Major GST Portal Update: GSTR-3B Now allows Negative Values in Outward Supply at Table 3.1

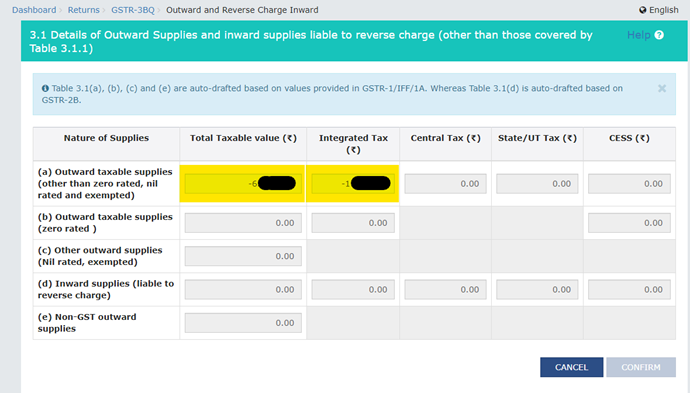

The Goods and Services Tax Network (GSTN) has made the functionality to input negative values in GST Return GSTR-3B

In a recent update to the GST Portal, the Goods and Services Tax Network ( GSTN ) has made the functionality to input negative values in GST Return GSTR-3B, allowing taxpayers to reflect the correct figures in months where there were only sales return transactions and no sales transactions.

The new update is set to resolve the issue of Negative Liability in cases where there were only sale return transactions in a particular month and no sale transactions, easing compliance headaches to taxpayers and professionals alike.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

Read Also:

GSTN issues GST Advisory on mandatory mentioning of HSN codes in GSTR-1 & GSTR 1A

Updated GST Portal Live Now: Know the Changes

GST Portal Glitches: 7 Common Issues Cited by Taxpayers and Experts

The latest update is welcomed by all professionals in the tax community as the same was raised as a major concern in earlier discussions on Social Media Platform X –

Meanwhile, Some of the seasoned tax professionals also commented on the delayed implementation of the same basic functionality.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates