Last Instalment of Advance Tax for F.Y. 2024-25 due by Mid-March, Know When and How to Pay Advance Tax Here!

Advance Tax is applicable to all individuals and businesses whose total tax liability exceeds ₹10,000 in a financial year

Advance Tax – Instalment of Advance Tax – How to Pay Advance Tax Here – taxscan

Advance Tax – Instalment of Advance Tax – How to Pay Advance Tax Here – taxscan

The Income Tax Department of India, via its official X handle (@IncomeTaxIndia), has reminded taxpayers that the last instalment of advance tax for the Financial Year 2024-25 is due by March 15, 2025. The department urged taxpayers to pay on time, stating that compliance not only avoids penalties but also strengthens the "Viksit Bharat Movement", contributing to India's goal of self-reliance and economic prosperity.

Read More: March 2025: Income Tax & GST Compliance Calendar

What is Advance Tax?

Advance tax is the payment of income tax in instalments rather than as a lump sum at the end of the financial year. It follows the "Pay as You Earn" principle, ensuring that tax liabilities are settled in phases rather than accumulating into a large amount due at the year's end.

Crack the Fraud Code. Master the Law. Stay Ahead! - Click Here

Who Are Required to Pay Advance Tax?

Advance tax applies to all individuals and businesses whose total tax liability exceeds ₹10,000 in a financial year. The following categories must comply:

- Salaried individuals, freelancers, and businesses whose tax dues exceed ₹10,000.

- Senior citizens (above 60 years) are exempt unless they have business income.

- Presumptive taxpayers (Section 44AD & 44ADA): Businesses and professionals under presumptive taxation must pay 100% of their advance tax in one instalment by March 15.

Crack the Fraud Code. Master the Law. Stay Ahead! - Click Here

Crack the Fraud Code. Master the Law. Stay Ahead! - Click Here

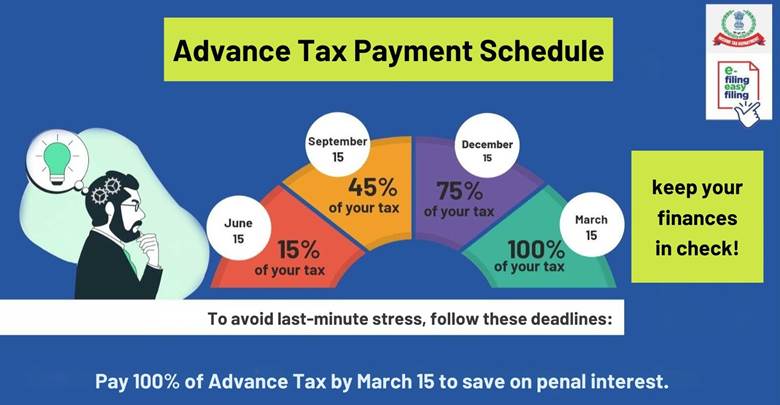

Advance Tax Payment Due Dates for FY 2024-25

| Due Date | Advance Tax to be Paid |

| June 15 | 15% of total tax |

| September 15 | 45% of total tax (minus previous payments) |

| December 15 | 75% of total tax (minus previous payments) |

| March 15 | 100% of total tax (minus previous payments) |

For presumptive taxpayers (business & professionals) under Section 44AD/44ADA, 100% of advance tax is payable by March 15. They also have the option to pay all dues by March 31.

Crack the Fraud Code. Master the Law. Stay Ahead! - Click Here

How to Pay Advance Tax Online?

Paying advance tax is quick and easy through the Income Tax Department's e-filing portal. Here’s how:

- Visit the e-filing portal of the Income Tax Department.

- Click on ‘e-Pay Tax’ under Quick Links or use the search bar.

- Enter PAN, confirm details, and provide a mobile number.

- Verify OTP and proceed.

- Choose ‘Income Tax’ and click on ‘Proceed’.

- Select Assessment Year 2025-26 and Type of Payment as ‘Advance Tax (100)’.

- Enter the tax amount, select the payment method, and proceed.

- Preview details, confirm, and complete payment.

- Save the BSR code & challan serial number for filing your tax return.

Why is Timely Payment Important?

Failure to pay advance tax by the due date may attract interest under Section 234B & 234C of the Income Tax Act. Avoid penalties by ensuring full payment by March 15, 2025. Stay compliant and contribute to India's economic growth!

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates