (4) of section 16 of the CGST Act, but where such input tax credit is now available as per the provisions of sub-section (5) or sub-section (6) of section 16 of the CGST Act, and where appeal against the said order has not been filed, the concerned taxpayer may apply for rectification of such order under the special procedure under section 148 of the CGST Act notified vide Notification No. 22/2024 – Central tax dated 08.10.2024, within a period of six months from the date of issuance of the said notification.

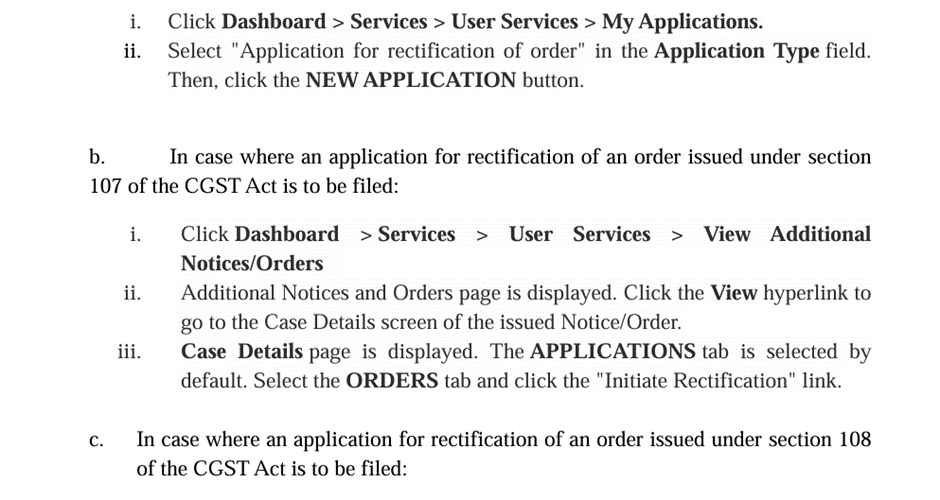

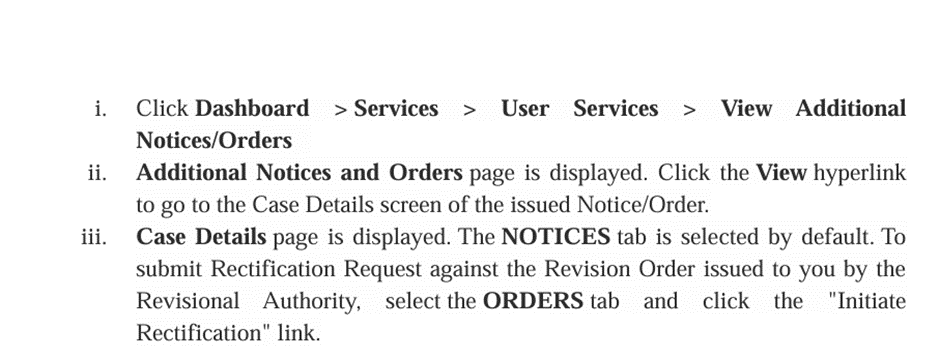

3.5.1 The taxpayers can file an application for rectification electronically, after login to www.gst.gov.in, using their credentials, by navigating as below in various cases:

3.5.2 While filing such application for rectification of order, the taxpayer shall upload along with the application for rectification of order, the information in the proforma in Annexure A of the said notification, containing inter-alia the details of the demand confirmed in the said order of the input tax credit wrongly availed on account of contravention of sub-section (4) of section 16 of the CGST Act, which is now eligible as per sub-section (5) and/or sub-section (6) of section 16 of the CGST Act.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates