Major GST Portal Update: GSTN enables GST Payments through Credit/Debit Cards

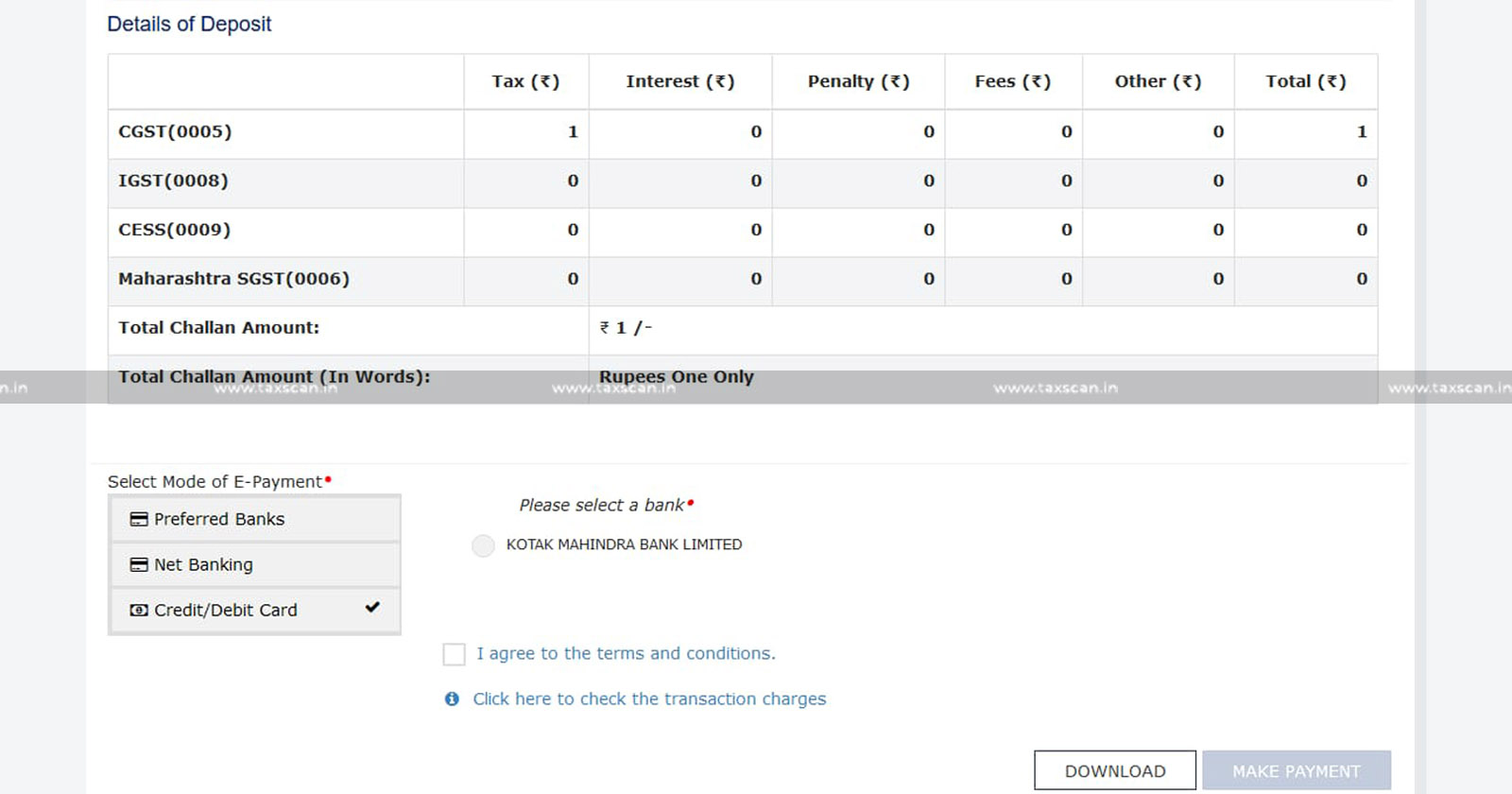

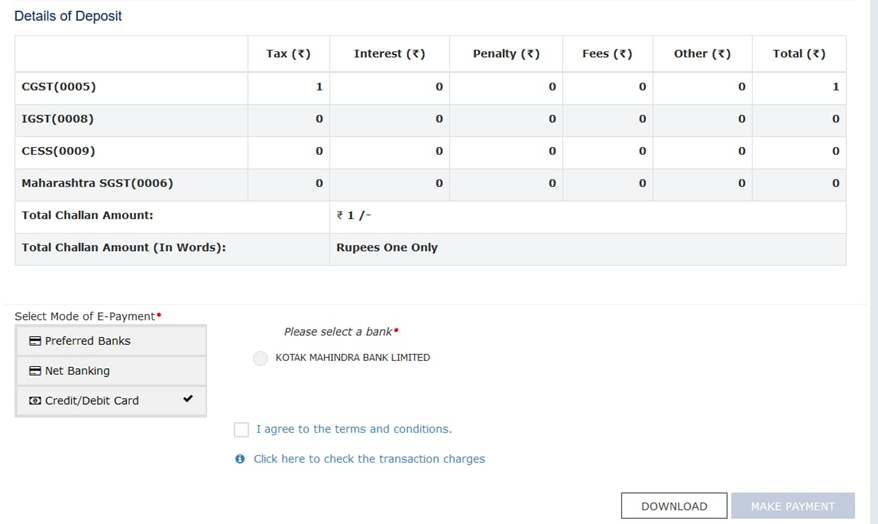

The Goods and Services Tax (GST) portal has been enabled with a new feature. The GST payers can now make their payments through debit or credit card through Kotak Mahindra Payment Gateway. Currently, the portal exclusively accommodates cards through Kotak Mahindra Gateway, with the possibility of expanding the list of acceptable variations of Credit Cards in the near future.

The portal is providing both online and offline payment methods. When generating the GST challan (PMT-06), businesses are required to select a specific mode of GST payment. The decision should be based on factors such as the time available to file the GST return before the due date, convenience, the chosen banker, and other relevant considerations.

As of now, the active online methods for GST payment include net banking, Immediate Payment Services (IMPS), and UPI. Additionally, payment through debit/credit cards has been enabled.

The available offline payment methods encompass Over-the-Counter (OTC) options such as cheques, demand drafts, and cash. Additionally, NEFT or RTGS are also accepted.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates