Madras HC orders retest to determine presence of Polyurethrene for Imposing Anti-dumping Duty [Read Order]

Madras – HC – Polyurethrene – Anti – dumping – Duty – TAXSCAN

Madras – HC – Polyurethrene – Anti – dumping – Duty – TAXSCAN

A Single Bench of the Madras High Court ordered retest to determine presence of Polyurethrene for imposing Anti-dumping duty.

The Petitioner, M/s.Flower Garden, challenged the impugned order under which the request for re-testing made by the petitioner in respect of the imported goods was rejected by the respondents.

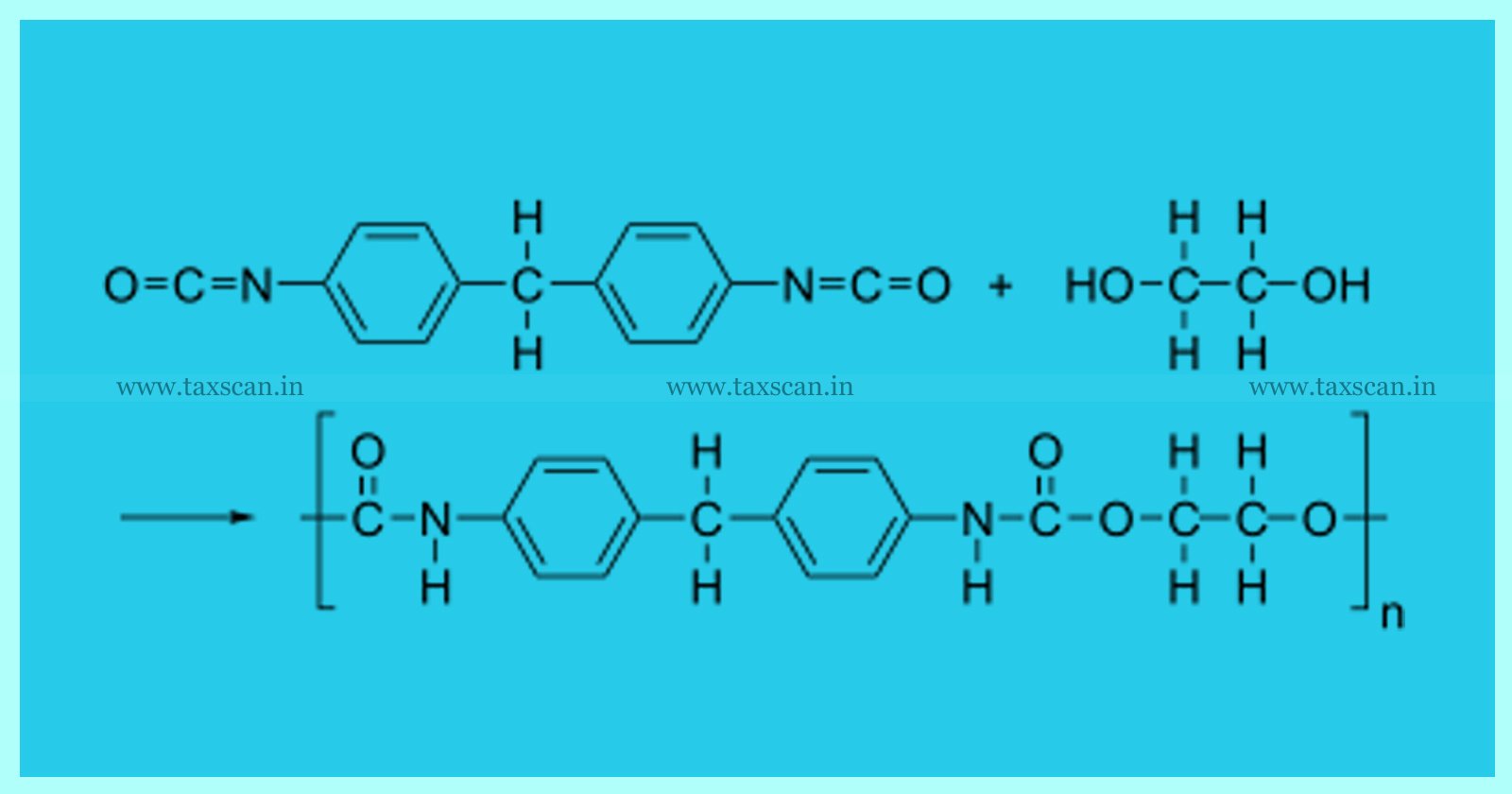

The petitioner had imported lining materials from China. If the lining materials contain Polyurethrene, the petitioner is liable to pay Anti-Dumping Duty. However, according to the petitioner, the lining material does not contain Polyurethrene and it contains only Polyethelene and therefore, they are not liable to pay Anti-Dumping Duty.

The petitioner relied upon the said report before the respondents and claimed exemption from payment of Anti-Dumping Duty. The respondents, on the other hand, relied on a laboratory report based on the samples collected from the imported goods which discloses that the lining materials imported by the petitioner contains Polyurethrene and therefore, based on the said report, the respondents have levied Anti-Dumping Duty on the petitioner.

The respondents have also contended that their test report precedes the test report produced by the petitioner. Based on the test report of the respondents, the imported goods of the petitioner were levied with Anti-Dumping Duty by the respondents. Aggrieved by the same, the petitioner filed the Writ Petition.

The counsel for the petitioner would now submit on instructions that if the samples of the imported goods of the petitioner are tested once again by an independent laboratory, truth will come out and it will be found that the imported goods does not contain Polyurethrene and therefore, Anti-Dumping Duty cannot be levied on the said imported goods.

The Court noted that no prejudice would be caused to any of the parties if the test about the imported goods of the petitioner viz., lining materials is conducted once again by a reputed laboratory engaged by the respondents to find out whether the imported goods contain Polyurethrene or not and the cost for the same will have to be necessarily borne by the petitioner.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to TaxscanAdFree. Follow us on Telegram for quick updates.