MCA imposes Penalty on Company Omitting to Print E-mail ID and Phone Number on Resolution attached to Form GNL-1 [Read Order]

MCA imposes Penalty – Penalty – Company Omitting to Print E-mail ID and Phone Number – MCA – Print E-mail ID and Phone Number – E-mail ID – E-mail – Phone Number – Form GNL-1 – Taxscan

MCA imposes Penalty – Penalty – Company Omitting to Print E-mail ID and Phone Number – MCA – Print E-mail ID and Phone Number – E-mail ID – E-mail – Phone Number – Form GNL-1 – Taxscan

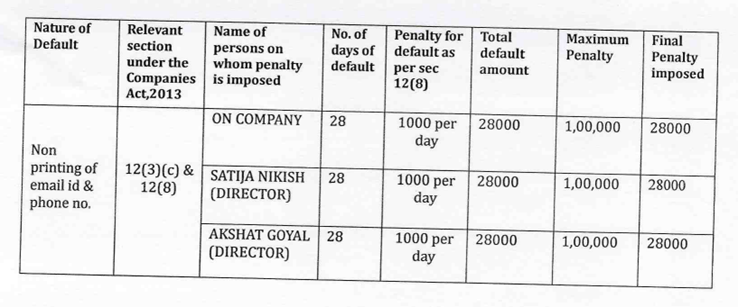

The Ministry of Corporate Affairs, in the adjudication of M/s Riverdale Foundation observed that the company noted that the company had failed to include an Email ID and Phone number on the resolution attached to form GNL 1. As a result, a fine of Rs. 84,000 was levied.

The Company submitted Form GNL 1 to the Registrar of Companies' office. Upon review, it was discovered that the company had neglected to include their Email ID and Phone number in the attached resolution, as required by Section 12(3)(c) of the Companies Act, 2013.

The Section 12(3)(c) states that, “Get its name, address of its registered office and the Corporate Identity Number along with telephone number, fax number, if any, e-mail, and website addresses, if any, printed in all its business letters, billheads, letter papers and in all its notices and other official publications; and”

The omission of any stated in the Section 12(3) Companies Act shall lead to a penalty of not more than Rs. 1 lakh and the same is clearly stated in the Section 12(8) of Companies Act.

In accordance with Section 12(8) of the Companies Act, if there is a failure to adhere to the stipulations of this section, both the company and any responsible officer will be subject to a penalty of one thousand rupees for each day the non-compliance persists, with the maximum penalty not exceeding one lakh rupees.

The adjudicating officer issued a show cause notice. The director of the company replied that “ due to running short of printed letterhead we used this computer made letter head wherein we mistakenly missed to add phone no and mail id on letter head prepared on computer.”

The director also claimed that it was an unintentional and inadvertent mistake and they have no motive to conceal information from the officers or anyone.

As it is evident from record that email, and phone no of the company were not printed on the resolutions attached to the form GNL-I and company itself has admitted its mistake in reply dated 18/07/2023.

Therefore, it was held that the company and its officer in default has not complied with the requirement of Section 12(3) of the Companies Act and are liable for penalty of Rs. 84,000 as prescribed under section 12(8) of the Companies Act.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates