MCA notifies LLP (Second Amendment) Rules replacing Form 3 and Form 4 [Read Notification]

MCA notifies LLP – Second Amendment – Rules replacing Form 3 and Form 4 – TAXSCAN

MCA notifies LLP – Second Amendment – Rules replacing Form 3 and Form 4 – TAXSCAN

The Ministry of Corporate Affairs (MCA) vide notification number G.S.R. 644(E) issued on 4th September 2023 has substituted the Form 3 and 4 in the Limited Liability Partnership Rules, 2009 which has to be filed electronically.

These rules may be called the Limited Liability Partnership (Second Amendment) Rules, 2023. It came into force on 4th September 2023.

By virtue of the authority granted under Sections 79(1) and (2) of the Limited Liability Partnership Act, 2008, the Central Government introduces the subsequent regulations to modify the Limited Liability Partnership Rules, 2009.

Form 3 is mandatory for submitting information related to the limited liability partnership agreement and any modifications made to it. Conversely, Form 4 is obligatory for reporting each instance of the appointment, resignation, or alteration in the name, address, or designation of a designated partner or partner.

In the new Form 3, it is mandatory to mention the Jurisdiction of Police Station right after the address of the LLP. Also added new separate columns for state and district which were absent in the old Form 3.

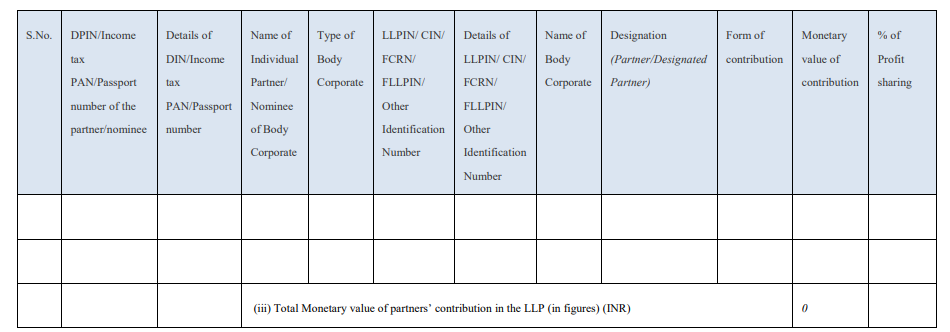

Regarding the details of each partner to contribute money or property or other benefit or to perform services and their profit sharing ratio, a new table has been updated by the MCA as follows:

New Table

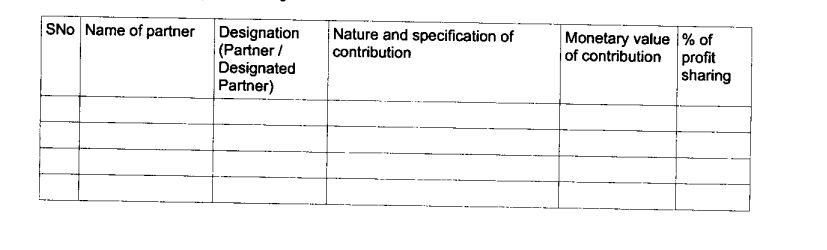

Old table

Part B of the old Form 3, after the 17th serial number (which is numbered as 16 in new Form 3) has added two sub-serial numbers (a) and (b). According to the new form 3, the filers have to mention Number of amendments/changes made in LLP agreement till date and SRN of Form 4 or Form 5 of last one year from the date of filing this form through which notice of change/amendment in the LLP agreement has been filed with the Registrar.

The MCA has updated the entire Form 3 and 4 in alignment with the requirements of the year 2023 and in response to the modifications introduced in the LLP procedure. The new forms are much more elaborate and specific compared to the old forms. It is advised to refer both the forms to find the necessary difference.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates